Check Cashing Fee Chart

Check Cashing Fee Chart - The fee structure is as follows: Best for a variety of rewards. As of 2018, we have a check cashing limit of $5,000, although we increase this limit to $7,500 from january to april of each year. Web the federal reserve financial check service 2024 fees provides information on fedforward, fedreturn, fedreceipt, endpoints and tier listing, district check. Web the fee for pls money orders (up to but not exceeding $1,000) is 1 percent of the check amount, plus $1. Several grocery stores across the nation partner with money services to provide check cashing services. A typical example is $2.27 for a $100.00 check. Financial regulators on wednesday adopted changes to check cashing rules in new york meant to address fees for consumers. $4 for checks up to $2,000 if you have a store shopper’s card and $4.50 without a shopper’s card 2. Web published 12:26 pm et jan. Web the federal reserve financial check service 2024 fees provides information on fedforward, fedreturn, fedreceipt, endpoints and tier listing, district check. Best for a variety of rewards. Web cash limits and the costs to you. As of 2018, we have a check cashing limit of $5,000, although we increase this limit to $7,500 from january to april of each year.. Web best checking accounts of 2024. Web march 04, 2019 19:38. At most institutions, account holders won’t pay. Web fees are typically a percentage of your check rather than a flat rate, which means that the higher your check amount, the more you'll pay. The rate is established and regulated by. Web effective february 26, 2021, new york state has increased the maximum fee that check cashers in new york state may charge. The rate is established and regulated by. Web the fee for pls money orders (up to but not exceeding $1,000) is 1 percent of the check amount, plus $1. This includes checks for social. Web what is the. Web cash limits and the costs to you. Several grocery stores across the nation partner with money services to provide check cashing services. But there's one place to avoid. Web fees are typically a percentage of your check rather than a flat rate, which means that the higher your check amount, the more you'll pay. Your local bank or credit. Web the fee for pls money orders (up to but not exceeding $1,000) is 1 percent of the check amount, plus $1. Commercial checks may have slightly higher fees. We are new york’s largest provider of check cashing & financial services. Outside money orders have fees that are system. One of the best places to cash checks is your local. Web march 04, 2019 19:38. The increase is to 2.27 percent of the face. Web best checking accounts of 2024. Web the federal reserve financial check service 2024 fees provides information on fedforward, fedreturn, fedreceipt, endpoints and tier listing, district check. Web the fees shown here are based on payroll or government checks. Web march 04, 2019 19:38. Best for avoiding common bank fees. Outside money orders have fees that are system. Financial regulators on wednesday adopted changes to check cashing rules in new york meant to address fees for consumers. We are new york’s largest provider of check cashing & financial services. Web 20 rows our check cashing fees and vip club savings for our southern california stores and northern california stores are provided in the chart below: Web march 04, 2019 19:38. The fee structure is as follows: Your local bank or credit union. Best for a variety of rewards. Web what is the fee to cash a check at ace? A typical example is $2.27 for a $100.00 check. Web march 04, 2019 19:38. Commercial checks may have slightly higher fees. Please see store for details. The increase is to 2.27 percent of the face. Each ace location has a menu board that provides check cashing fees for different types of checks. Web the fees shown here are based on payroll or government checks. This includes checks for social. Web effective february 26, 2021, new york state has increased the maximum fee that check cashers in. Commercial checks may have slightly higher fees. Each ace location has a menu board that provides check cashing fees for different types of checks. Web cash limits and the costs to you. At most institutions, account holders won’t pay. As of 2018, we have a check cashing limit of $5,000, although we increase this limit to $7,500 from january to april of each year. Web best checking accounts of 2024. Web the fees shown here are based on payroll or government checks. A typical example is $2.27 for a $100.00 check. Best for avoiding common bank fees. Several grocery stores across the nation partner with money services to provide check cashing services. Web 20 rows our check cashing fees and vip club savings for our southern california stores and northern california stores are provided in the chart below: Web the federal reserve financial check service 2024 fees provides information on fedforward, fedreturn, fedreceipt, endpoints and tier listing, district check. Your local bank or credit union. The rate is established and regulated by. We offer a variety of store services that make life easier for our customers. Web the maximum fee that any check casher can charge for a public assistance check issued by a federal or state agency is 1.5%.

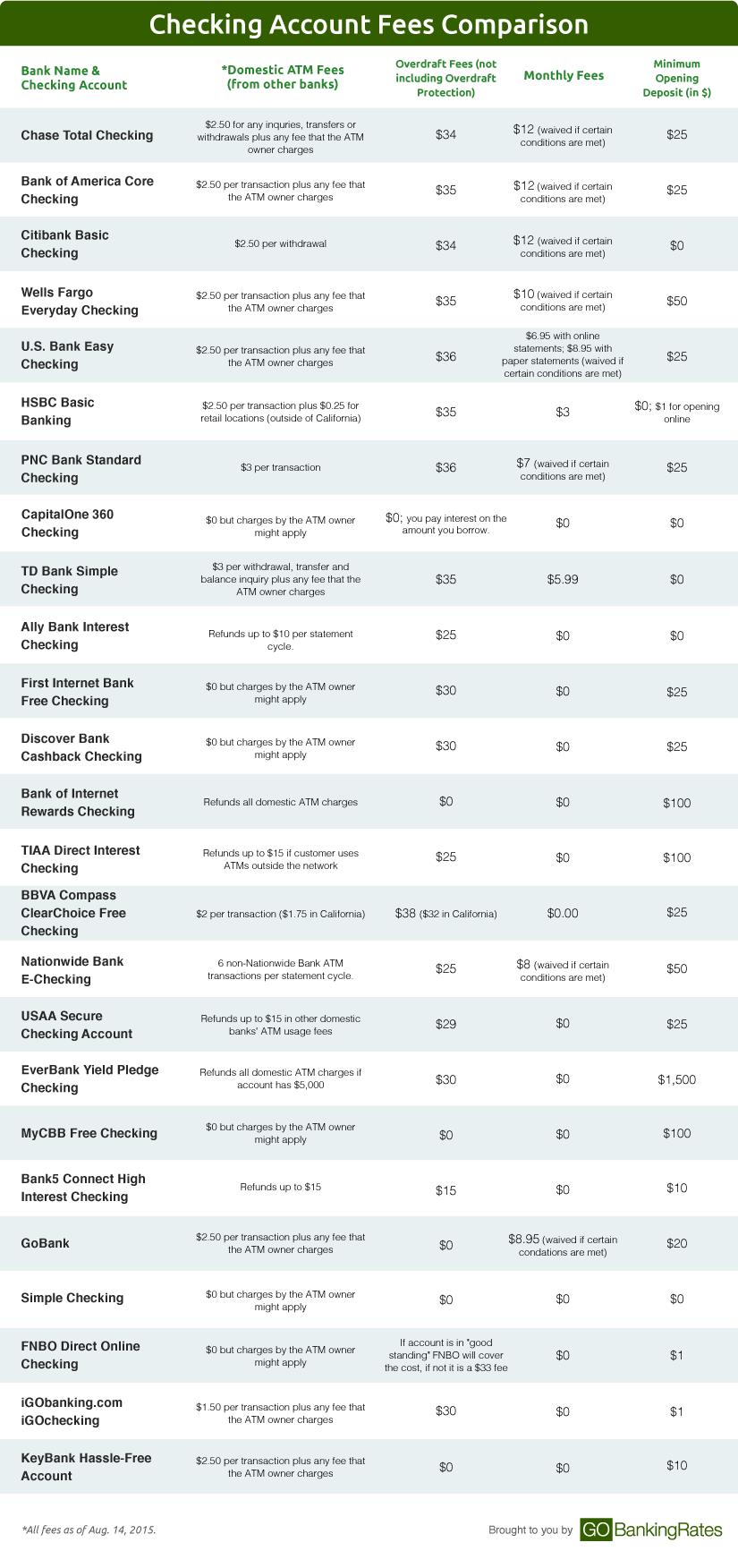

Checking Account Fees Comparison Chart What Are the Best Banks for

Pay O Matic Check Cashing Fee Chart

Currancy Exchange Fee Currency Exchange Rates

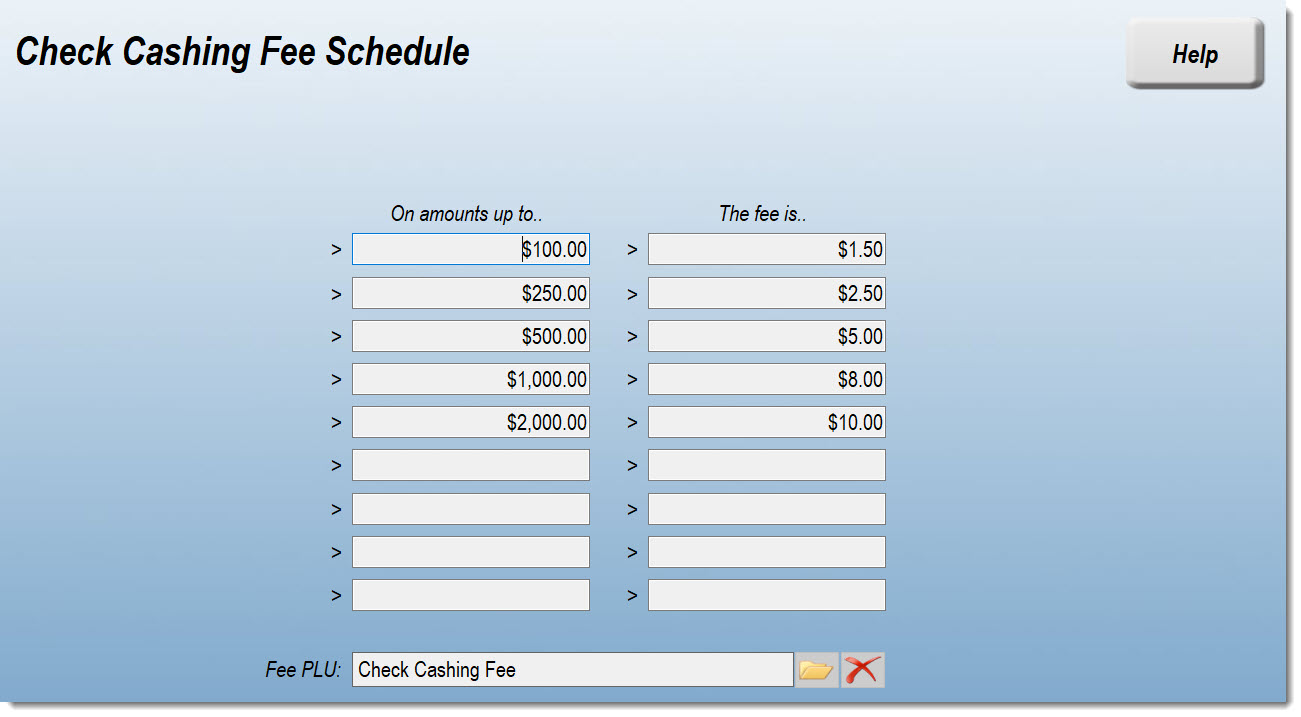

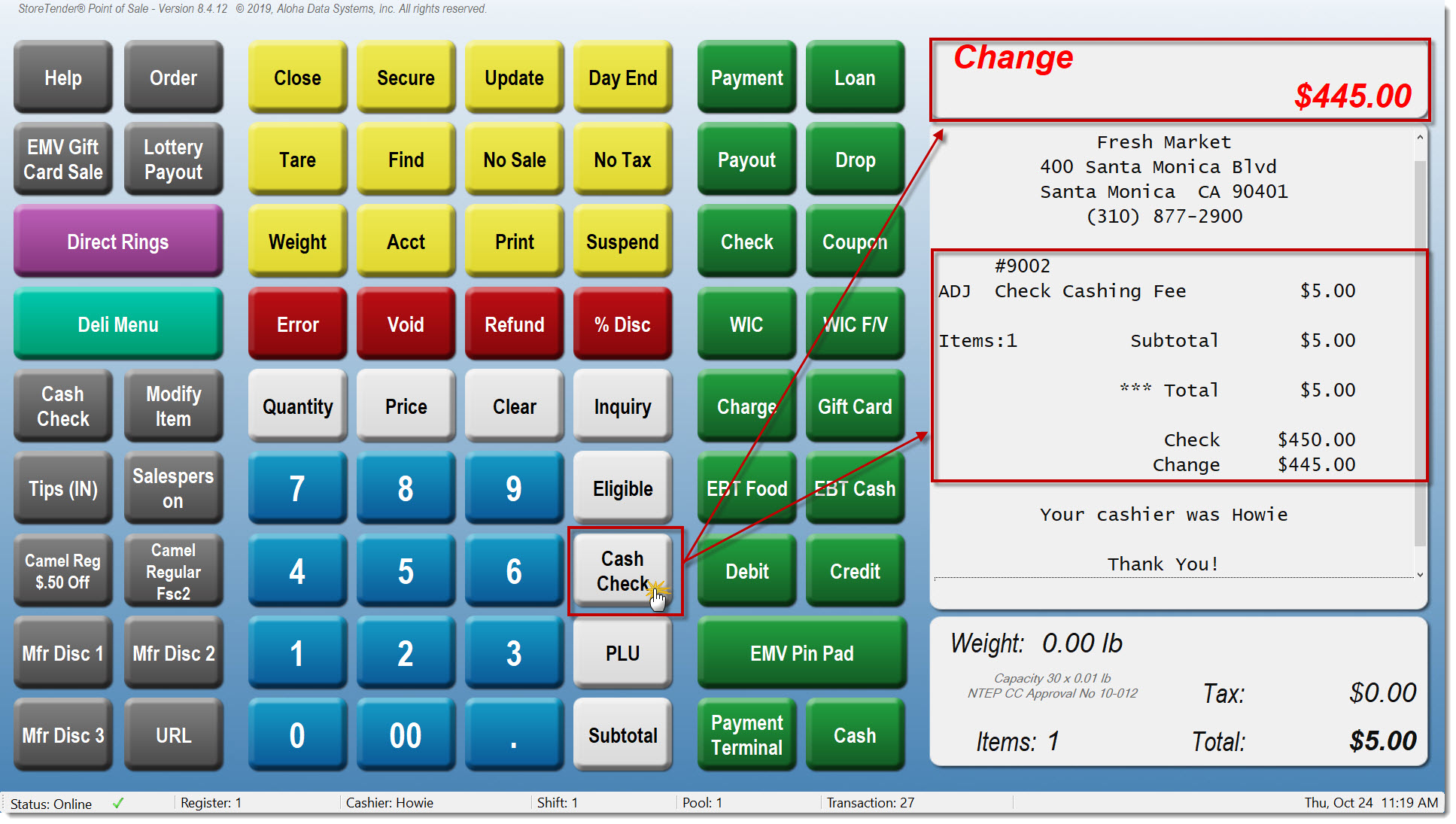

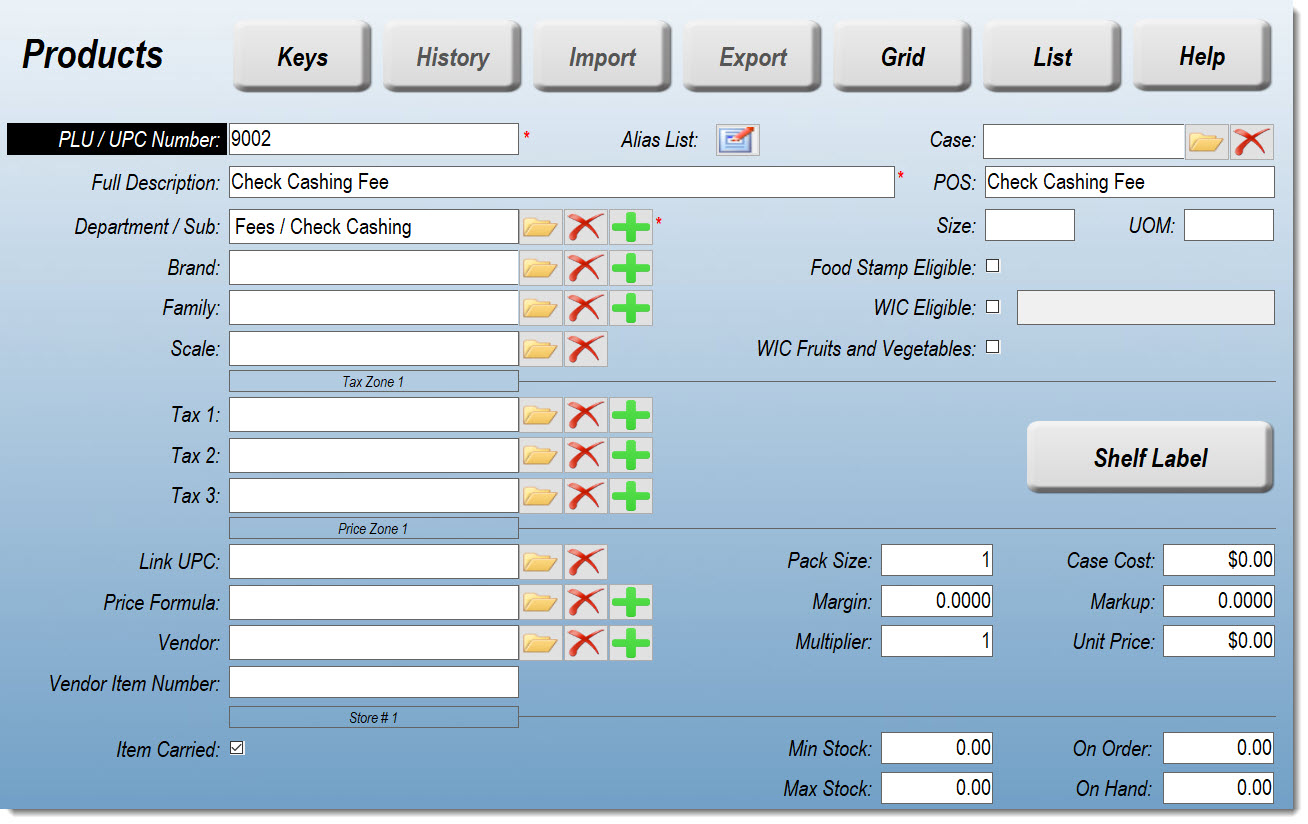

Charging Check Cashing Fees Knowledgebase StoreTender Online

Triangular Schism Here are the check cashing fees at the PayOMatic...

IL Check Cashing Fees Raised on Payroll Checks, Lower on State

Charging Check Cashing Fees Knowledgebase StoreTender Online

Charging Check Cashing Fees Knowledgebase StoreTender Online

Rates and Fees Colorado Check City

checkcashing Bloomington,, IL Market Street Currency Exchange, Inc.

One Of The Best Places To Cash Checks Is Your Local Bank Or Credit Union.

The Increase Is To 2.27 Percent Of The Face.

Please See Store For Details.

Effective March 02, 2021, The New Check Cashing Rate Is 2.27%.

Related Post: