Certified Payroll Professional Online Courses

Certified Payroll Professional Online Courses - (2 or 4 credit hours) Answer a few questions, and we'll give you. Now is the time to advance your payroll career with an fpc or cpp certification! Web online training that works around your schedule. Web certified payroll professional (cpp): Web payroll fundamentals (formerlypaytrain® fundamentals), part of the payroll certificate program, covers the fundamental concepts, calculations, fringe benefits, tax compliance, record keeping and best practices, accounting, and administration as they apply to payroll. Key concepts covered include gross income and items that are statutorily included or excluded in it, personal and. Subject matter experts payroll professionals legal counsel The fundamental payroll certification (fpc) signifies a baseline knowledge of payroll while the certified payroll professional (cpp) certification shows mastery. Web the certified payroll professional (cpp) course provides a comprehensive understanding of advanced payroll topics for payroll managers and supervisors. Web certification prep education courses & seminars prepare for certification exams certification prep the courses and resources you need to successfully pass payrollorg’s certification examinations. It covers and focuses on the u.s. Web 6 free online cybersecurity courses. Each program takes approximately five days to complete. Fundamental payroll certification (fpc) certified payroll professional (cpp) get college credits; Key concepts covered include gross income and items that are statutorily included or excluded in it, personal and. Some certificates can be applied toward a degree program, getting you closer to graduation while. Federal tax system as it relates to individuals, employees, and sole proprietors. Web payroll fundamentals (formerlypaytrain® fundamentals), part of the payroll certificate program, covers the fundamental concepts,. Complete the foundations of payroll certificate program and the payroll administration certificate program either in person or online. Web certified payroll professional (cpp): Federal tax system via conceptual and applied material. (2 or 4 credit hours) Web our payroll certification training courses cover how to: Web certified payroll professional (cpp): Web payroll fundamentals (formerlypaytrain® fundamentals), part of the payroll certificate program, covers the fundamental concepts, calculations, fringe benefits, tax compliance, record keeping and best practices, accounting, and administration as they apply to payroll. Web there are 9 modules in this course. This course provides an intensive conceptual and applied introduction to auditing in society. Each. Develop skills critical to payroll leadership. This specialization introduces the u.s. Web an hr certification is a professional credential verifying skills in the hr field. With over 30 years providing unrivaled payroll education, you can trust paytrain® to deepen your understanding of payroll practices and legislation impacting payroll. Prepare for the certified payroll professional (cpp) exam. Prepare for the certified payroll professional (cpp) exam. Whether you are seeking professional development or studying for the certified payroll professional (cpp) exam, choose paytrain to help you meet your goals. Web certified payroll professional (cpp) and fundamental payroll certification (fpc) program. Properly classify workers apply the various exemptions calculate gross pay and properly make deductions properly identify, pay, and. Develop skills critical to payroll leadership. This specialization introduces the u.s. Web this 12 week learning plan will help you prepare for the certified payroll specialist in adp workforce now exam. Learners will be able to apply basic principles to settings involving individuals, corporations, and other business entities, complete key components of major, individual u.s. Some certificates can be applied. With over 30 years providing unrivaled payroll education, you can trust paytrain® to deepen your understanding of payroll practices and legislation impacting payroll. Answer a few questions, and we'll give you. This course provides an intensive conceptual and applied introduction to auditing in society. Complete the certified payroll professional boot camp, which takes four months to complete. Now is the. Fundamental payroll certification (fpc) certified payroll professional (cpp) get college credits; It covers and focuses on the u.s. Exam prep & study guide. Web there are 9 modules in this course. Live content can be accessed from anywhere, using any computer or mobile device. Web certification prep education courses & seminars prepare for certification exams certification prep the courses and resources you need to successfully pass payrollorg’s certification examinations. Some certificates can be applied toward a degree program, getting you closer to graduation while. Federal tax system as it relates to individuals, employees, and sole proprietors. Web certification prep to demonstrate your mastery of. Web payroll fundamentals (formerlypaytrain® fundamentals), part of the payroll certificate program, covers the fundamental concepts, calculations, fringe benefits, tax compliance, record keeping and best practices, accounting, and administration as they apply to payroll. Web this 12 week learning plan will help you prepare for the certified payroll specialist in adp workforce now exam. Web the apa's certified payroll professional boot camp provides an extensive, online training program with tools and resources to help you study and prepare for the cpp exam. With over 30 years providing unrivaled payroll education, you can trust paytrain® to deepen your understanding of payroll practices and legislation impacting payroll. Live content can be accessed from anywhere, using any computer or mobile device. Complete the certified payroll professional boot camp, which takes four months to complete. Learners will be able to apply basic principles to settings involving individuals, corporations, and other business entities, complete key components of major, individual u.s. Web certified payroll professional (cpp) and fundamental payroll certification (fpc) program. Web online training that works around your schedule. Federal tax returns, and identify tax. This program is ideal for experienced payroll professionals seeking compliance training, professional development, or cpp certification preparation. Key concepts covered include gross income and items that are statutorily included or excluded in it, personal and. What you will learn with our payroll certification courses Answer a few questions, and we'll give you. Web our payroll certification training courses cover how to: Join the 16,000+ payroll professionals who have earned the prestigious fundamental payroll certification (fpc) and certified payroll professional (cpp).

Payroll Certificates Professional Payroll Certification Course Online

Certified Payroll Professional Credly

HR and Payroll Management Online Certification Courses

America's 1 Payroll Certification NACPB

Certified Payroll Professional (CPP) Exam Payroll Forms, use and due

Certified Payroll Professional Practice Test (updated 2023)

Certified Payroll Professional (CPP) Program NIAT Philippines

SAP HR US Payroll Training SAP Payroll Online Course

Certified Payroll Professional (CPP) 3 Necessary Skills Eddy

Xero Training Courses Learn Xero with KBM

Complete The Foundations Of Payroll Certificate Program And The Payroll Administration Certificate Program Either In Person Or Online.

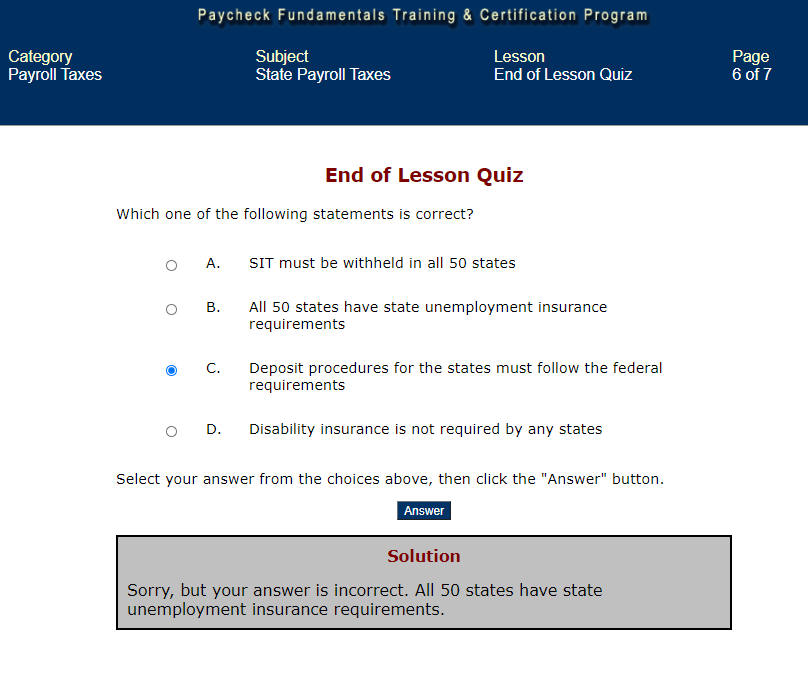

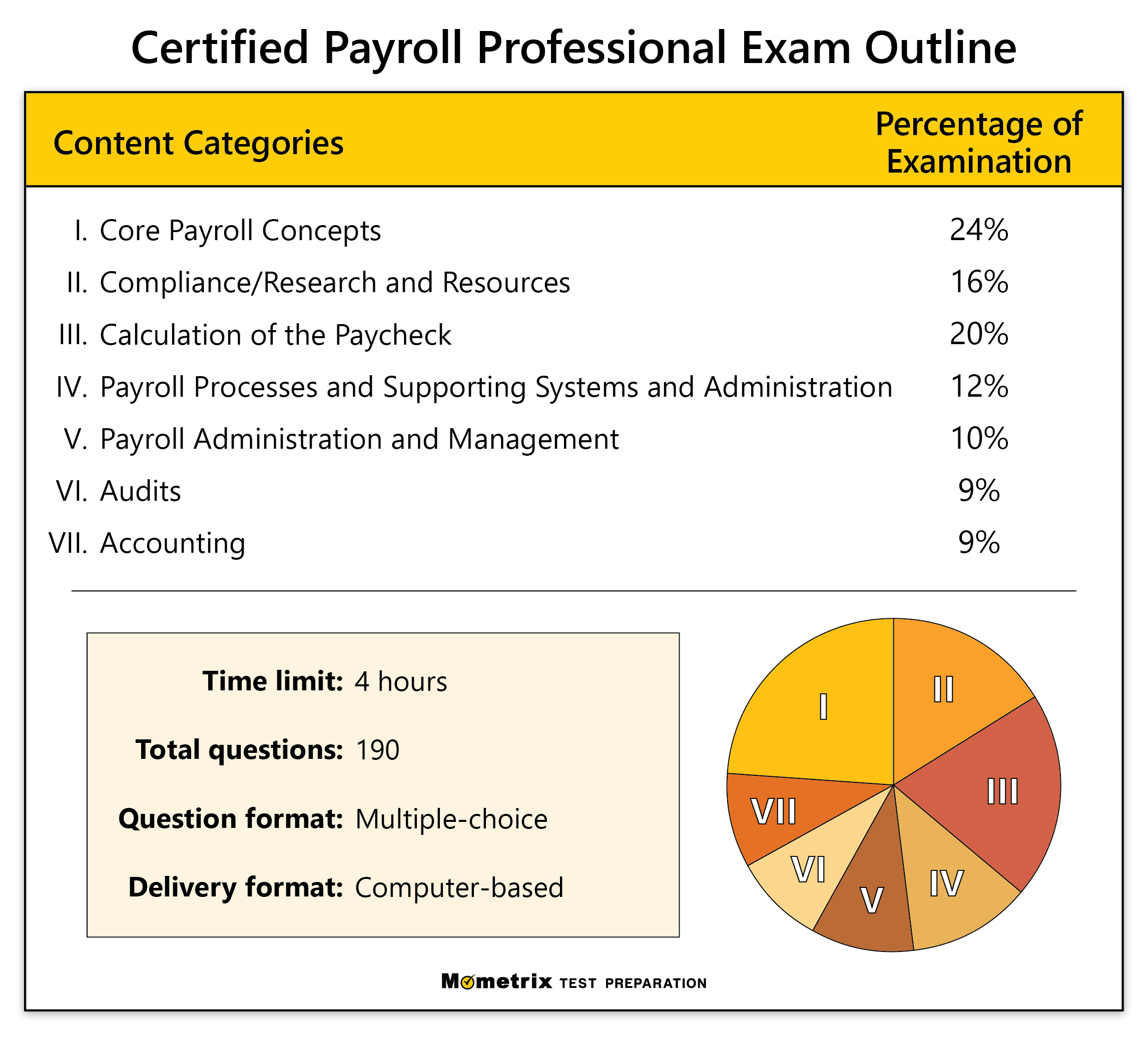

Web Fundamental Payroll Certification (Fpc) Fpc Exam Content Outline;

Certified Payroll Professional (Cpp) Cpp Exam Content Outline;

This Specialization Introduces The U.s.

Related Post: