Bullish Reversal Candlestick Patterns

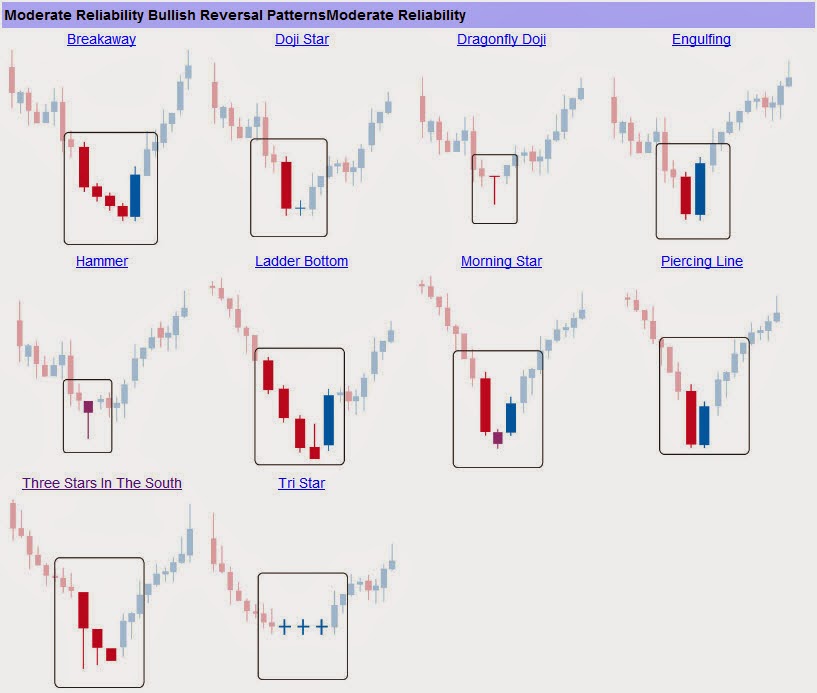

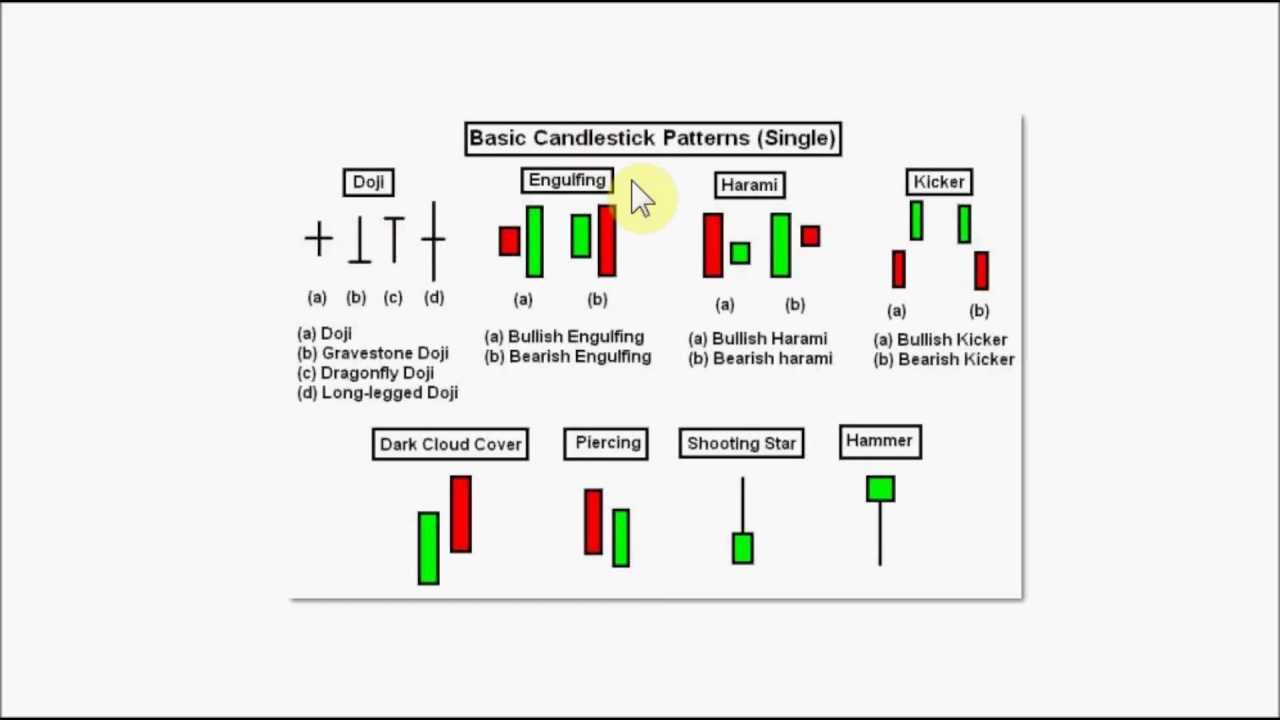

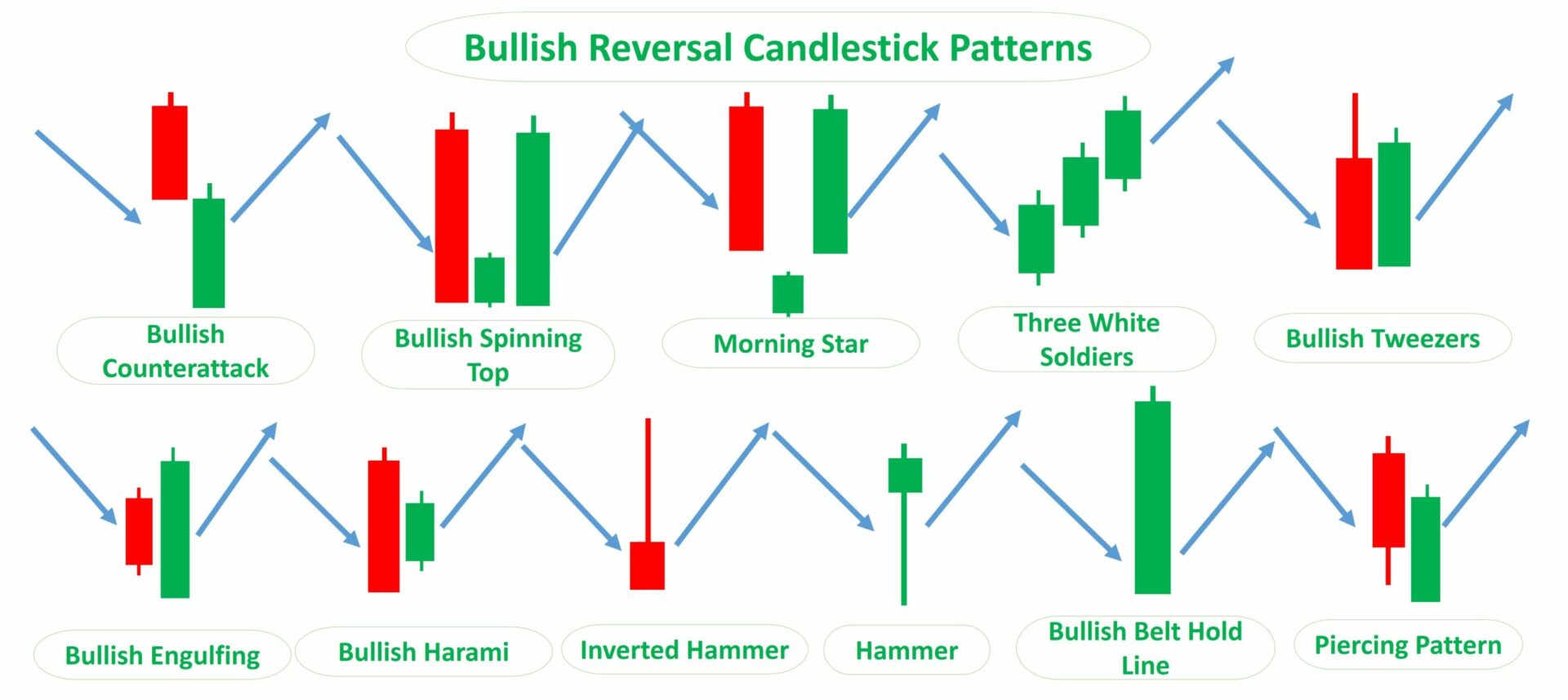

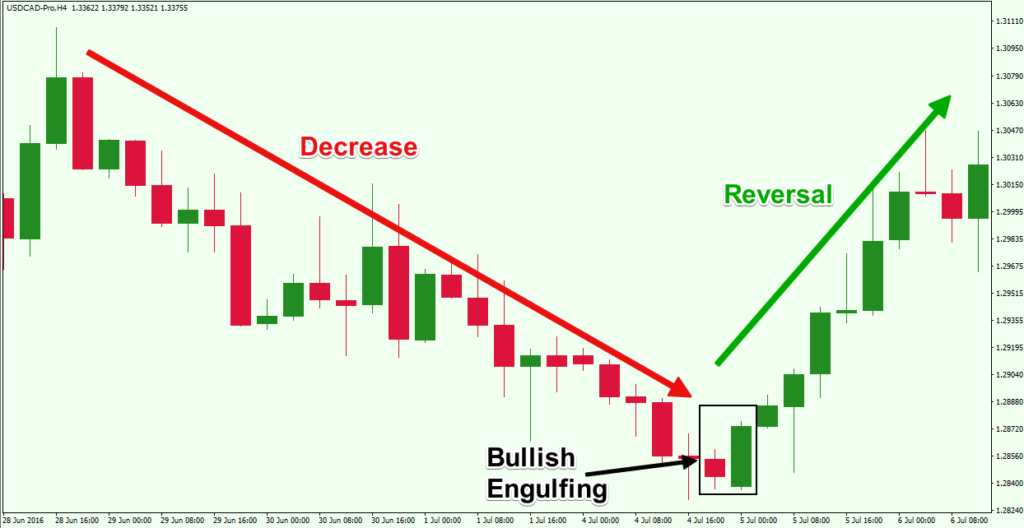

Bullish Reversal Candlestick Patterns - The other type is bearish candles. Web the bullish reversal patterns form at the bottom of trends on a chart and leads to a market shifts from a downtrend to an uprising trend. Web there are a number of candlestick patterns used by technical traders to spot bullish reversal, bearish reversal, or continuation patterns. There are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. Candlestick formation,major reversal patterns,continuation patterns,rare candlestick patterns. For this article, i am going to share 25. Web 4.1 candlestick bullish reversal patterns. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Web hammer is a single candlestick bullish reversal pattern. One can use these kinds of patterns to identify a potential reversal in assets’ prices. Web let's examine some of the most common bullish reversal candlestick patterns next. There are two factors that also help in differentiating both. Otherwise, it’s not a bullish pattern, but a continuation pattern. Web bullish reversal candlestick patterns: Download now and embark on a journey towards. Web a downtrend has been apparent in definitive healthcare corp. Download now and embark on a journey towards. Web a bullish reversal candlestick pattern signals a potential change from a downtrend to an uptrend. Web nifty 50 formed a ‘bullish hammer’ candlestick pattern on the daily chart, which indicates short term bullish trend reversal. For this article, i am going. Web when a trader is watching for a bullish reversal, any red candlestick followed by a white candlestick could be an alert, but the piercing pattern is a special indication because the. And when you learn to spot them on charts, they can signal a potential change in trend direction. How to find high probability bullish reversal setups. Web the. How to find high probability trend continuation setups. Candlestick formation,major reversal patterns,continuation patterns,rare candlestick patterns. And when you learn to spot them on charts, they can signal a potential change in trend direction. Bullish candlesticks are one of two different candlesticks that form on stock charts. Web bullish reversal candlestick patterns. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. Important bullish reversal candlestick patterns to know. Download now and embark on a journey towards. There are two factors that also help in differentiating both. Candlesticks are graphical representations of price movements for a given period of time. Bullish candlesticks are one of two different candlesticks that form on stock charts. The hammer is a bullish candlestick pattern that indicates when a security is about to reverse upwards. Conversely, the bearish candlestick reversal occurs at the top of trends and leads to a market move from an uprising trend to a downtrend. Web 4.1 candlestick bullish reversal patterns.. But as the saying goes, context is everything. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Candlestick formation,major reversal patterns,continuation patterns,rare candlestick patterns. Reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: Candlestick chart types have become popular among traders because they. 4.2 candlestick bearish reversal patterns. In general, a bullish candlestick formation indicates buying pressure is starting to overwhelm selling momentum that tend to precede upside price moves. Download now and embark on a journey towards. There are two factors that also help in differentiating both. There are dozens of bullish reversal candlestick patterns. For this article, i am going to share 25. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. It's a hint that the market's sentiment might be shifting from selling to buying. Reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: Web from bullish engulfing patterns. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. Web the bullish reversal patterns form at the bottom of trends on a chart and leads to a market shifts from a downtrend to an uprising trend. At this point, bulls should overpower bears and push prices higher and make close to the. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market story. Web below you can find the schemes and explanations of the most common reversal candlestick patterns. Important bullish reversal candlestick patterns to know. Otherwise, it’s not a bullish pattern, but a continuation pattern. Web bullish reversal patterns should form within a downtrend. Web there are a number of candlestick patterns used by technical traders to spot bullish reversal, bearish reversal, or continuation patterns. They are commonly formed by the opening, high,. They are typically green, white, or blue on stock charts. And when you learn to spot them on charts, they can signal a potential change in trend direction. Web nifty 50 formed a ‘bullish hammer’ candlestick pattern on the daily chart, which indicates short term bullish trend reversal. Web bullish reversal candlestick patterns. It's a hint that the market's sentiment might be shifting from selling to buying. There are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. It can signal an end of the bearish trend, a bottom or a support level. At this point, bulls should overpower bears and push prices higher and make close to the opening price. Web for the bullish pattern, enter long after the gap and move in the opposite direction.

Using 5 Bullish Candlestick Patterns To Buy Stocks

Bullish Candlestick Reversal Patterns Cheat Sheet Trading charts

6 Reliable Bullish Candlestick Pattern TradingSim

Forex Master Class Candlestick Reversal Patterns

bullishreversalcandlestickpatternsforexsignals daytrading

25 Bullish reversal candlestick pattern every trader must know and how

Candlestick Charts Part Two Single Candlestick Reversal Signals

The Most Reliable Candlestick Patterns You Must Know

Top Reversal Candlestick Patterns

Top Forex Reversal Patterns that Every Trader Should Know Forex

Web Bullish Candlestick Reversal Patterns Contain The Open Price At The Low Of The Period And Close Near The High.

Bullish Japanese Candlestick Reversal Patterns Are Displayed Below From Strongest To Weakest.

Bullish Candlesticks Are One Of Two Different Candlesticks That Form On Stock Charts.

Some Examples Of Bullish Candles Are The Hammer, Inverted Hammer, And Bullish Engulfing Patterns.

Related Post: