Bull Flag Chart Pattern

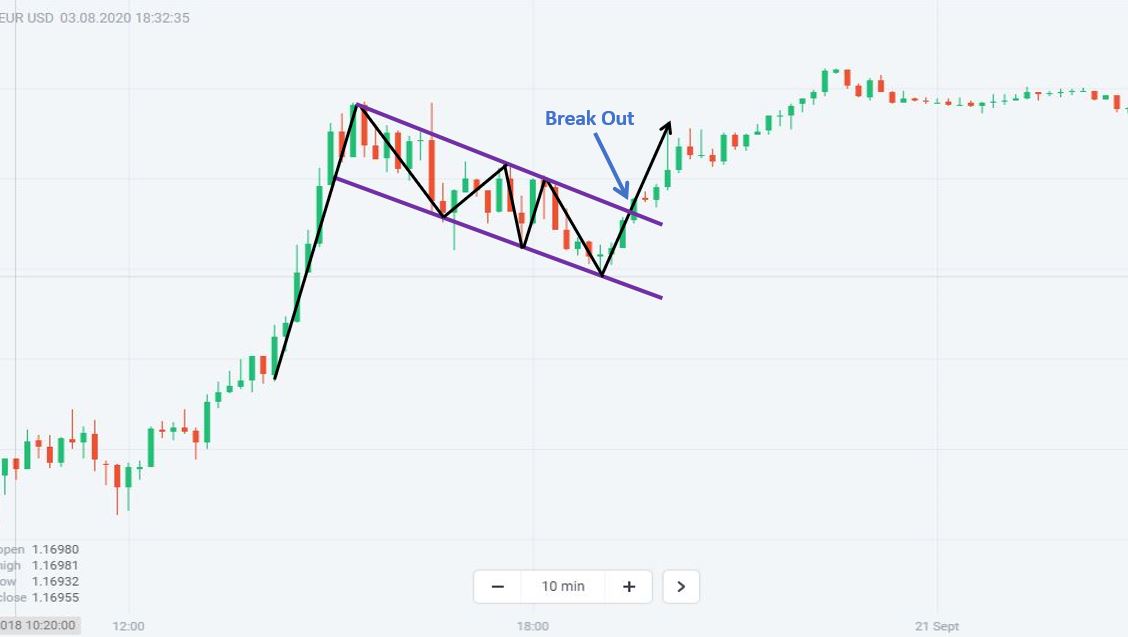

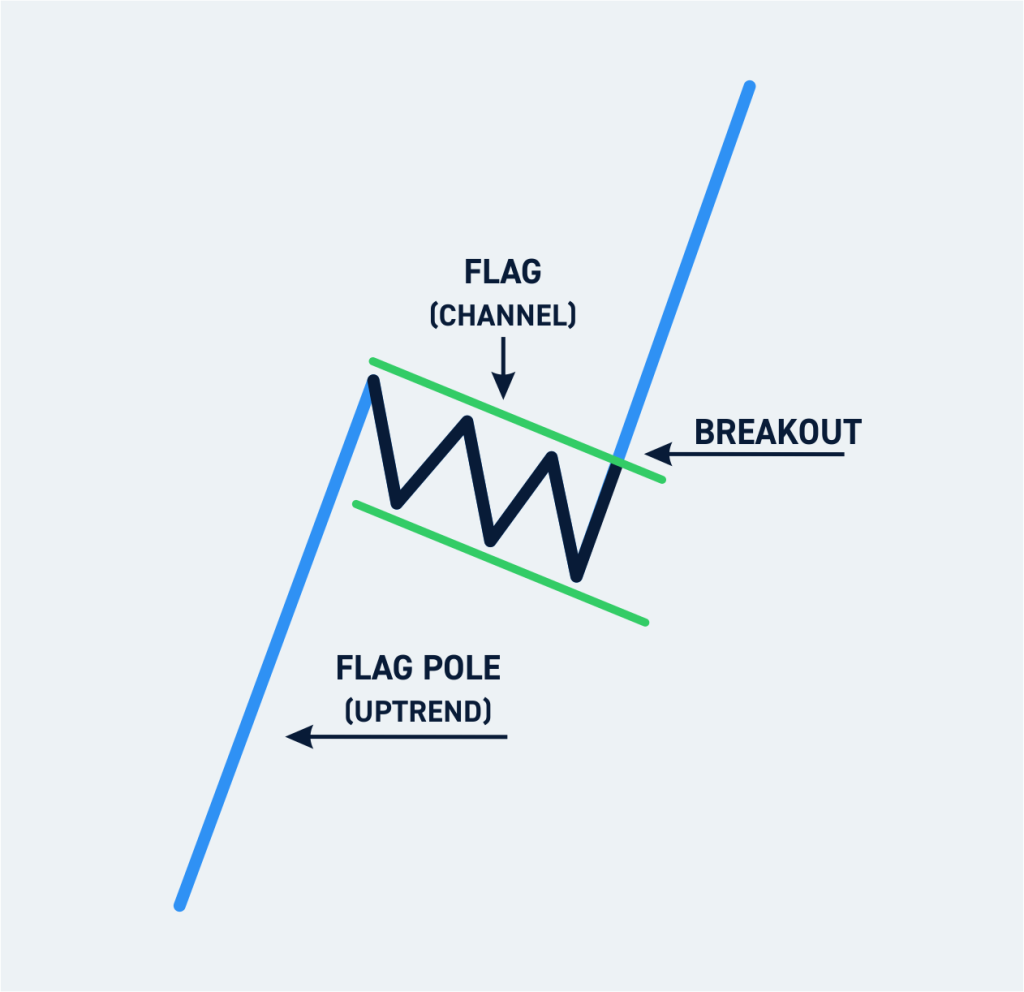

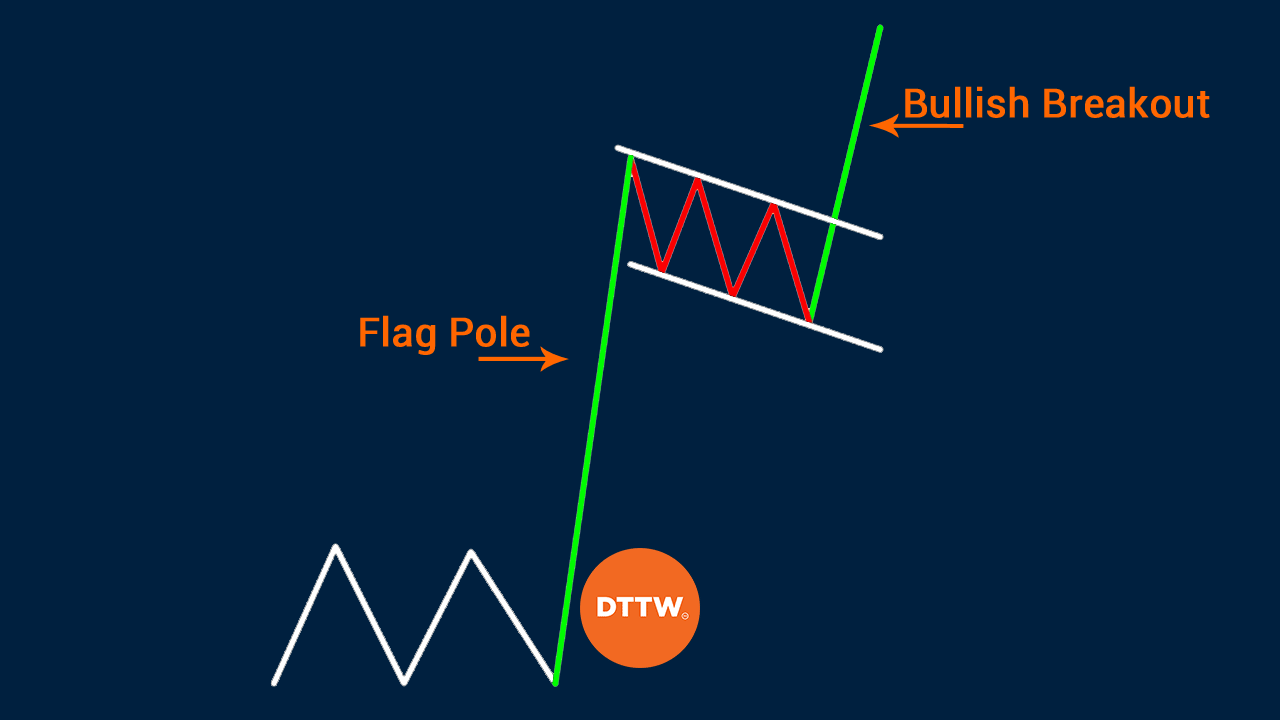

Bull Flag Chart Pattern - What's the importance of a bull flag pattern in technical analysis? The flag is formed by. The above chart highlights a bull flag. What is a bullish flag? Web updated on apr 24, 2024. Web the bull flag chart pattern is a continuation chart pattern that resembles a flag in a pole and emerges when a trade experiences a significant price rise. Web updated may 26, 2021. The bull flag pattern is a technical analysis chart pattern commonly used in trading. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Web bull flags are one of the most well known & easily recognized chart patterns. There should be a straight run upwards leading up to. Web the bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. As a result, it’s called a bull flag because of its shape. The bull flag is a clear technical pattern that has three distinct components: Web the. First, there’s a strong move up, resulting in bullish candlesticks forming the pole. The flag pole, the flag, and the break of the price channel. The bull flag formation is a technical analysis pattern that resembles a flag. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. It signals that the prevailing vertical trend may be in the process of extending its range. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a flag pattern is a technical. As a result, it’s called a bull flag because of its shape. Web the bull flag pattern is easily spotted by its small, rectangular consolidation after a significant upward price movement, similar to a flag flying high on a pole. In the first stage, buyers aggressively step into the market, driving prices higher. It is formed when there is a. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. It signals that the prevailing vertical trend may be in the process of extending its range. Web updated on apr 24, 2024. The bull flag chart pattern looks like a downward sloping. The pattern occurs in an uptrend wherein a stock pauses. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. Web the bull flag pattern is identified by a flag pole rise in the stock followed by the stock trading pattern that hits support and resistance prices for a period of time where some investors. They. Trading the bull flag pattern helps you spot continuations in price and capture large price swings with ease. Web a bull flag chart pattern happens when a stock is in a strong uptrend but then has a slight consolidation period before continuing its trend up. The above chart highlights a bull flag. Web a bull flag is a bullish stock. Web what is a bull flag chart pattern? Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. This pattern is easily recognizable by its initial sharp rise in prices, forming the ‘flagpole,’ followed. The flagpole and the flag. First, there’s a strong move up, resulting in bullish candlesticks forming the pole. Web updated on apr 24, 2024. The flag is formed by. Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. The bull flag formation is a technical analysis pattern that resembles a flag. Trading this pattern helps professional traders identify price trends with ease, and pick up substantial price swings in a short time. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. They are called bull flags. What is a bullish flag? The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. A line connects the peaks of all the rally candles that form the flagpole. Bull flags are the opposite of bear flags, which form amid a concerted downtrend. And the rally needs high volume. Web the bull flag pattern is identified by a flag pole rise in the stock followed by the stock trading pattern that hits support and resistance prices for a period of time where some investors. Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. Trading the bull flag pattern helps you spot continuations in price and capture large price swings with ease. The pattern occurs in an uptrend wherein a stock pauses for a time, pulls back to some degree, and then resumes the uptrend. Web the bull flag pattern is easily spotted by its small, rectangular consolidation after a significant upward price movement, similar to a flag flying high on a pole. In the first stage, buyers aggressively step into the market, driving prices higher. This pattern is easily recognizable by its initial sharp rise in prices, forming the ‘flagpole,’ followed by a more moderate downward or sideways price movement, creating the ‘flag’ itself. The above chart highlights a bull flag. It is considered a continuation pattern, which indicates a temporary pause in the upward trend of an asset before it continues its upward movement.

Bullish Flag Chart Pattern

Bull Flag and Bear Flag Chart Patterns Explained

Bull Flag Pattern New Trader U

Bull Flag Chart Pattern & Trading Strategies Warrior Trading

What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

Bull Flag Pattern How to Identify it and Trade it Like a PRO [Forex

How to Identify and Trade The Bull Flag Pattern

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

Bull Flag Chart Patterns The Complete Guide for Traders

What is Bull Flag Pattern & How to Identify Points to Enter Trade DTTW™

Web A Bull Flag Is A Powerful Pattern Seen On Price Charts, Indicative Of A Continuation In An Uptrend Following A Brief Period Of Consolidation.

The Strong Directional Move Up Is Known As The ‘Flagpole’, While The Slow Counter Trend Move Lower Is What Is Referred To As The ‘Flag’.

First, There’s A Strong Move Up, Resulting In Bullish Candlesticks Forming The Pole.

Web A Bull Flag Is A Continuation Pattern That Occurs As A Brief Pause In The Trend Following A Strong Price Move Higher.

Related Post: