Candlestick Piercing Pattern

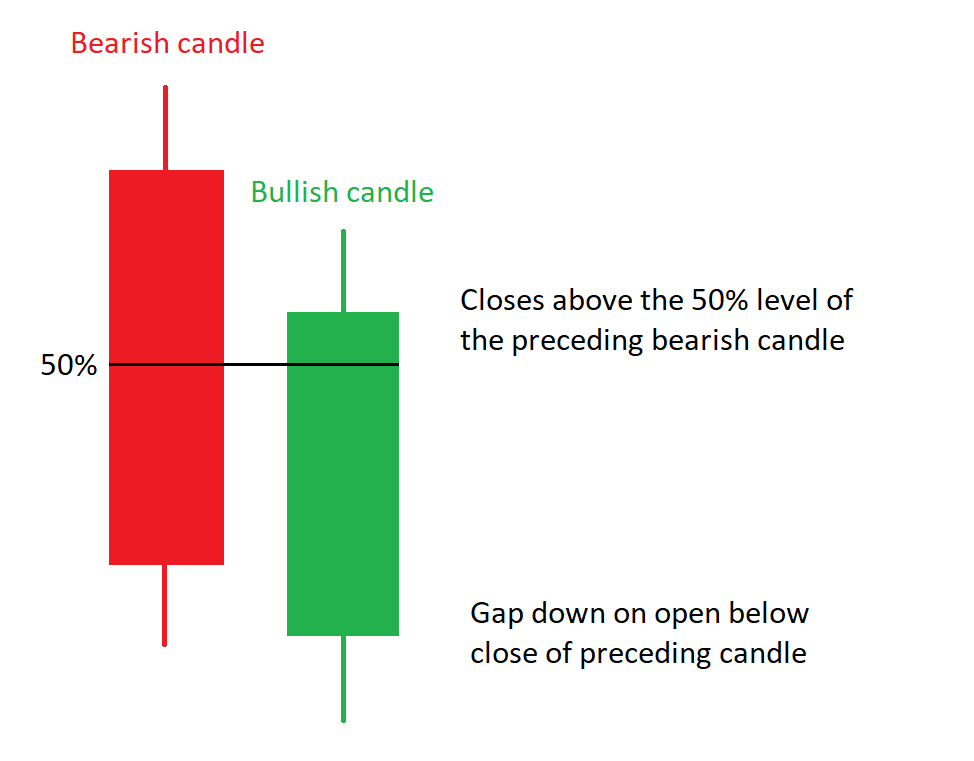

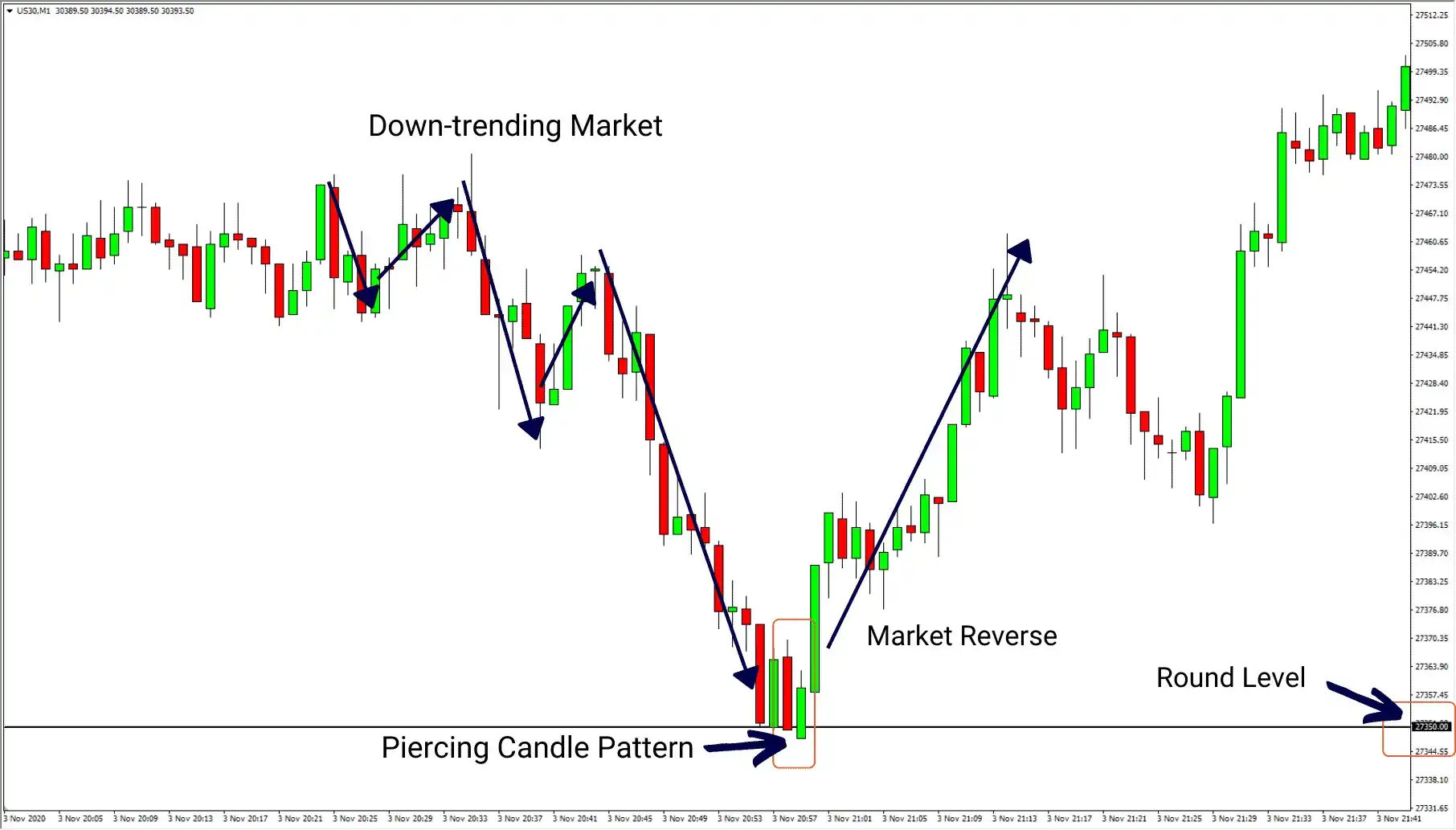

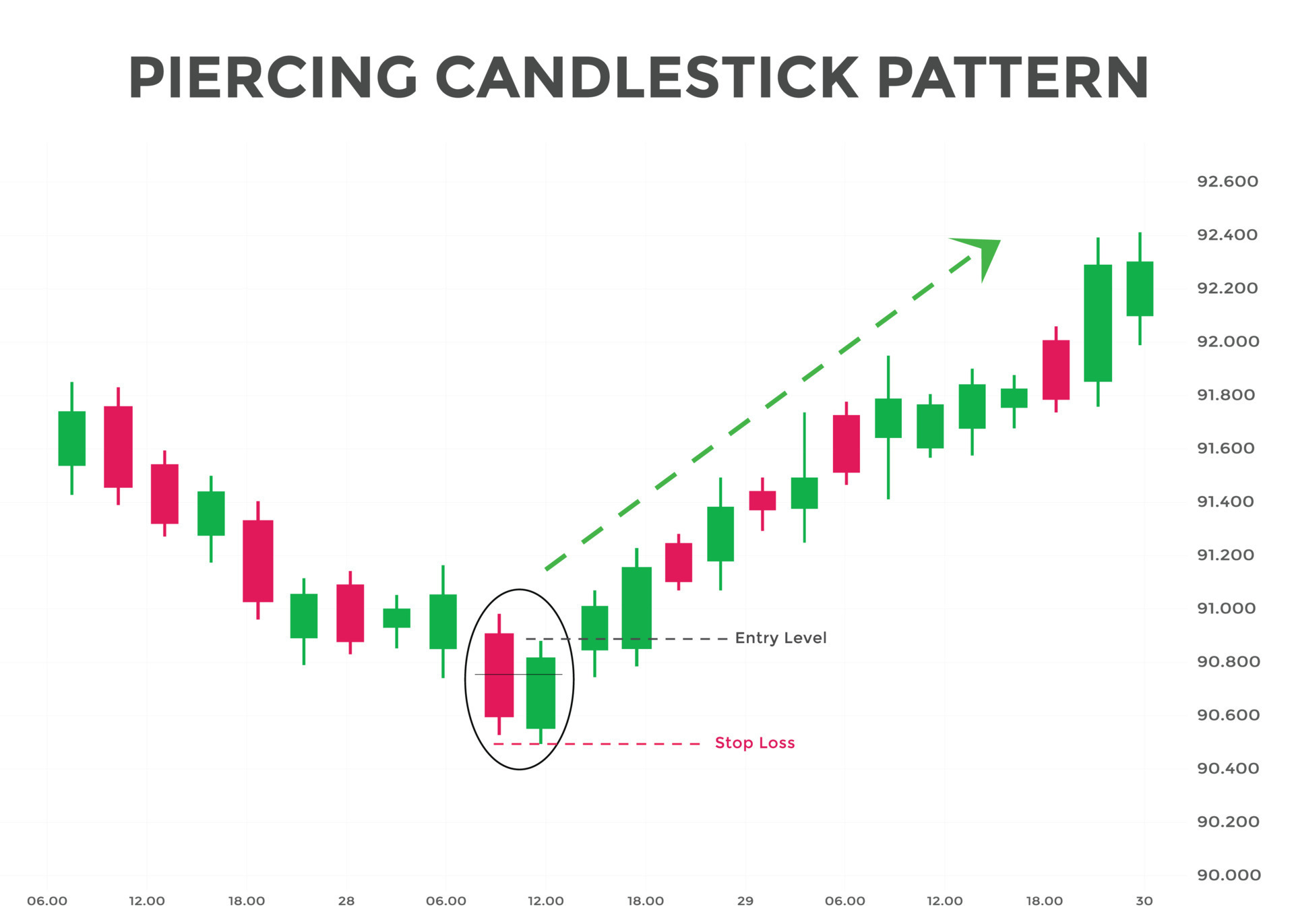

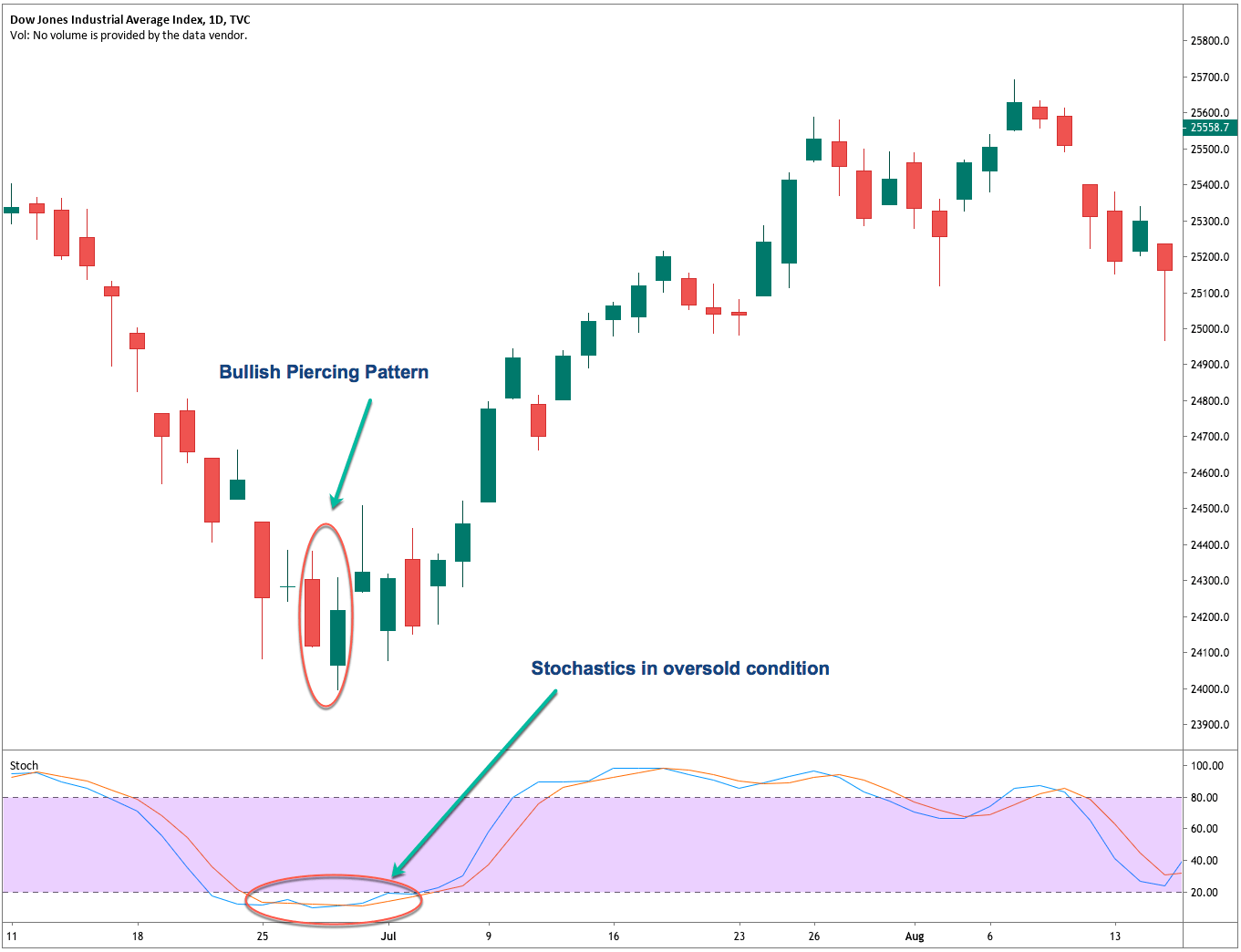

Candlestick Piercing Pattern - Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. Web the piercing pattern acts in theory as it does in reality, as a bullish reversal, ranking 21 out of 103 candlestick patterns where 1 is best. The second candlestick then gaps down and away from the real body of the previous candlestick to open below the low of the. Therefore, once the piercing line formation is complete, traders will attempt to go long (buy). The sellers dived into freezing waters and immediately jumped back up! A gap lower to begin the second day, more prevalent in stocks due to their overnight trading nature. There is usually a significant gap down between the first candlestick’s closing price, and the green candlestick’s opening. This indicates a shift in market sentiment from bearish to bullish and suggests that buyers are gaining control. The dark cloud cover pattern is the bearish version of the piercing line. Piercing candlestick pattern is a bullish reversal pattern that can be found at the end of a downtrend. The first day of the pattern is a black candle appearing as a long line in a downtrend, except spinning tops and doji candles. The piercing pattern is made up of two candlesticks. Open below the low of the first candlestick; The bearish piercing pattern is composed of two candles with the second candle closing below the first candle’s close. Being one of the few two candlestick patterns, the piercing line pattern consists of two consecutive candles with a first bearish candlestick and a second bullish candle having long bodies and short. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. Web a piercing pattern happens when a candle gaps down at the open:. A gap lower to begin the second day, more prevalent in stocks due to their overnight trading nature. Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. Web the piercing line is a bullish reversal candlestick pattern found at the end of a bearish trend that helps traders find potential reversal. Web the bearish piercing pattern. Learn to trade it here. Identifying a piercing pattern involves observing three critical characteristics: Web a piercing pattern happens when a candle gaps down at the open: To be valid, it must appear after a move to the downside. It is a bullish reversal signal that forms when a red candlestick with a large real body is followed by a green candlestick that opens below the low of the first. Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. The sellers dived into freezing waters and immediately jumped back up!. Web the piercing pattern acts in theory as it does in reality, as a bullish reversal, ranking 21 out of 103 candlestick patterns where 1 is best. This is followed by buyers driving prices up to close above 50%. It’s a bullish reversal pattern, meaning that it signs a potential reversal to the upside. The piercing pattern depends upon the. “wait a minute, that looks like a bullish engulfing candle!”. The piercing pattern is made up of two candlesticks. Look at the diagram below. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. This type of pattern is formed when the bulls and bears both fight to gain control over the prices. Web piercing pattern formation. Web the piercing pattern acts in theory as it does in reality, as a bullish reversal, ranking 21 out of 103 candlestick patterns where 1 is best. The pattern includes the first day opening near the. The sellers dived into freezing waters and immediately jumped back up! It signals a potential short term reversal from downwards. “wait a minute, that looks like a bullish engulfing candle!”. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. Web the piercing pattern is made of two candlesticks, the first one is bearish and the second one is a bullish candlestick. It appears at the bottom of a downtrend and indicates that buyers are. Web the piercing pattern involves two candlesticks with the second bullish candlestick opening lower than the preceding bearish candle. It consists of two major components, a bullish candle of day 2 and a bearish candle of day 1. It is a bullish reversal signal that forms when a red candlestick with a large real body is followed by a green. Web the piercing candlestick pattern is a 2 candle bullish reversal pattern that any trader can use as part of a trading strategy. Learn to trade it here. The hammer or the inverted hammer. Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. The bearish piercing pattern is composed of two candles with the second candle closing below the first candle’s close but opening above its closing price, giving. The first day of the pattern is a black candle appearing as a long line in a downtrend, except spinning tops and doji candles. This candlestick pattern is used as an indicator to enter a long position or exit the sell position. It consists of two major components, a bullish candle of day 2 and a bearish candle of day 1. Web the piercing line is a bullish reversal candlestick pattern found at the end of a bearish trend that helps traders find potential reversal zones. The dark cloud cover pattern is the bearish version of the piercing line. This is followed by buyers driving prices up to close above 50%. The pattern includes the first day opening near the. The fact that bulls were able to press further up into the. Web the piercing pattern is formed when the first candlestick is a long bearish candle, followed by a long bullish candle that opens below the previous candle’s low and closes above its midpoint. The piercing pattern is made up of two candlesticks. The hammer is a bullish reversal pattern, which signals that a.

Powerful Piercing Pattern How to Trade with Piercing Candlestick?2022

Candlestick Patterns Explained with Examples NEED TO KNOW!

Piercing Candlestick Pattern How to Identify Piercing Line

Piercing Candlestick Pattern Overview with Trading Setup

piercing pattern candlestick chart pattern. Bullish Candlestick chart

Piercing Candlestick Pattern Piercing Candle

Candlestick Patterns The Definitive Guide (2021)

Candlestick Reversal Patterns I Overview and The Piercing Pattern

Piercing Pattern Candlestick Trading For Beginners InfoBrother

What Is the Piercing Line Candlestick Pattern? FOR INVEST

This Type Of Pattern Is Formed When The Bulls And Bears Both Fight To Gain Control Over The Prices.

The Rejection Of The Gap Down By The Bulls Typically Can Be Viewed As A Bullish Sign.

In Other Words, The First Line Can Be One Of The Following Basic Candles:

Web The Bearish Piercing Pattern.

Related Post: