Blank Printable W 9 Form

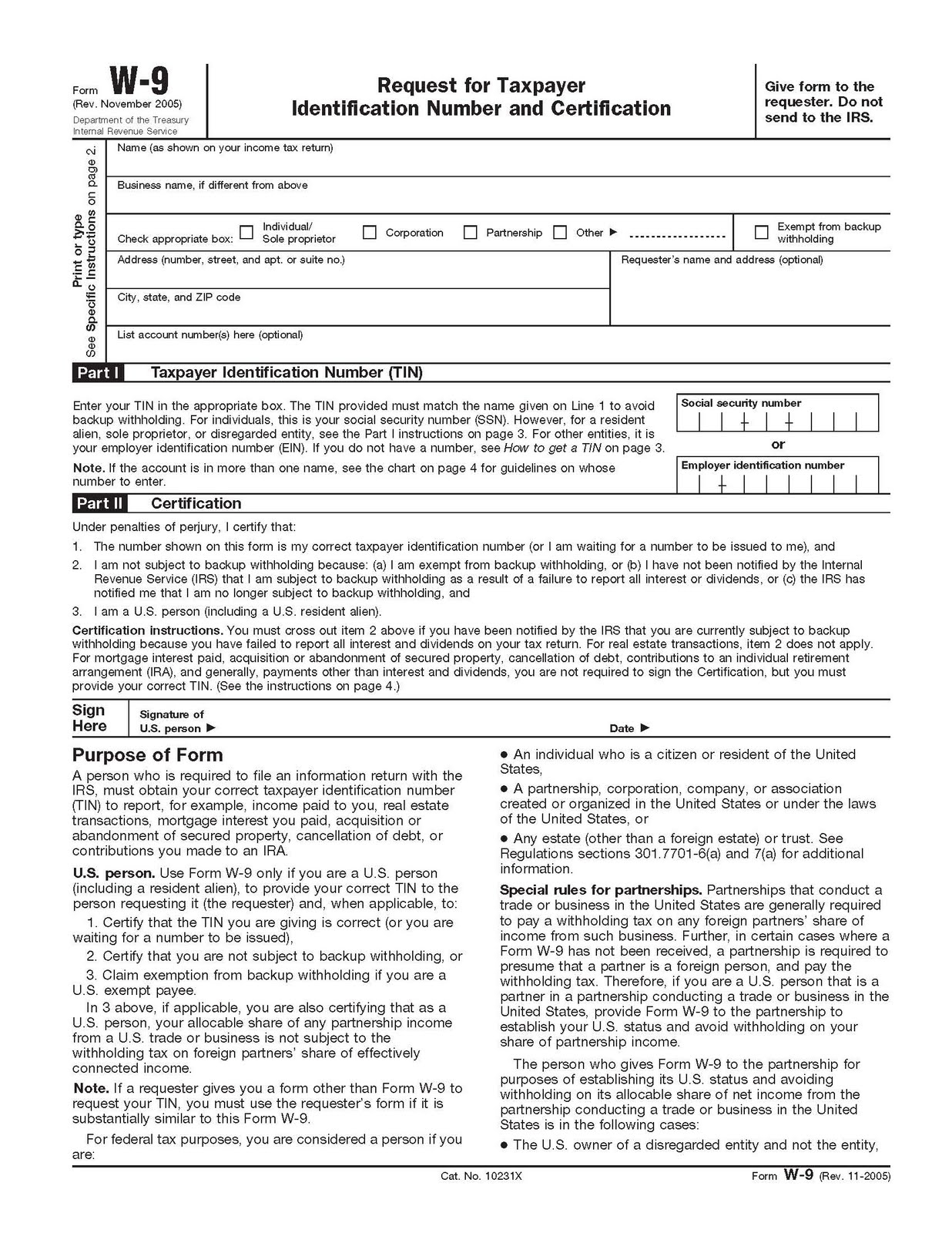

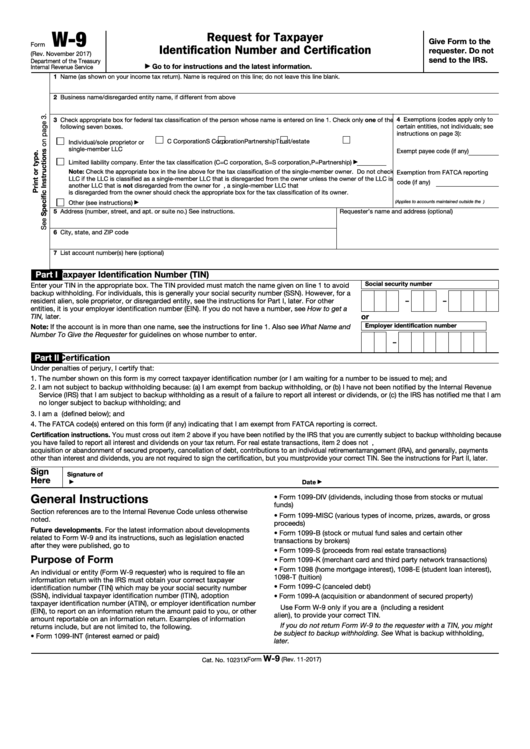

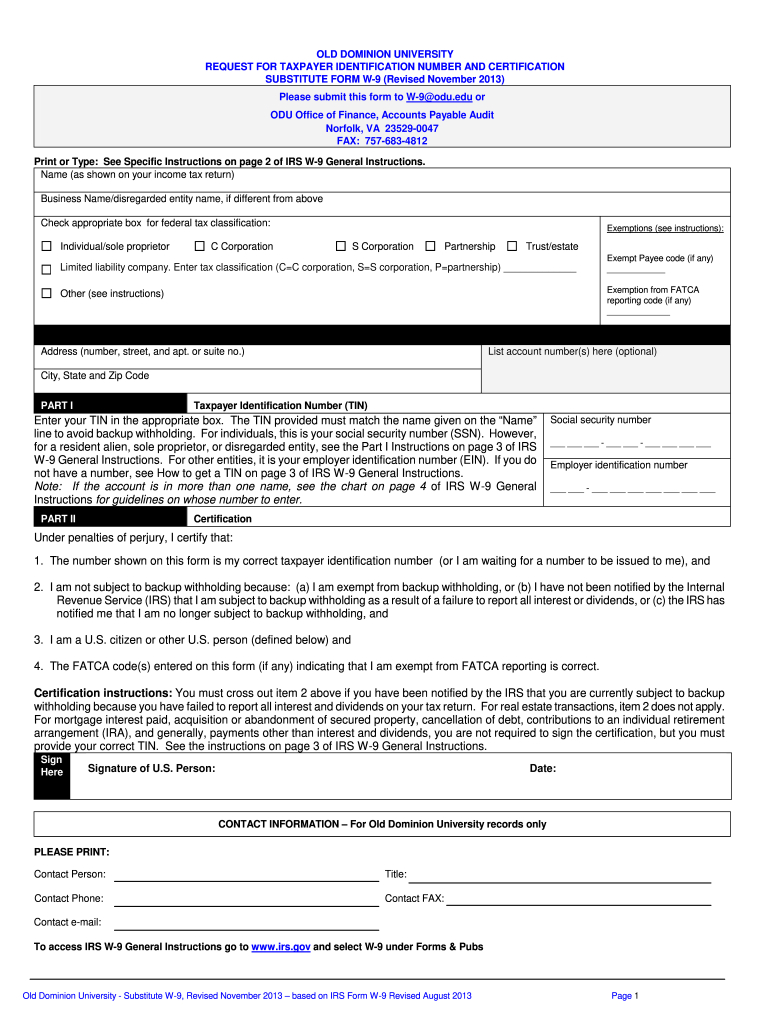

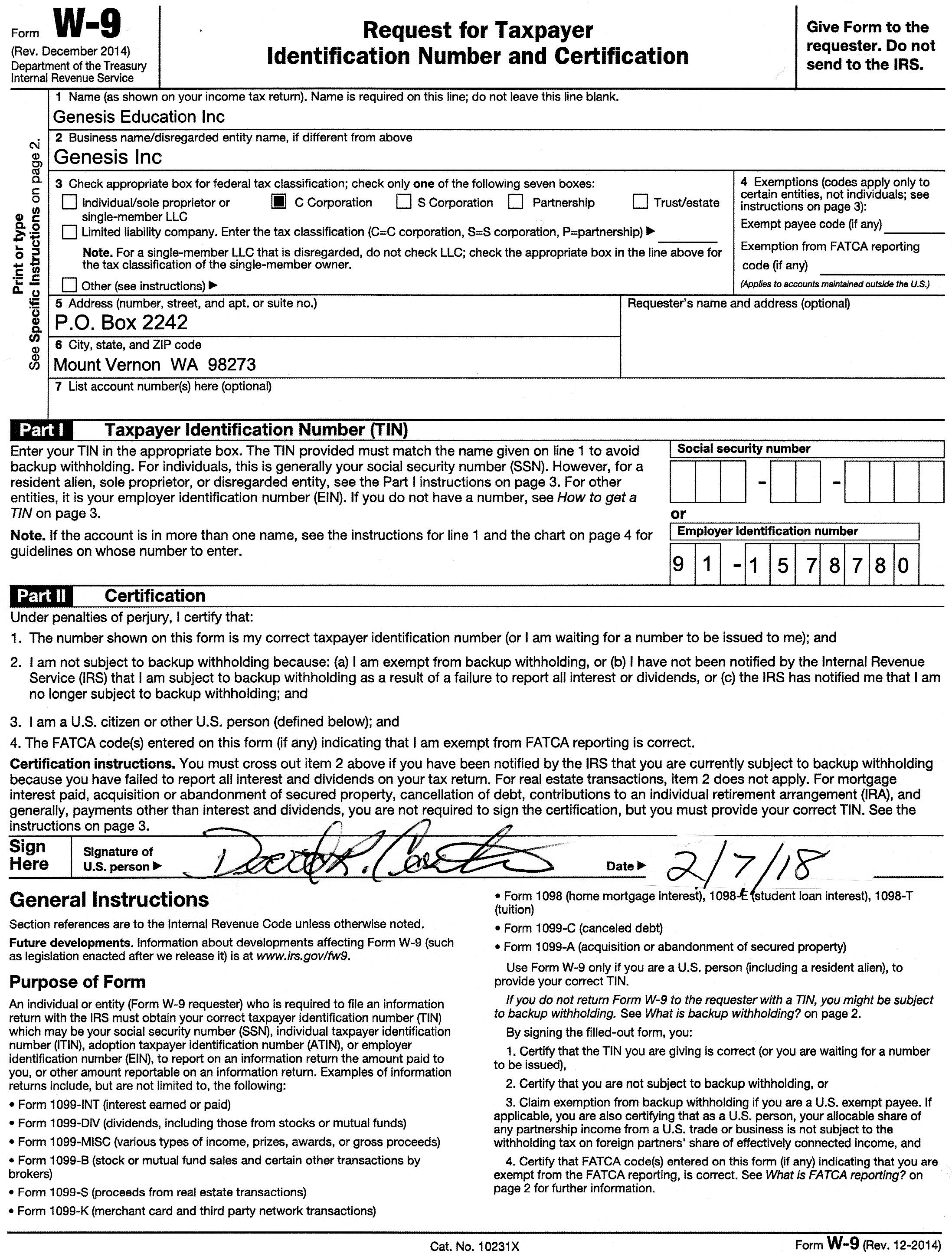

Blank Printable W 9 Form - Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. Form used to apply for a refund of the amount of tax withheld on the. Person date employer identification number print or type. See what is backup withholding, later. Claim exemption from backup withholding if you are a u.s. Web 2024 w 9 form printable. Give form to the requester. Do not send to the irs. Do not send to the irs. Name is required on this line; Name is required on this line; Request for taxpayer identification number and certification. Give form to the requester. Business name/disregarded entity name, if different from above. Web 2024 w 9 form printable. See what is backup withholding, later. Person (including a resident alien), to provide your correct tin. December 2014) department of the treasury. September 13, 2022 by printw9. Form used to apply for a refund of the amount of tax withheld on the. ©2024 washington university in st. December 2014) department of the treasury internal revenue service. This form must be filled out in order. Go to www.irs.gov/formw9 for instructions and the latest information. Give form to the requester. Form used to apply for a refund of the amount of tax withheld on the. See specific instructions on page 3. Web request for taxpayer identification number and certification. Status and avoid section 1446 withholding on your share of partnership income. December 2014) department of the treasury. Request for taxpayer identification number and certification. See specific instructions on page 3. This form must be filled out in order. Sign here signature of u.s. Web 4.certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. Do not send to the irs. You may be requested to sign by the withholding agent even if item 1, below, and items 4 and 5 on page 4 indicate otherwise. Form used to apply for a refund of the amount of tax withheld on the. Person date employer identification number print or type. Person (including a resident alien), to. Web to establish to the withholding agent that you are a u.s. The form helps businesses obtain important information from payees to prepare information returns for the irs. Request for taxpayer identification number and certification. Do not leave this line blank. For a joint account, only the person whose tin is shown in part i should sign (when required). Name (as shown on your income tax return). Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. Web the w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those. See what is backup withholding, later. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. You may be requested to sign by the withholding agent even if item 1, below, and items 4 and 5 on page 4 indicate otherwise.. This form must be filled out in order. Do not send to the irs. Go to www.irs.gov/formw9 for instructions and the latest information. The form asks for information such as the ic's name, address, social security number (ssn), and more. Web to establish to the withholding agent that you are a u.s. Web the w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won’t be withholding income tax from their pay—contractors must pay their own taxes on this income. Failure to supply your tin, or supplying us with an incorrect tin,. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments,. Web 2019 form wi w9 fill online, printable, fillable, blank pdffiller, tax day is approaching, and it will soon be time to begin. The form helps businesses obtain important information from payees to prepare information returns for the irs. Web request for taxpayer identification number and certification. Sign here signature of u.s. Independent contractors who were paid at least $600 during the year need to fill out a. Claim exemption from backup withholding if you are a u.s. Name is required on this line; See what is backup withholding, later. The adobe acrobat library contains Give form to the requester. If you are a u.s. Do not send to the irs. The form asks for information such as the ic's name, address, social security number (ssn), and more.

Blank Printable W9 Form

Fillable W 9

Blank Printable W9 Form 2021 Calendar Template Printable

Printable W9 Form 2020 Fillable IRS W9 Form

W9 Form 2019 Printable IRS W9 Tax Blank in PDF

Printabvle Idaho W9 Form Fill and Sign Printable Template Online US

blank w9 form Question Integrity

Fill Free fillable W92018 W9 2018 Copy.pdf PDF form

Printable W9 Form for W9 Tax Form 2016

W 9 Form Free Printable

This Form Can Be Used To Request The Correct Name And Taxpayer Identification Number, Or Tin, Of The Payee.

Request For Taxpayer Identification Number And Certification.

Certify That The Tin You Are Giving Is Correct (Or You Are Waiting For A Number To Be Issued), Certify That You Are Not Subject To Backup Withholding, Or.

Do Not Leave This Line Blank.

Related Post: