Bullish Continuation Patterns

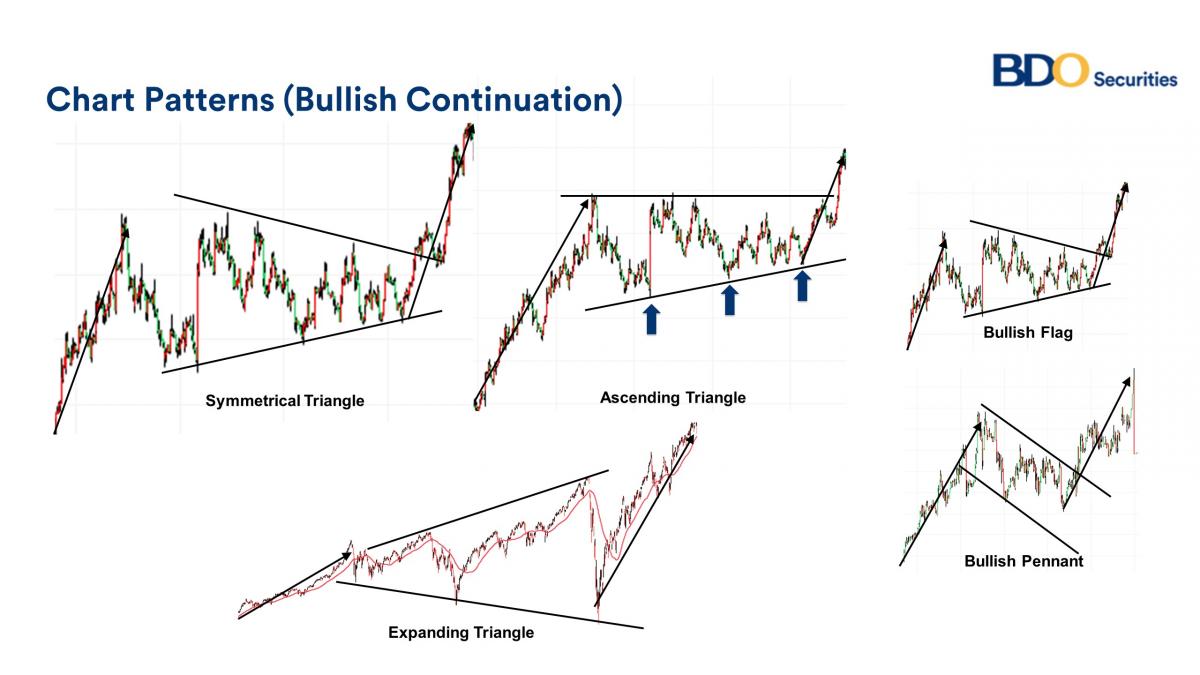

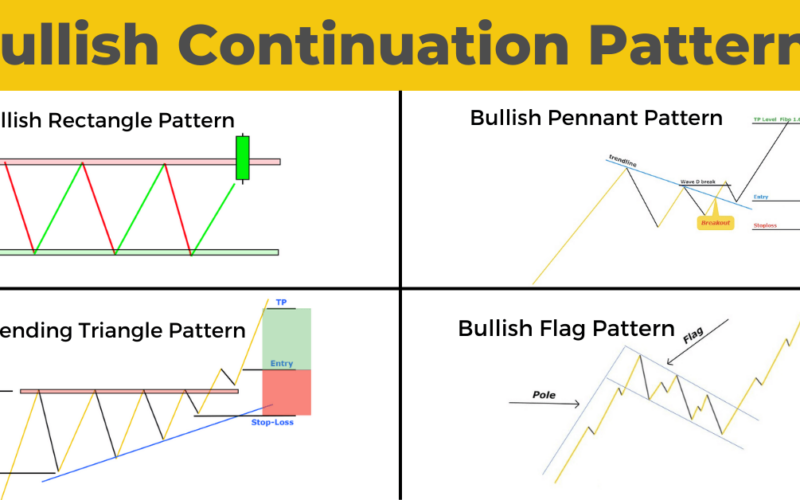

Bullish Continuation Patterns - There could be a double bottom to start the reversal advance, a price channel during the reversal advance, an ascending triangle to mark the consolidation and another price channel to mark the continuation advance. Analysts identify a bullish falling wedge pattern on bitcoin's daily chart, indicating bullish rally for btc ahead. Yet, a new bullish wave might begin soon. Technical analysis by tradingrage the daily chart on the daily chart, the btc price has been trapped inside a large descending channel pattern, making lower hig… The pattern consists of two distinct parts: Head and shoulders pattern head and shoulders consist of three parts: The bearish continuation pattern works in The bears tried again immediately after the mat hold candlestick pattern had been formed. The portion between black lines. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. Yet, a new bullish wave might begin soon. Web rising three methods: Web bullish continuation candlestick patterns. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. Web crypto analyst ali martinez predicts bitcoin could rally to $76,610 if it breaks. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. This exceptional rally emphasizes the potential of continuation patterns: They effectively inform trading decisions at a graduate level. Web the bullish measured move can be made up of a number of patterns.. Web bitcoin’s price has failed to continue its upward trajectory since dropping from the $75k level. The basic chart patterns are the same. Web this pattern is generally considered a continuation pattern, suggesting that the price will continue in the trend direction it was moving before the pattern appeared. A technical analysis pattern that suggests a trend is exhibiting a. Web bullish continuation patterns are key indicators that traders and investors use to identify the likelihood of a trend persisting. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. Web bullish rectangle the bullish rectangle is a continuation patterns that occur when a price pauses during a strong trend and. The cup portion of the pattern should be a u shape that. Web bullish continuation candlestick patterns. Web continuation patterns can be found in both bullish and bearish trends, signaling the likelihood of the trend continuing. Wedge chart patterns can be both continuation and reversal patterns, depending on whether there is a bullish or bearish trend. These patterns occur during. Web bullish continuation patterns. If a trend is bullish, that means the price is going up. Floki had been trapped in a symmetrical triangle and a bullish flag since hitting a high of $0.00031500 on march 14th. Web continuation patterns can be found in both bullish and bearish trends, signaling the likelihood of the trend continuing. Web bearish continuation candlestick. Technical analysis by tradingrage the daily chart on the daily chart, the btc price has been trapped inside a large descending channel pattern, making lower hig… Analysts identify a bullish falling wedge pattern on bitcoin's daily chart, indicating bullish rally for btc ahead. Web bullish continuation patterns are key indicators that traders and investors use to identify the likelihood of. This exceptional rally emphasizes the potential of continuation patterns: There could be a double bottom to start the reversal advance, a price channel during the reversal advance, an ascending triangle to mark the consolidation and another price channel to mark the continuation advance. Web gold’s trend remains bullish, says the analyst, noting that the precious metal’s breakout above the resistance. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. Yet, a new bullish wave might begin soon. This exceptional rally emphasizes the potential of continuation patterns: The bearish continuation pattern works in In a bullish trend, continuation patterns suggest that. Continuation patterns are similar whether you’re looking at bullish or bearish trends. Japanese candlestick continuation patterns are displayed below from strongest to weakest. Here traders are booking their profit. Web bitcoin’s price has failed to continue its upward trajectory since dropping from the $75k level. Web the bullish measured move can be made up of a number of patterns. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. The you will see, stock will trade sideways for some time. They effectively inform trading decisions at a graduate level. Forexboat.com) bullish and bearish continuation patterns. The pattern consists of two distinct parts: This pattern is formed when the candlesticks meet the following characteristics. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. If a trend is bullish, that means the price is going up. A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior, and will eventually continue on its existing trend. Web the bulls overran the bears on the 5th candlestick, causing a gap up at its opening price. Web the bullish measured move can be made up of a number of patterns. Web the “mat hold” candlestick pattern is a stronger continuation pattern than the “rising three methods”. Some of the major ones to look out for are the following: Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. Web gold’s trend remains bullish, says the analyst, noting that the precious metal’s breakout above the resistance line on a descending wedge pattern on the daily chart means bulls now have a. Web bullish continuation patterns are key indicators that traders and investors use to identify the likelihood of a trend persisting.

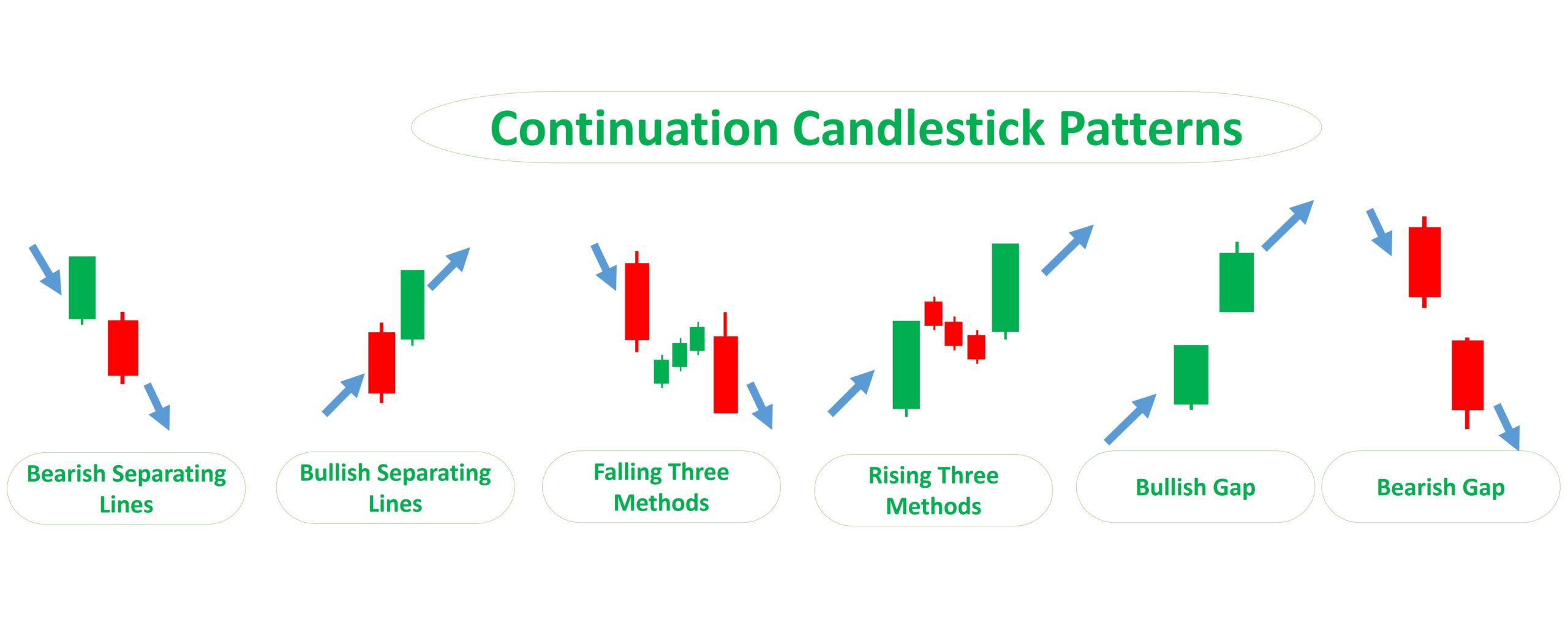

Top Continuation Candlestick Patterns

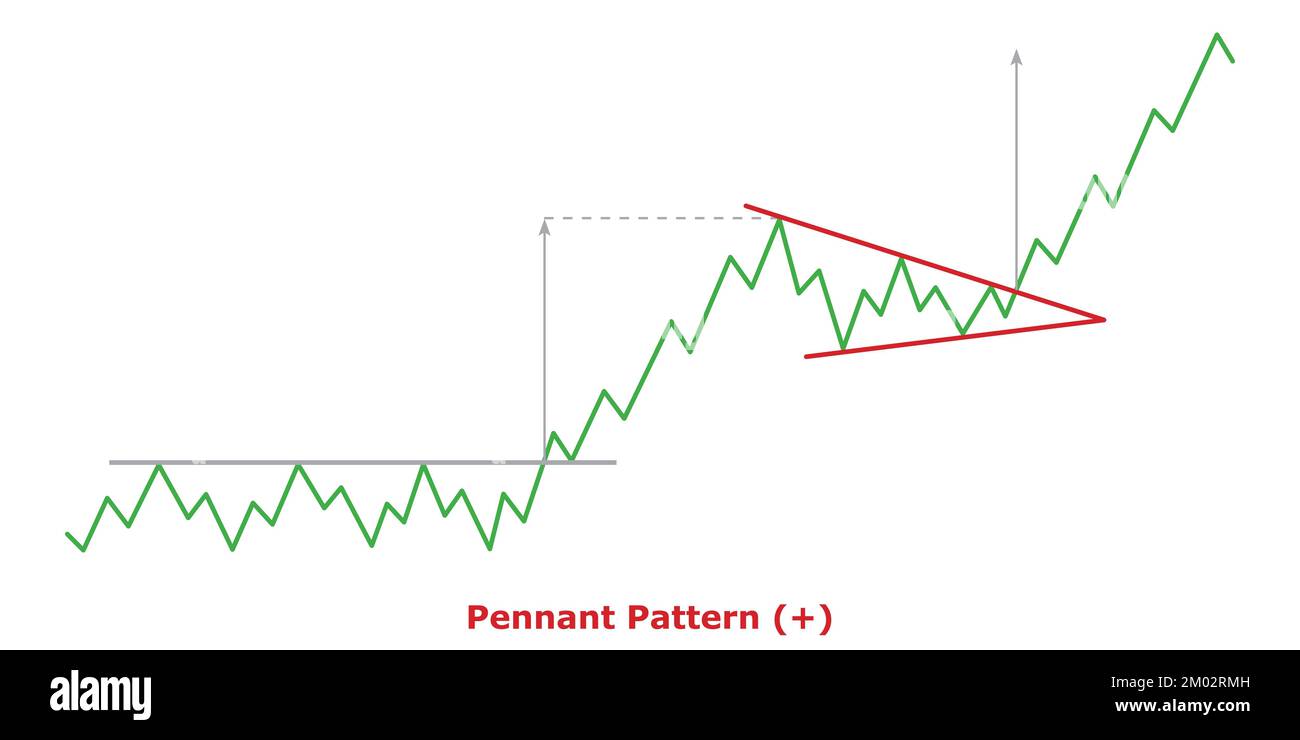

Pennant Pattern Bullish (+) Green & Red Bullish Continuation

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

Flag Bullish Continuation Pattern ChartPatterns Stock Market Forex

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

FOUR CONTINUATION CANDLESTICK PATTERNS YouTube

Continuation Patterns

Bullish Continuation Patterns Overview ForexBee

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

Continuation Pattern Meaning, Types & Working Finschool

Web Rising Three Methods:

These Patterns Occur During Periods Of Price Consolidation, Generally Following A Strong Uptrend In A Financial Instrument, Such As A Stock Or Currency Pair.

Yet, A New Bullish Wave Might Begin Soon.

Wedge Chart Patterns Can Be Both Continuation And Reversal Patterns, Depending On Whether There Is A Bullish Or Bearish Trend.

Related Post: