Bull Flag Patterns

Bull Flag Patterns - Currently, the market is poised within this bull flag pattern, and a decisive break above the $2,375. The bull flag is a clear technical pattern that has three distinct components: Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. Web a bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price move higher. Web what is a bull flag pattern? What is a bull flag? The flagpole and the flag. And the rally needs high volume. What is a bullish flag? However, most guides out there teach you how to spot them and not how to trade them. Advantages and disadvantages of a bullish flag. Conservative traders may look for additional confirmation of the trend continuing. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. Trading this pattern helps professional traders identify price trends with ease, and pick up substantial price swings in a short time. The bull flag formation is a technical. Many professional traders use this continuation pattern to find the optimal place to trade with the trend. Web the bull flag chart pattern is a continuation chart pattern that resembles a flag in a pole and emerges when a trade experiences a significant price rise. Web what is a bull flag pattern? They are called bull flags. Recognized by a. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. What is a bullish flag? This trade setup assumes another breakout after the consolidation period. Conservative traders may look for additional confirmation of the trend continuing. Web what is a bull flag pattern? What's the importance of a bull flag pattern in technical analysis? It signals that the prevailing vertical trend may be in the process of extending its range. What is a bull flag? Web bullish flags can form after an uptrend, bearish flags can form after a downtrend. Bullish flag formations are found in stocks with strong uptrends and are considered. Web the strong support level at $2,285 was discussed in april 2024 and proved to be strong support. A bull flag is a powerful upward price movement (the flagstaff) followed by a period of consolidation (the flag). Web what is a bullish flag pattern? Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. It forms. There are two main price levels that make up the bull flag pattern: The bull flag is a clear technical pattern that has three distinct components: Web what is a bullish flag pattern? Advantages and disadvantages of a bullish flag. Web the bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of. Web a bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. Trading this pattern helps professional traders identify price trends with ease, and pick up substantial price swings in a short time. It’s simple, and it’s effective. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole,. © 2024 millionaire media, llc. Web what are bull flag patterns? And the rally needs high volume. However, most guides out there teach you how to spot them and not how to trade them. Web the bull flag chart pattern is a continuation chart pattern that resembles a flag in a pole and emerges when a trade experiences a significant. The flagpole and the flag. Conservative traders may look for additional confirmation of the trend continuing. When this pattern appears, it tells a story of accumulation and resilience, indicating that the market is steadying itself for more progress. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing. Web updated may 26, 2021. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web a bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. Web a bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price. This post is written by jet toyco, a trader and trading coach. A bull flag must have orderly characteristics to be considered a bull flag. Web what is a bull flag pattern? Learn how to spot a bull flag and why some investors might use a bull flag pattern to identify buy and sell signals. Web the bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. They are called bull flags. It is formed when there is a steep rise in prices (the flagpole) followed by a consolidation period (the flag). Web the bull flag chart pattern is a continuation chart pattern that resembles a flag in a pole and emerges when a trade experiences a significant price rise. Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. When this pattern appears, it tells a story of accumulation and resilience, indicating that the market is steadying itself for more progress. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. A bull flag is a technical pattern that provides an accurate entry to participate in a strong uptrend. And the rally needs high volume. It’s simple, and it’s effective. Web the bull flag pattern is identified by a flag pole rise in the stock followed by the stock trading pattern that hits support and resistance prices for a period of time where some investors.

How to Trade Bullish Flag Patterns

Bull Flag Chart Patterns ThinkMarkets

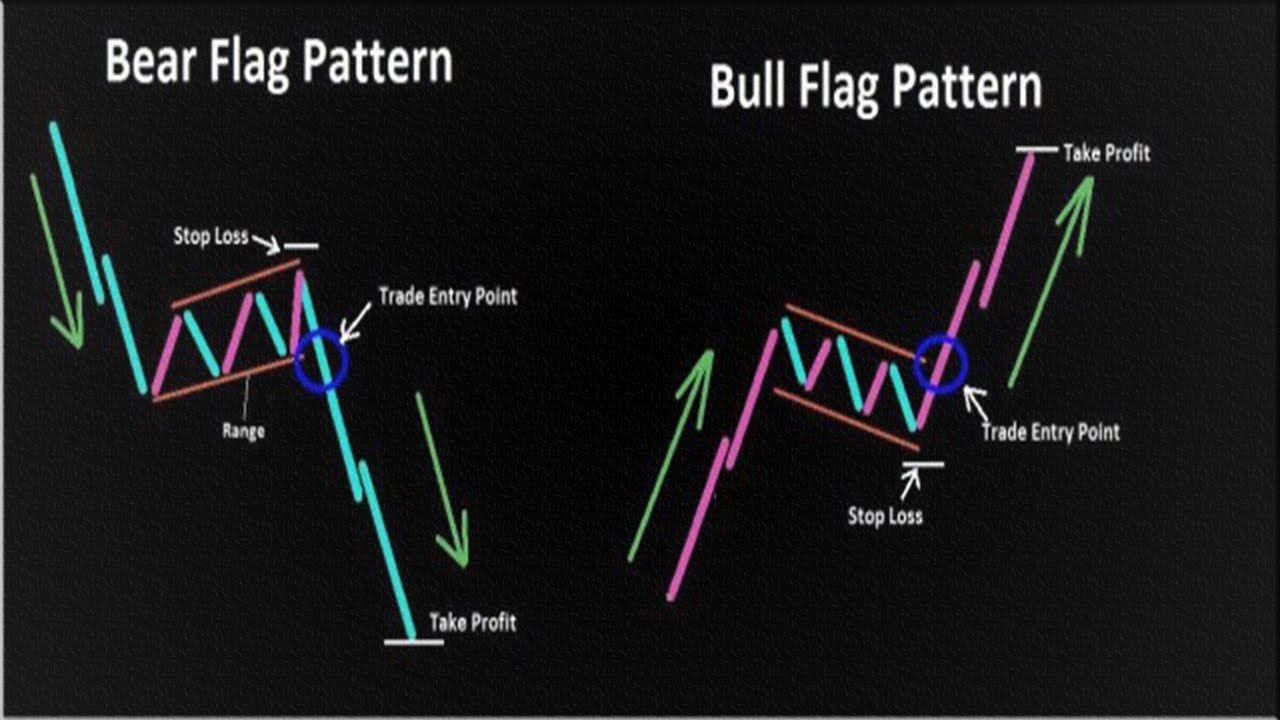

How To Trade Bullish And Bearish Flag Patterns Daily Price Action

Bull Flag Chart Pattern & Trading Strategies Warrior Trading

Bull Flag and Bear Flag Chart Patterns Explained

Bull Flag Chart Patterns The Complete Guide for Traders

What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

High Tight Flag Pattern Explained New Trader U

What is Bull flag pattern? Everything on InoSocial

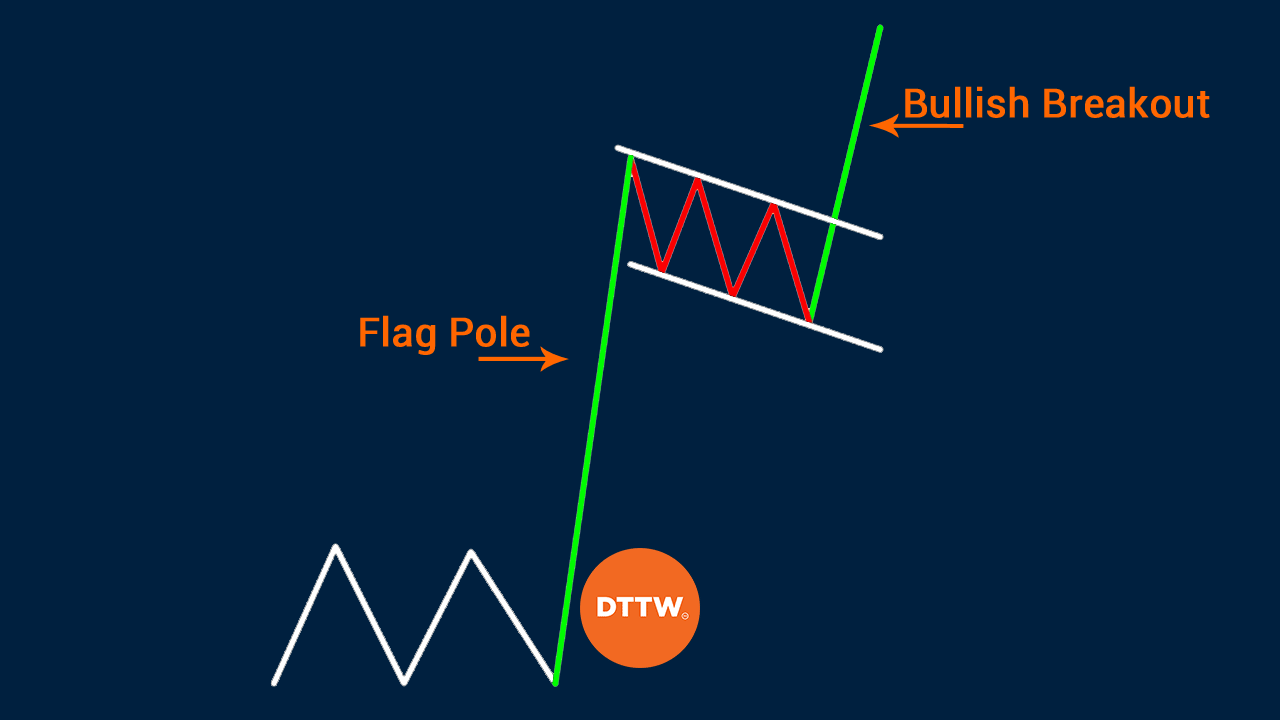

What is Bull Flag Pattern & How to Identify Points to Enter Trade DTTW™

The Bull Flag Chart Pattern Looks Like A Downward Sloping.

The Pattern Occurs In An Uptrend Wherein A Stock Pauses For A Time, Pulls Back To Some Degree, And Then Resumes The Uptrend.

It Is Called A Flag Pattern Because It Resembles A Flag And Pole.

However, Most Guides Out There Teach You How To Spot Them And Not How To Trade Them.

Related Post: