Bullish Pennant Pattern

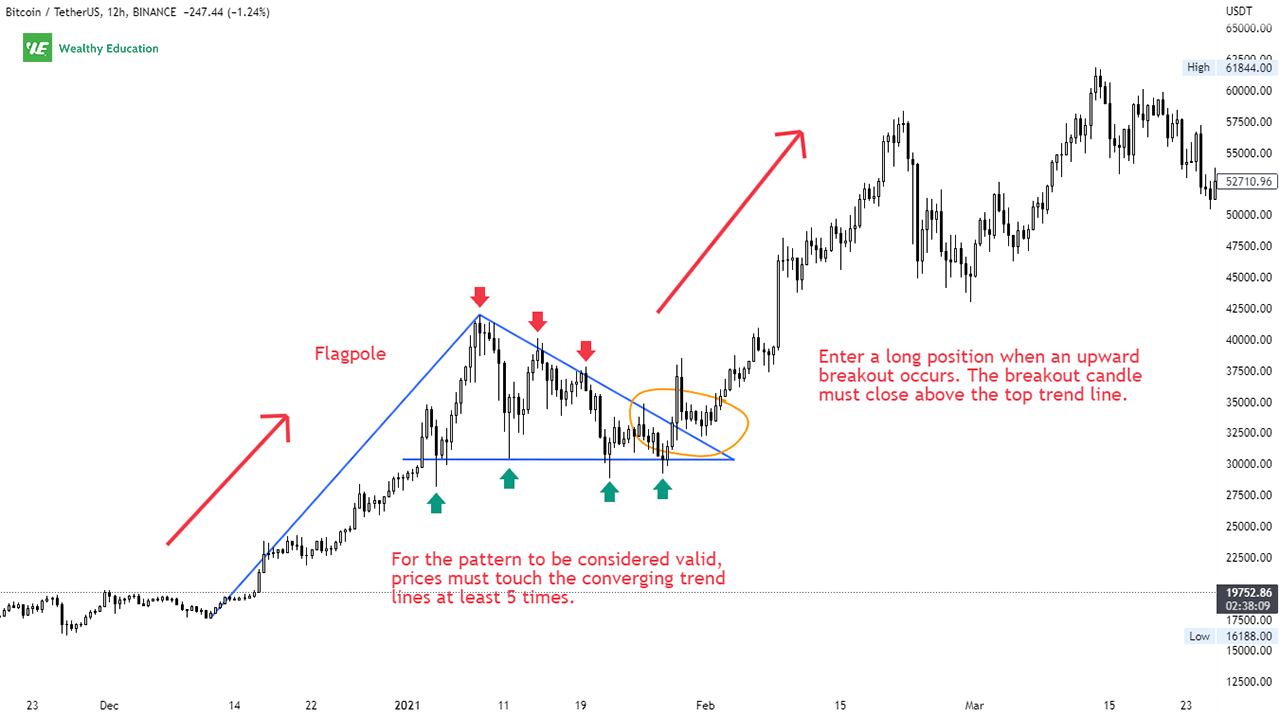

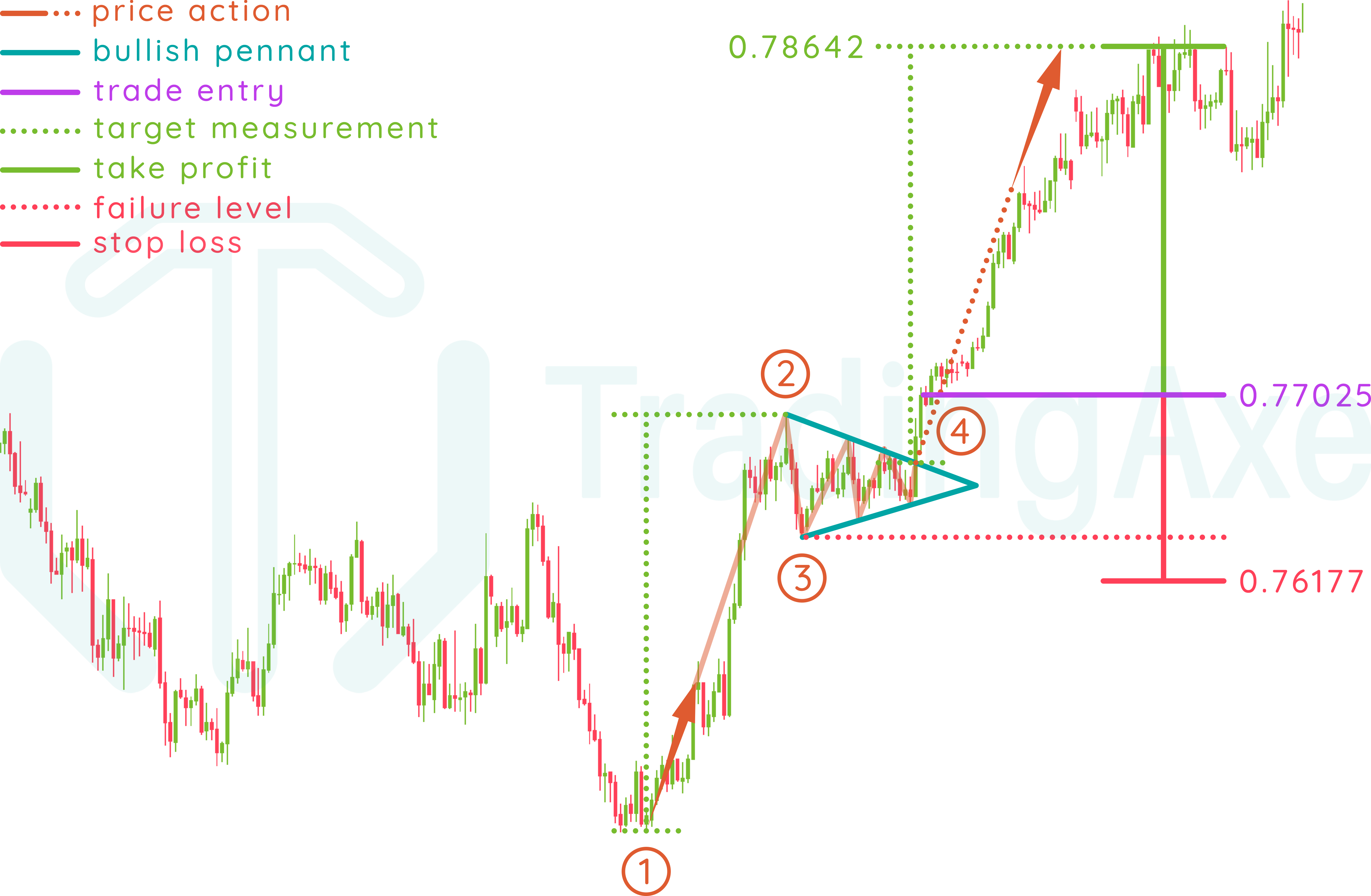

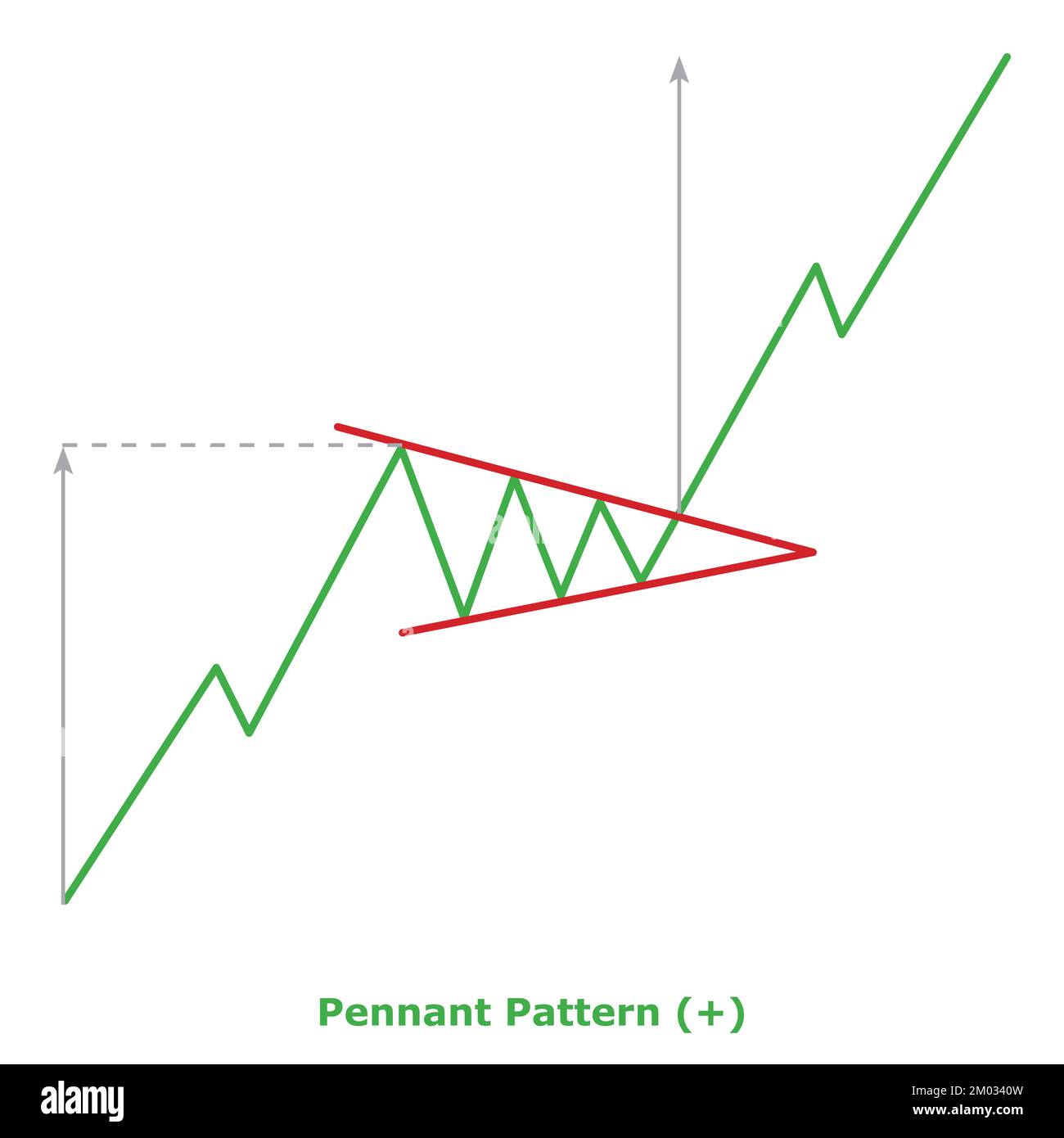

Bullish Pennant Pattern - Web a bull pennant is one of the most popular bullish patterns. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. How to trade bearish and bullish pennants. Web the pattern is considered bullish if the price action is moving up towards the apex of the triangle and bearish if it is moving down. The breakout from this consolidation typically occurs to. For a bearish flag or pennant, a break below support signals that the previous decline has resumed. You can see below that the nzdusd is capped by the 200dma (red) but developing a bullish pennant. The pennant is formed from an upward flagpole, a consolidation period and then the continuation of the. When the security breaks out, the trader may look for. Web the pattern is considered bullish if the price action is moving up towards the apex of the triangle and bearish if it is moving down. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Web bullish pennants can. Web march 16, 2023 admin. Traders aim to close their position, assuming a reversal is on the horizon during this period. Web bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. Web what is a bullish pennant pattern. They consist of either a large bullish candlestick or several smaller. Web the bullish pennant pattern is a formation that occurs after an uptrend. What is the pennant chart pattern? This post was originally posted here. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. A bullish pennant pattern occurs in strong uptrends. Web for a bullish flag or pennant, a break above resistance signals that the previous advance has resumed. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. Web in this guide, we unveil the secrets of bullish pennant pattern, exploring its psychology, identification, and trading strategies. Web bullish on disgruntled. The breakout from this consolidation typically occurs. Web for example, a trader may see that a bullish pennant is forming and place a limit buy order just above the pennant's upper trendline. Potential 80k move when we test resistance of a bullish pennant and flag pole on. Web the pattern is considered bullish if the price action is moving up towards the apex of the triangle and. Web bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. When the security breaks out, the trader may look for. Volume should be heavy during the advance or decline that forms the flagpole. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging. The pattern has completed when price breaks out of the triangle in the direction of the preceding trend, at which point it will likely continue in this direction. What is a bullish pennant? How to trade bearish and bullish pennants. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by. A bull pennant forms during a strong upside price move, signaling a temporary pause and potential continuation of the prevailing trend. The bullish pennant is among the strongest continuation patterns, as it frequently precedes up trend extension. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in the same direction. The bullish pennant is among the strongest continuation patterns, as. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. Web the bull pennant pattern is a technical analysis indicator that signals the extension of an uptrend. Web march 16, 2023 admin. A bullish pennant is a technical trading pattern that indicates the impending continuation. Typically occurring during a robust upward market trend, this pattern features a significant price increase followed by a brief consolidation phase. This post was originally posted here. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. A bullish pennant pattern occurs in strong uptrends. Pennant and flag pole $index:btcusd. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. It’s a powerful and versatile chart pattern that lets you “buy low” in an existing uptrend. Web bullish and bearish are the main two kinds of pennant patterns. The bearish pennant pattern occurs after a significant decrease in a financial instrument’s price. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. It consists of a single or series of upward price breaks, followed by market consolidation. Once the price increases, the currency pair starts trading within a range between its support and resistance levels, and fluctuates by dropping a. Volume should be heavy during the advance or decline that forms the flagpole. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by several smaller bearish candlesticks forming consolidation into a triangle, which forms the pennant. Web the nzdusd is setting up for a bullish breakout this week and target above the.6150 level and closer to.6200 if the us cpi data comes in weaker than the market expects.

BULLISH PENNANT CHART PATTERN FREE CHART PATTERN COURSES TECHNICAL

How To Identify and Trade Pennant Patterns? Phemex Academy

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Patterns Trading Bearish & Bullish Pennants

Bullish Pennant Patterns A Complete Guide

Bull Pennant Pattern (Updated 2023)

Bullish Pennant Patterns A Complete Guide

How To Trade Bullish Pennant Chart Pattern TradingAxe

Pennant Pattern Bullish (+) Small Illustration Green & Red

How To Trade Bearish And Bullish Pennants.

It Gets Its Name From The Pennant Shape Created By Two Converging Trend Lines.

The Pattern Has Completed When Price Breaks Out Of The Triangle In The Direction Of The Preceding Trend, At Which Point It Will Likely Continue In This Direction.

Potential 80K Move When We Test Resistance Of A Bullish Pennant And Flag Pole On.

Related Post: