Bullish Flag Chart Pattern

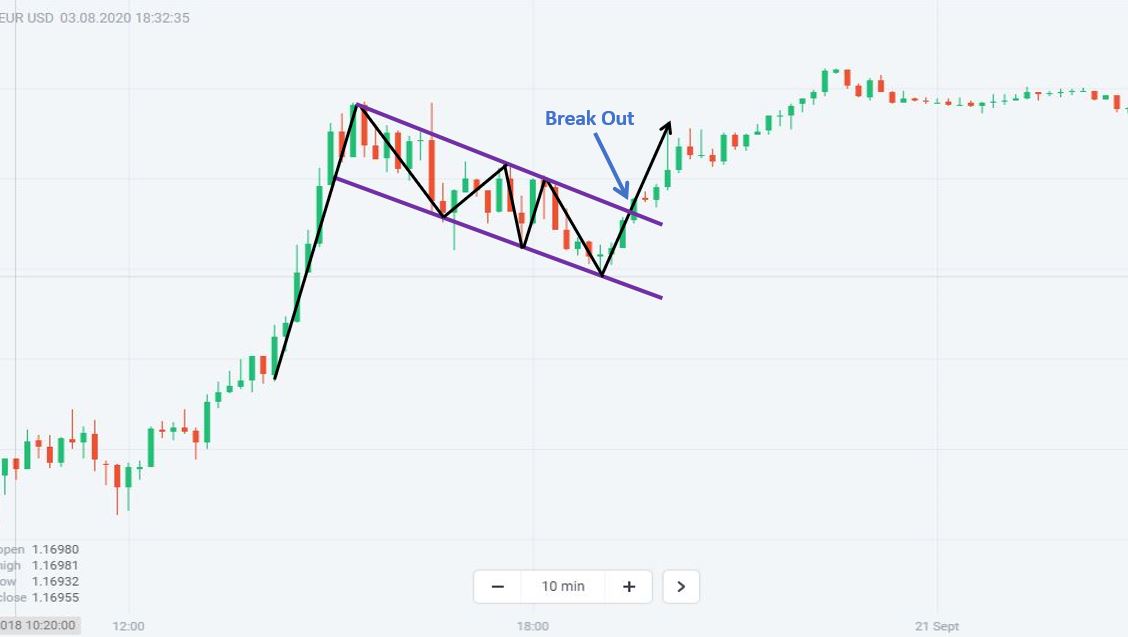

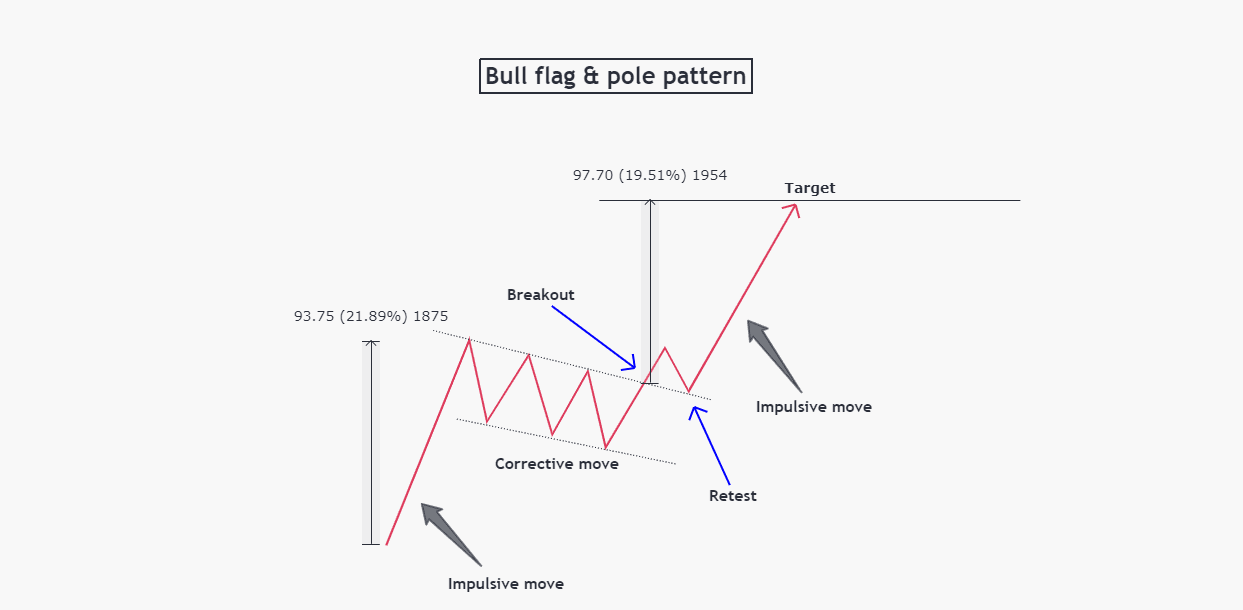

Bullish Flag Chart Pattern - Price is contained by 2 parallel trend lines that lie close together and are sloped against the mast. If the pattern plays out, pepe will retest the breakout level, leading to a continuous uptrend. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. Identifying bullish & bearish flag patterns on a chart: Identified by measuring the flag's pole height, which is the vertical distance between points (1) and (2), that measurement is then applied from the breakout rate (4) stop loss: Web a bullish flag pattern is a continuation chart pattern commonly observed in trading. Bull flag and bear flag trading explained. Web what is a bullish flag pattern? The flag pattern is a technical analysis chart pattern that has mainly 6 distinct characteristics such as strong trend, consolidation, parallel trendlines, volume, breakout, and target price. How does bullish flag pattern? Web a bull flag is a bullish stock chart pattern that resembles a flag, visually. Web gold bull flag formation. Web a bullish flag pattern is a continuation chart pattern commonly observed in trading. Web for a bullish flag or pennant, a break above resistance signals that the previous advance has resumed. Web updated may 26, 2021. Web the chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. Look for a strong upward move (the flagpole) before the pattern. The technical analysis of the gold market also indicates a strongly bullish outlook, as seen by recent trends observed on the daily chart. Web gold bull flag formation. Web 5 min read. Price is contained by 2 parallel trend lines that lie close together and are sloped against the mast. The flag's lowest low (3) bullish flag price action. Bullish flags can form after an uptrend, bearish flags can form after a downtrend. Bullish flags are present in all markets in all time frames. As a result, it’s called a bull flag. With market response to whale purchases and the formation of bullish patterns on price charts indicating a positive outlook for pepe, the token is set to. Identified by measuring the flag's pole height, which is the vertical distance between points (1) and (2), that measurement is then applied from the breakout rate (4) stop loss: Web updated may 26, 2021.. Web the pattern usually forms at the midpoint of a full swing and consolidates the prior move. The price in the channel should not fall below the middle of the flagpole. This often comes with increasing volume. Web a bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. First, there’s a strong move up, resulting. The flag's lowest low (3) bullish flag price action. The flag pattern is a technical analysis chart pattern that has mainly 6 distinct characteristics such as strong trend, consolidation, parallel trendlines, volume, breakout, and target price. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. Web the chart example above shows. Web bullish flag chart pattern: Web gold bull flag formation. The flagpole represents a strong price movement, followed by a period of consolidation, forming the flag. With market response to whale purchases and the formation of bullish patterns on price charts indicating a positive outlook for pepe, the token is set to. Bullish flags can form after an uptrend, bearish. Bullish flags can form after an uptrend, bearish flags can form after a downtrend. A bull flag must have orderly characteristics to be considered a bull flag. Web a bullish flag pattern is a continuation chart pattern commonly observed in trading. Web a bull flag is a powerful pattern seen on price charts, indicative of a continuation in an uptrend. The flag's lowest low (3) bullish flag price action. Price is contained by 2 parallel trend lines that lie close together and are sloped against the mast. Web the chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. How does bullish flag pattern? Web bullish flag chart pattern technical & fundamental stock screener, scan. The above chart highlights a bull flag. Web updated may 26, 2021. Over the past three weeks, gold. Web a bull flag is a powerful pattern seen on price charts, indicative of a continuation in an uptrend following a brief period of consolidation. Web a bull flag is a continuation pattern that occurs as a brief pause in the trend. Web a bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. The price in the channel should not fall below the middle of the flagpole. Over the past three weeks, gold. The above chart highlights a bull flag. The bullish flag pattern is usually found in assets with a strong uptrend. Web a bullish flag pattern is a continuation chart pattern commonly observed in trading. Web gold bull flag formation. Volume should be heavy during the advance or decline that forms the flagpole. Web a bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price move higher. Identifying bullish & bearish flag patterns on a chart: Web 5 min read. How does bullish flag pattern? Web bullish flag chart pattern: The flag's lowest low (3) bullish flag price action. Web flag patterns, whether bullish or bearish, are classic chart formations that traders use to predict potential continuations in the prevailing trend. Web a bull flag is a powerful pattern seen on price charts, indicative of a continuation in an uptrend following a brief period of consolidation.

What Is Flag Pattern? How To Verify And Trade It Efficiently

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

Bullish Flag Chart Pattern

Bull Flag Pattern New Trader U

How to use the flag chart pattern for successful trading

What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

Bullish Pennant Patterns A Complete Guide

Bullish flag chart pattern Basic characteristics & 3 examples

Bull Flag Chart Patterns The Complete Guide for Traders

How to Trade Bullish Flag Patterns

Bullish Flags Are Present In All Markets In All Time Frames.

The Technical Analysis Of The Gold Market Also Indicates A Strongly Bullish Outlook, As Seen By Recent Trends Observed On The Daily Chart.

Web The Bull Flag Chart Pattern Is A Continuation Chart Pattern That Resembles A Flag In A Pole And Emerges When A Trade Experiences A Significant Price Rise.

The Flagpole Represents A Strong Price Movement, Followed By A Period Of Consolidation, Forming The Flag.

Related Post: