Bullish Rectangle Pattern

Bullish Rectangle Pattern - Web learn how to identify and trade the bullish rectangle pattern, a consolidation pattern that indicates the continuation of an uptrend. Find out the entry, take profit,. Web a bullish rectangle, or a rectangle top pattern, appears within an uptrend. What is a bearish rectangle chart pattern? Web the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. See examples of hammer, inverted hammer,. Web bullish rectangle patterns are a type of classical chart pattern that indicate a period of indecision between buyers and sellers. A bullish rectangle is a continuation chart setup that suggests a temporary pause or consolidation in an. Web bullish rectangle pattern: Web how do you identify a bullish rectangle? Although the pattern can indicate trend reversal and continuation, it usually serves as a. Web bullish rectangle pattern: The rectangle occurs when the price is moving between horizontal support and resistance levels and ends with a breakout or breakdown. Web rectangles are patterns that happen when prices take a break in a strong trend. What is an example of. This pattern is also known as “rectangle consolidation,” “box,” and. A bullish rectangle pattern is a pattern that forms when market prices consolidate between a horizontal support trendline and a. Find out the entry, take profit,. They are common and powerful. As soon as the bullish and bearish forces of the market have played out,. The rectangle occurs when the price is moving between horizontal support and resistance levels and ends with a breakout or breakdown. Web a bullish rectangle is when the market is in a bullish trend that turns into a consolidation. Bullish chart patterns signal future price increases, but not all patterns are accurate or profitable. Bullish chart pattern reliability & profitability.. Web a rectangle can be bearish or bullish, depending on the direction of the price breakout. What is a bearish rectangle chart pattern? Find out the entry, take profit,. Web the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Web learn how to identify and trade the bullish rectangle pattern, a consolidation pattern that. Bullish chart pattern reliability & profitability. Although the pattern can indicate trend reversal and continuation, it usually serves as a. What is an example of. See examples of hammer, inverted hammer,. Web learn how to identify and use the bullish rectangle pattern, a chart pattern that indicates a consolidation phase before a bullish trend continues. Bullish chart patterns signal future price increases, but not all patterns are accurate or profitable. Discover the winning patterns that take stock traders to new heights! Web a bullish rectangle is when the market is in a bullish trend that turns into a consolidation. See examples of hammer, inverted hammer,. There's a bullish (good) and. What is an example of. Web a rectangle can be bearish or bullish, depending on the direction of the price breakout. The rectangle occurs when the price is moving between horizontal support and resistance levels and ends with a breakout or breakdown. Find out the entry, take profit,. A bullish rectangle pattern is a pattern that forms when market prices. Web the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. A bullish rectangle pattern is a pattern that forms when market prices consolidate between a horizontal support trendline and a. Web learn how to trade the bullish rectangle chart pattern, a continuation pattern that forms when price action reverses from a resistance to a. A bullish rectangle is a continuation chart setup that suggests a temporary pause or consolidation in an. A bullish rectangle pattern is a pattern that forms when market prices consolidate between a horizontal support trendline and a. Web learn how to identify and trade the bullish rectangle pattern, a consolidation pattern that indicates the continuation of an uptrend. Learn how. Bullish chart pattern reliability & profitability. See examples of hammer, inverted hammer,. Web the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Web what is a bullish rectangle chart pattern? There's a bullish (good) and. A bullish rectangle pattern is a pattern that forms when market prices consolidate between a horizontal support trendline and a. There's a bullish (good) and. Discover the winning patterns that take stock traders to new heights! The rectangle occurs when the price is moving between horizontal support and resistance levels and ends with a breakout or breakdown. The pattern has completed when price breaks out in the direction of. They bounce between two parallel lines before the trend goes on. Web a rectangle can be bearish or bullish, depending on the direction of the price breakout. Web learn how to use candlestick charts to identify bullish patterns that indicate buying opportunities in a downtrend. A bullish rectangle is a continuation chart setup that suggests a temporary pause or consolidation in an. As soon as the bullish and bearish forces of the market have played out,. Web learn how to identify and trade the bullish rectangle pattern, a consolidation pattern that indicates the continuation of an uptrend. Web bullish rectangle rectangles are continuation patterns that occur when a price pauses during a strong trend and temporarily bounces between two parallel levels before the. Learn how to identify and trade the rectangle pattern, a classical technical analysis formation that shows supply and demand in balance. They are common and powerful. Web how do you identify a bullish rectangle? Web a bullish rectangle is when the market is in a bullish trend that turns into a consolidation.

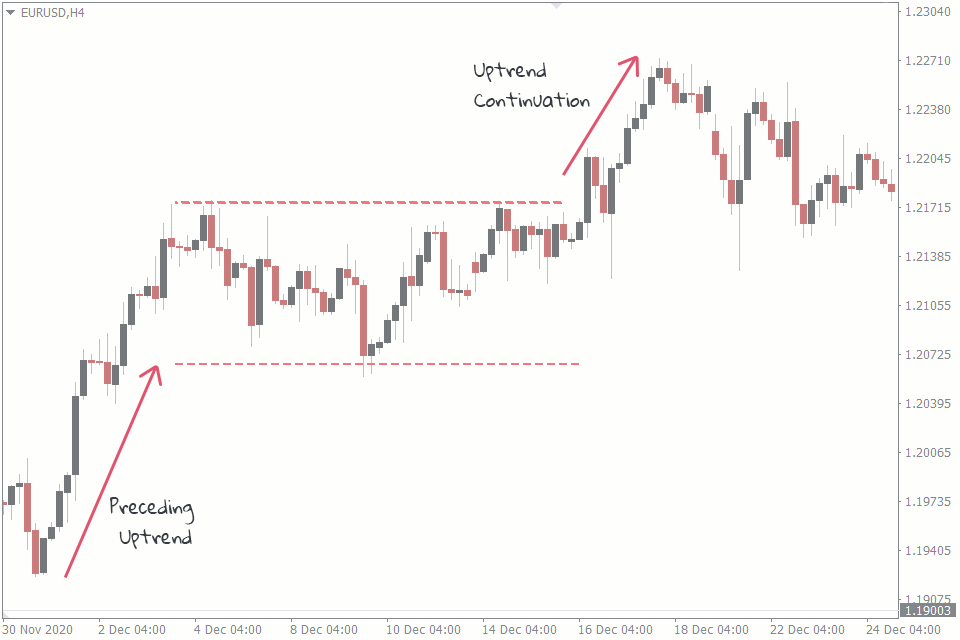

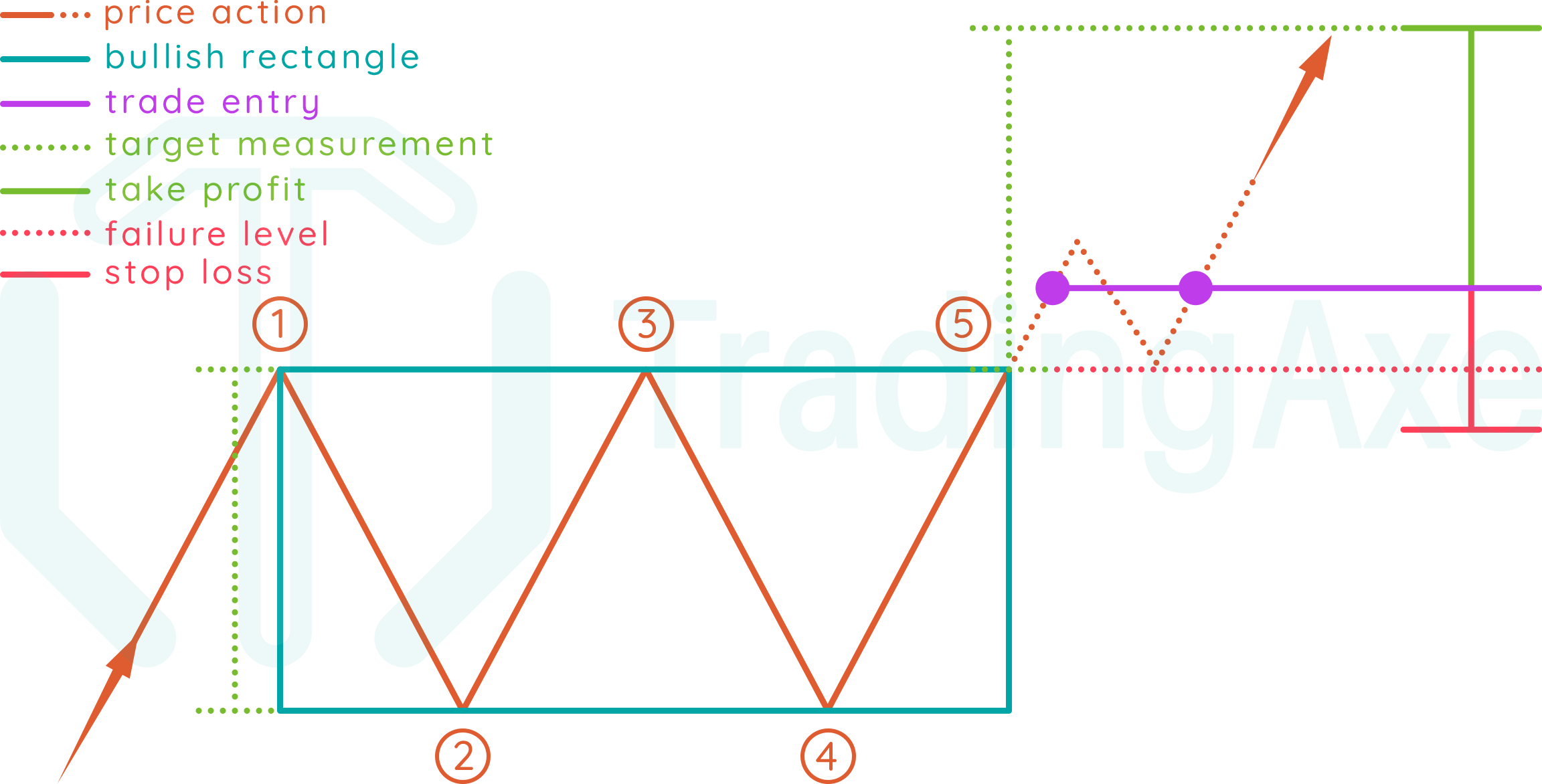

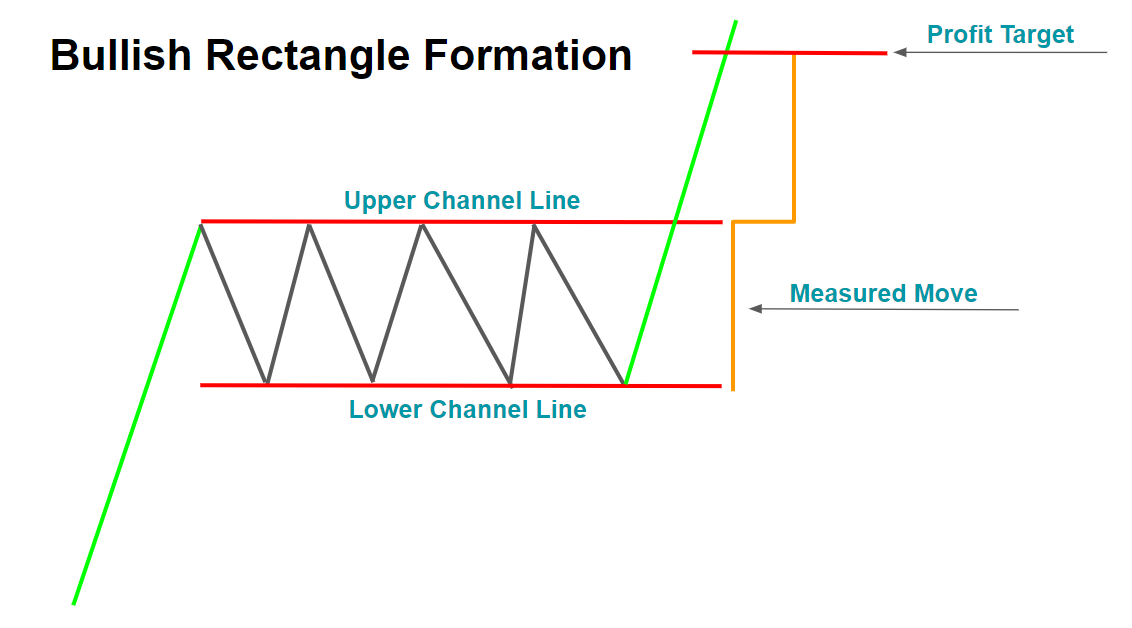

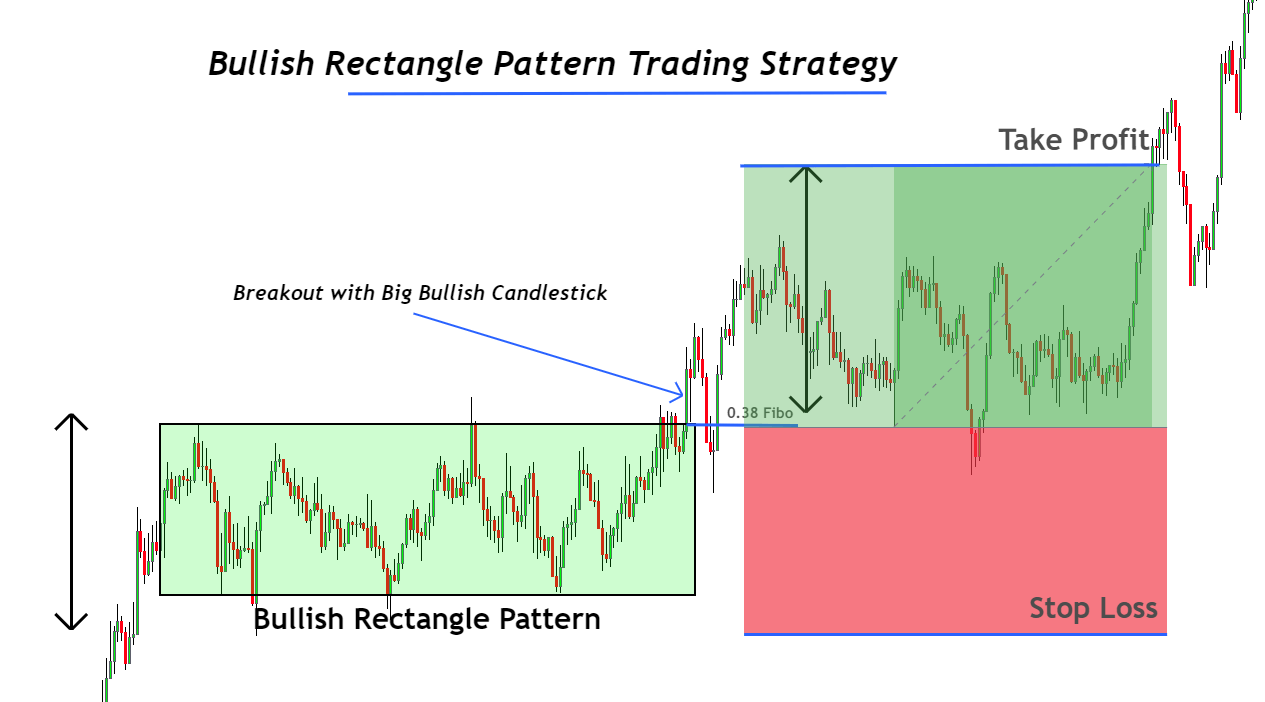

Trading Rectangle Patterns in Forex A Comprehensive Guide FXSSI

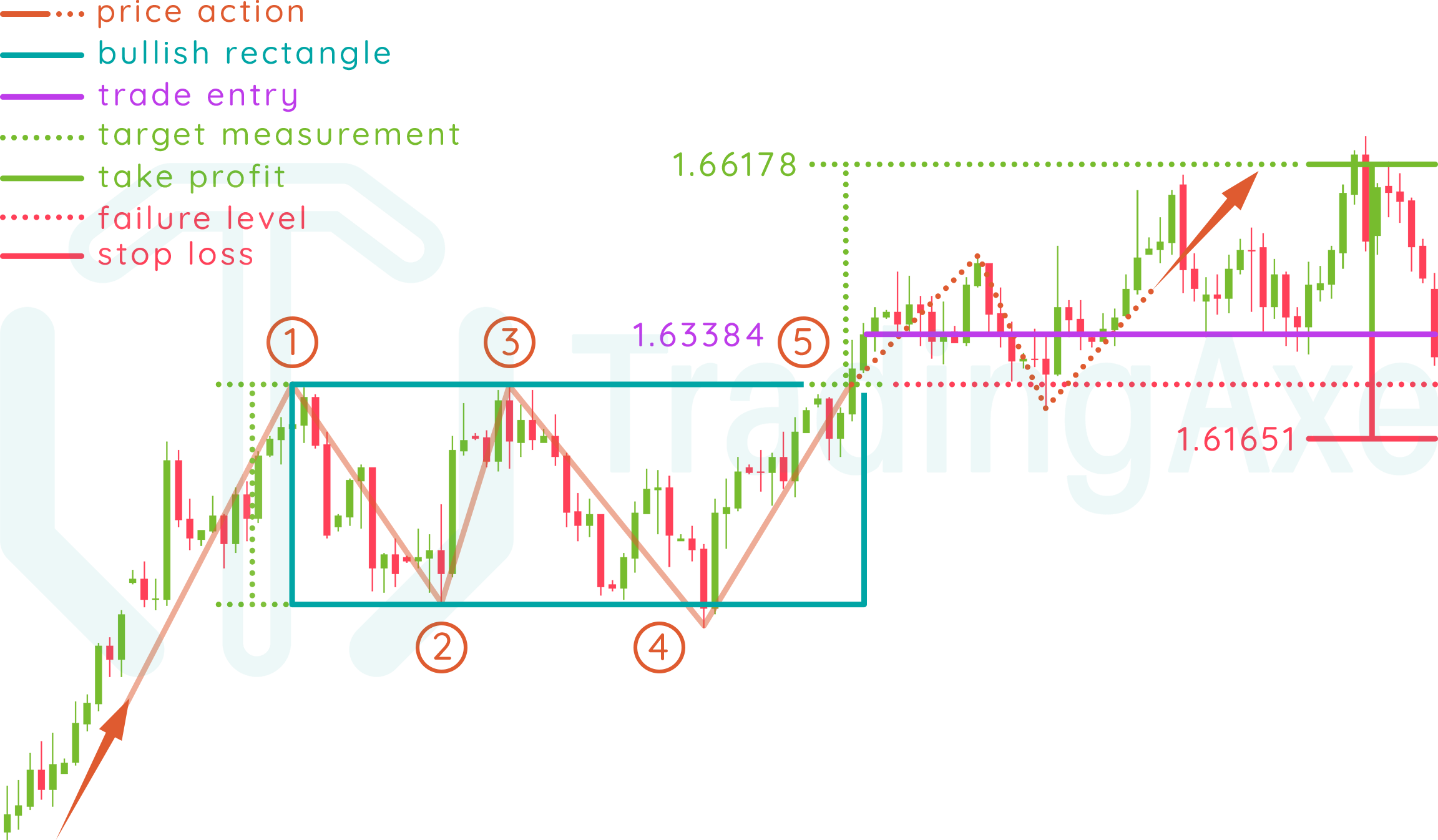

How To Trade Bullish Rectangle Chart Pattern TradingAxe

Topstep Trading 101 The Rectangle Formation Topstep

How to Use the Bullish Rectangle Chart Pattern Market Pulse

Bullish Rectangle Pattern Full Trading Guide ForexBee

Rectangle Chart Pattern Trading Guide Forex Training Group

![Chart Patterns The Advanced Guide [Bonus Cheat Sheet] ForexSpringBoard](https://forexspringboard.com/wp-content/uploads/2018/11/bullish_rectangle.png)

Chart Patterns The Advanced Guide [Bonus Cheat Sheet] ForexSpringBoard

Bullish Rectangle Pattern Full Trading Guide ForexBee

Bullish Rectangle Pattern Full Trading Guide ForexBee

How To Trade Bullish Rectangle Chart Pattern TradingAxe

Web Bullish Rectangle Patterns Are A Type Of Classical Chart Pattern That Indicate A Period Of Indecision Between Buyers And Sellers.

Web Bullish Rectangle Pattern:

Web What Is A Bullish Rectangle Chart Pattern?

Bullish Chart Pattern Reliability & Profitability.

Related Post: