Bullish Engulfing Pattern

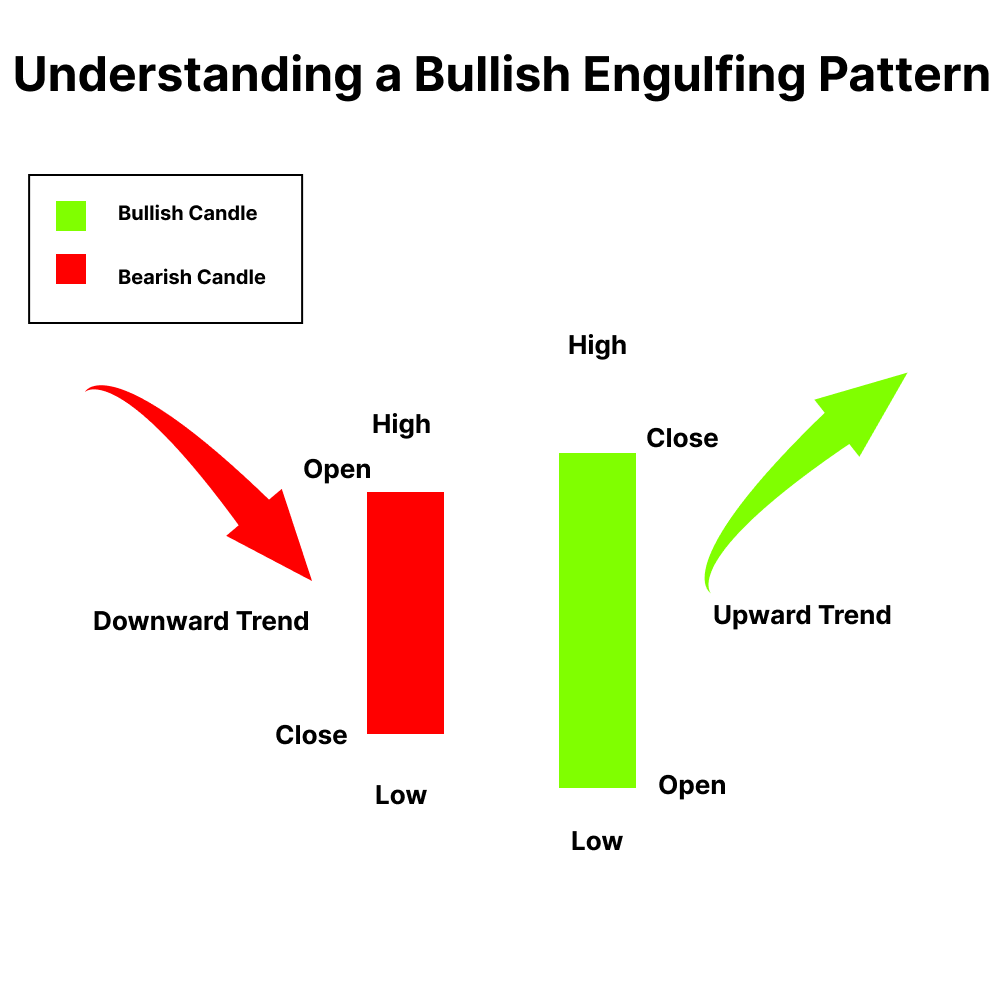

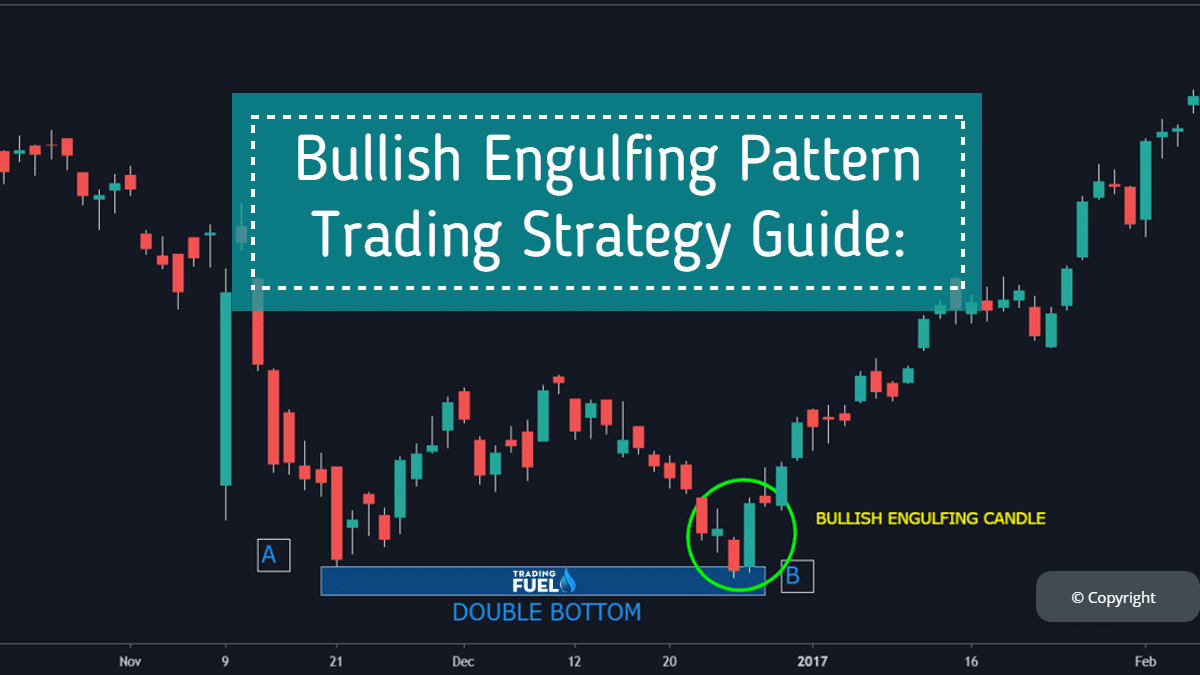

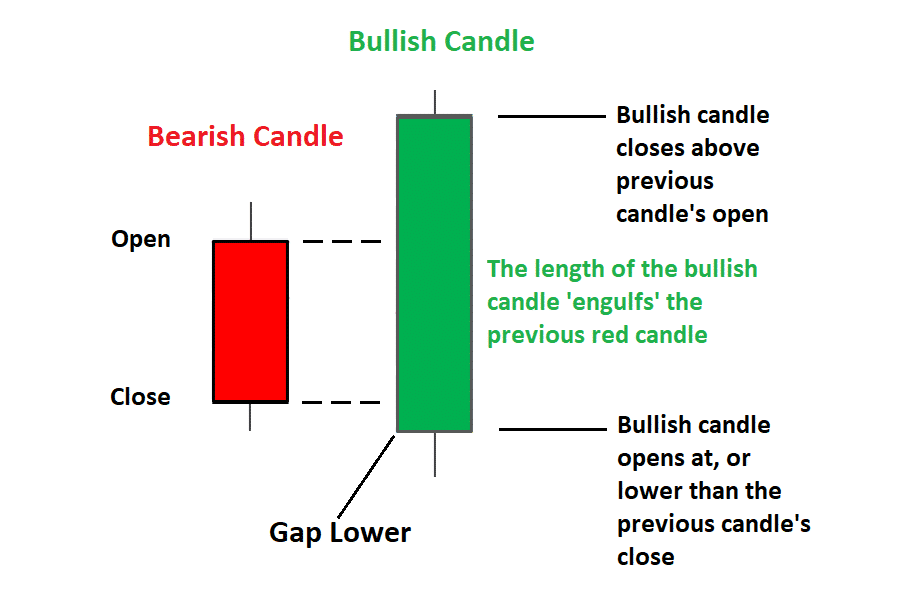

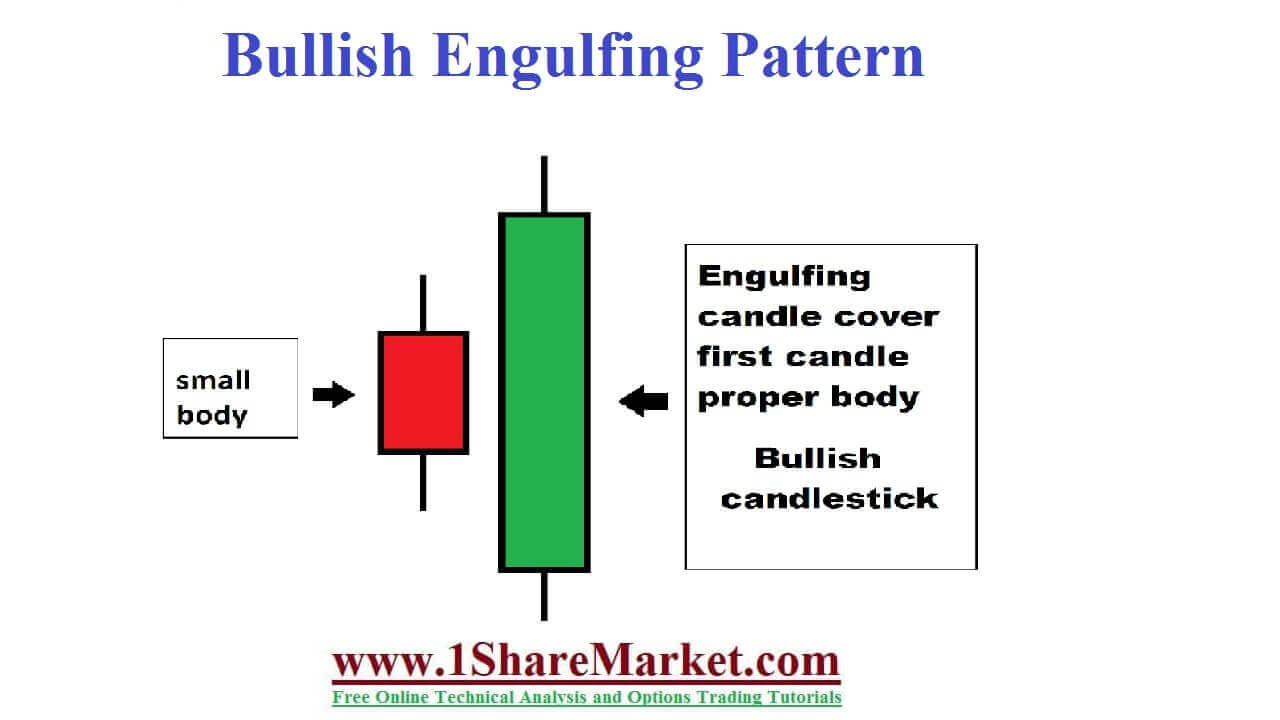

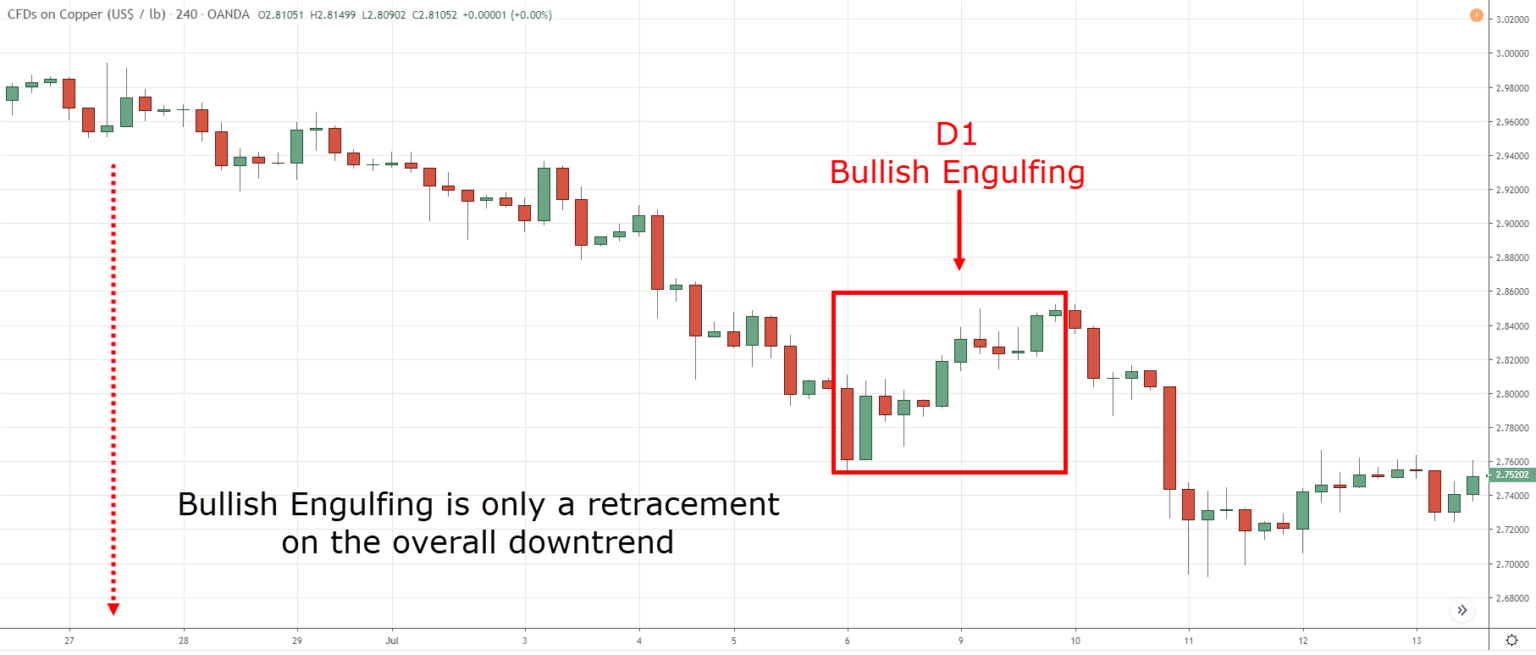

Bullish Engulfing Pattern - Comprising two consecutive candles, the pattern features a smaller. Example of a bullish engulfing pattern. They consist of a big bullish. Furthermore, friday’s nfp bearish engulfing day was on relatively low volume, meaning bears. Web what does a bullish engulfing pattern tell you? They are popular candlestick patterns because they are easy to spot and trade. Web this is the modified version of the engulfing candles indicator: Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. In other words, the green candle closes above the red candle’s opening price after opening lower than the latter’s closing price. This occurrence allows the white candle to engulf the prior day’s black candle. This occurrence allows the white candle to engulf the prior day’s black candle. Key takeaways in bullish engulfing pattern. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one. The first candle has a lower close. Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. The bullish engulfing candle signals a reversal of a downtrend and indicates a rise in buying pressure when it appears at the bottom of a downtrend. A small bearish (red or black) candlestick and. Less than 1 day ago The first candle in the pattern is bearish, followed by a bullish candle that completely engulfs the body of the first candle. The bullish engulfing pattern occurs after a downtrend consisting of two candlesticks, the bullish candlestick that covers the bearish candlestick. This script serves as the 'engulfing candles v2' indicator in tradingview. A small. In other words, the green candle closes above the red candle’s opening price after opening lower than the latter’s closing price. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web a bullish engulfing pattern is a technical analysis pattern that signals a potential reversal from a. Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. Most bullish reversal patterns require bullish. Consequently, the stock may experience an upward, or. Yet the small bullish inside week shows a hesitancy to break immediately lower, and the daily chart shows prices holding above 105. Web mon,. It indicates that the bears have lost control of the market and the bulls are likely to take control in the near future. Btc/usdt daily chart | credit: Scanner guide scan examples feedback. This script serves as the 'engulfing candles v2' indicator in tradingview. Otherwise, it’s not a bullish pattern, but a continuation pattern. Otherwise, it’s not a bullish pattern, but a continuation pattern. Yet the small bullish inside week shows a hesitancy to break immediately lower, and the daily chart shows prices holding above 105. What is bullish engulfing pattern? The bullish engulfing candle signals a reversal of a downtrend and indicates a rise in buying pressure when it appears at the bottom. The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high, and. Otherwise, it’s not a bullish pattern, but a continuation pattern. Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. In other words, the green candle closes above the. The bullish engulfing candle signals a reversal of a downtrend and indicates a rise in buying pressure when it appears at the bottom of a downtrend. The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high, and. This script serves as the 'engulfing candles v2' indicator in tradingview. Web. It gets its name from the second candle that engulfs the first candle in the bullish direction. Web the bullish engulfing pattern is a bullish reversal candlestick that forms after a decline in price. The second candle completely ‘engulfs’ the real body of the first one, without regard to the length of the tail shadows. Web the bullish engulfing candle. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. Unlike a mere white candle following a black one, a bullish engulfing pattern demands that the stock opens lower on day two than its close on day one. This pattern reverses the ongoing trend as more buyers enter the market and move the prices up further. A small red/black candlestick is followed by a large white candlestick that completely eclipses or engulfs the previous day's candlestick. The bullish engulfing pattern is considered a reversal at the end of downtrends or near support levels. Web what is it? The first candle has a lower close. Web what does a bullish engulfing pattern tell you? It gets its name from the second candle that engulfs the first candle in the bullish direction. The bullish engulfing pattern often triggers a reversal in trend as more buyers enter. Here’s how to recognize one: It is a popular technical analysis indicator used by traders to anticipate bullish uptrend in the price of an asset. Web mon, may 13th, 2024. The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high, and. The body of the 2 nd candle “covers” the body of the first candle. And here’s what a bullish engulfing pattern means…

Bullish Engulfing Pattern Meaning, Example & Limitations Finschool

Bullish Engulfing Pattern What is it? How to use it?

A Complete Guide To Bullish Engulfing Pattern InvestoPower

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)

Bullish Engulfing Pattern Definition, Example, and What It Means

Bullish Engulfing Pattern Trading Strategy Guide (Pro's Guide)

Bullish Engulfing Pattern An Important Technical Pattern

Bullish Engulfing Candlestick Pattern Best Analysis

Bullish engulfing pattern bullish engulfing candlestick pattern

Bullish Engulfing Pattern Trading Strategy Guide

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

Web Bullish Reversal Patterns Should Form Within A Downtrend.

Web A Bullish Engulfing Pattern Is A Candlestick Chart Pattern That Occurs After An Extended Downtrend.

It Indicates That The Bears Have Lost Control Of The Market And The Bulls Are Likely To Take Control In The Near Future.

What Is A Bullish Engulfing Candle?

Related Post: