Bearish Pattern

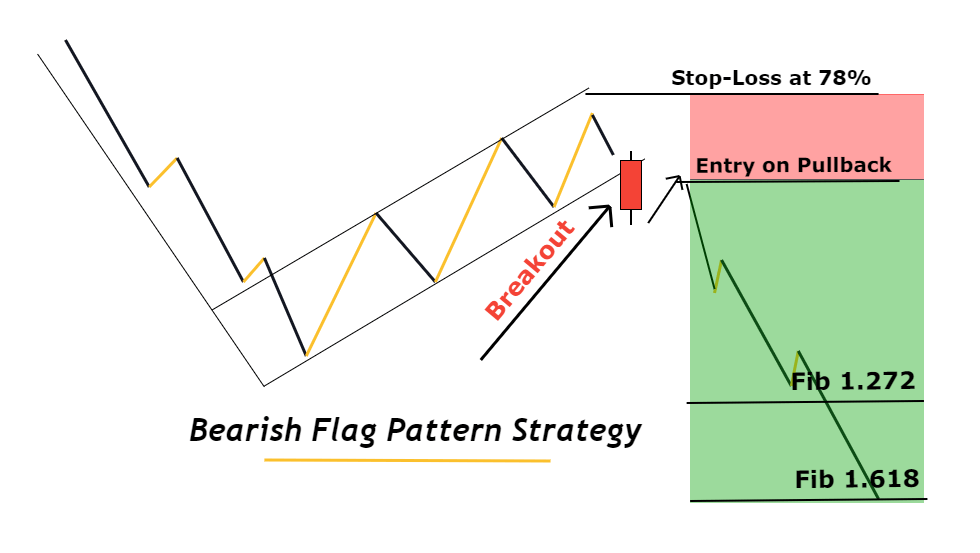

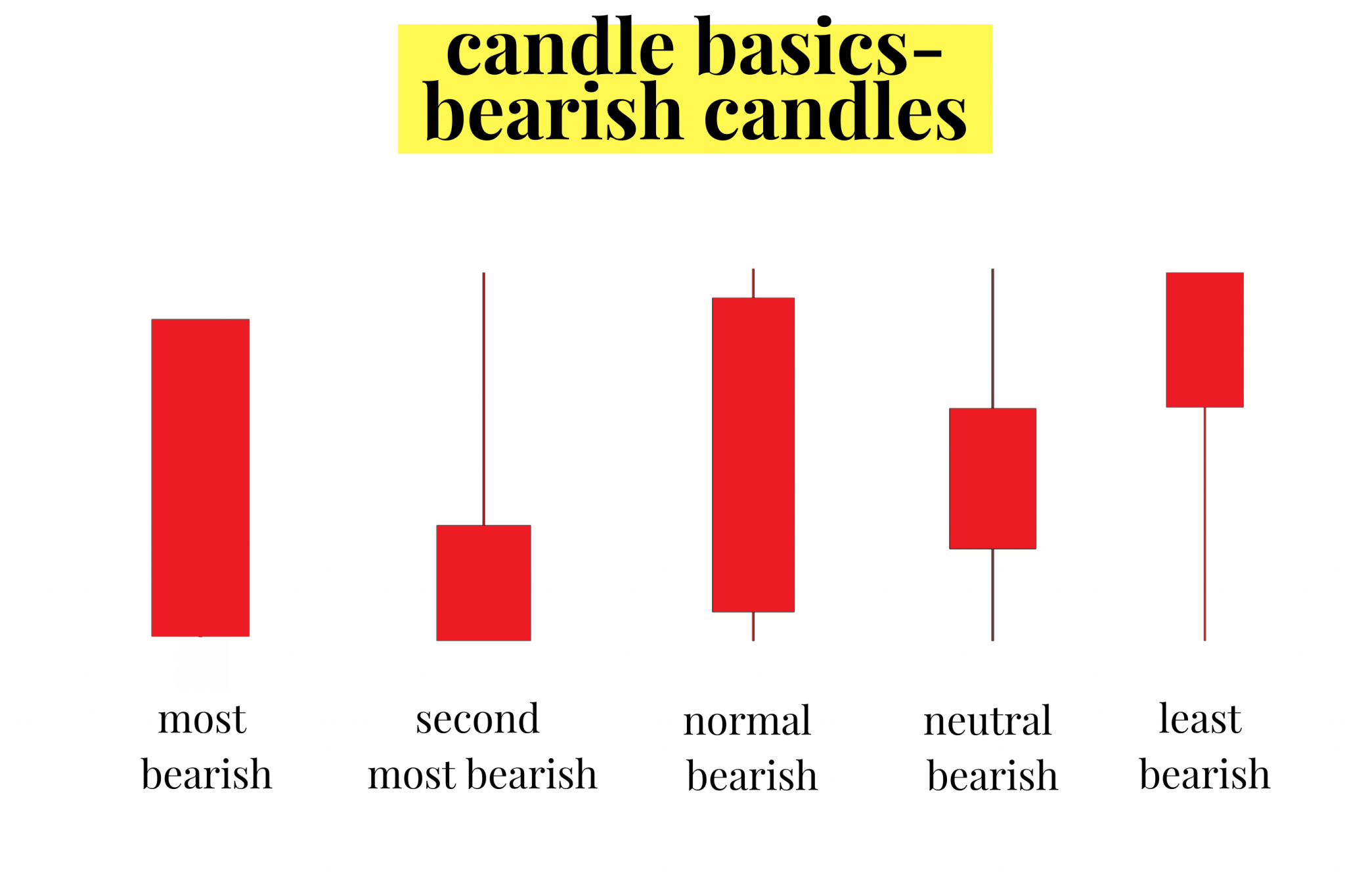

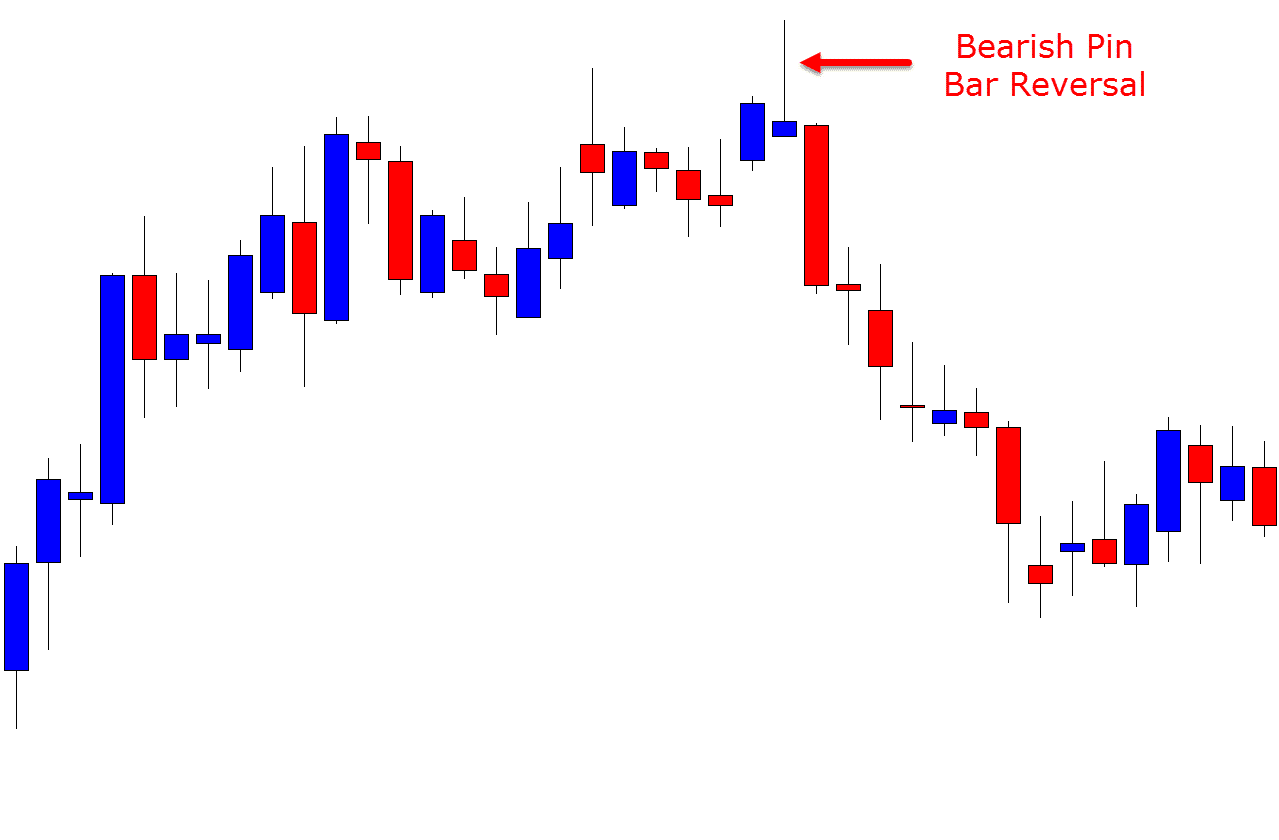

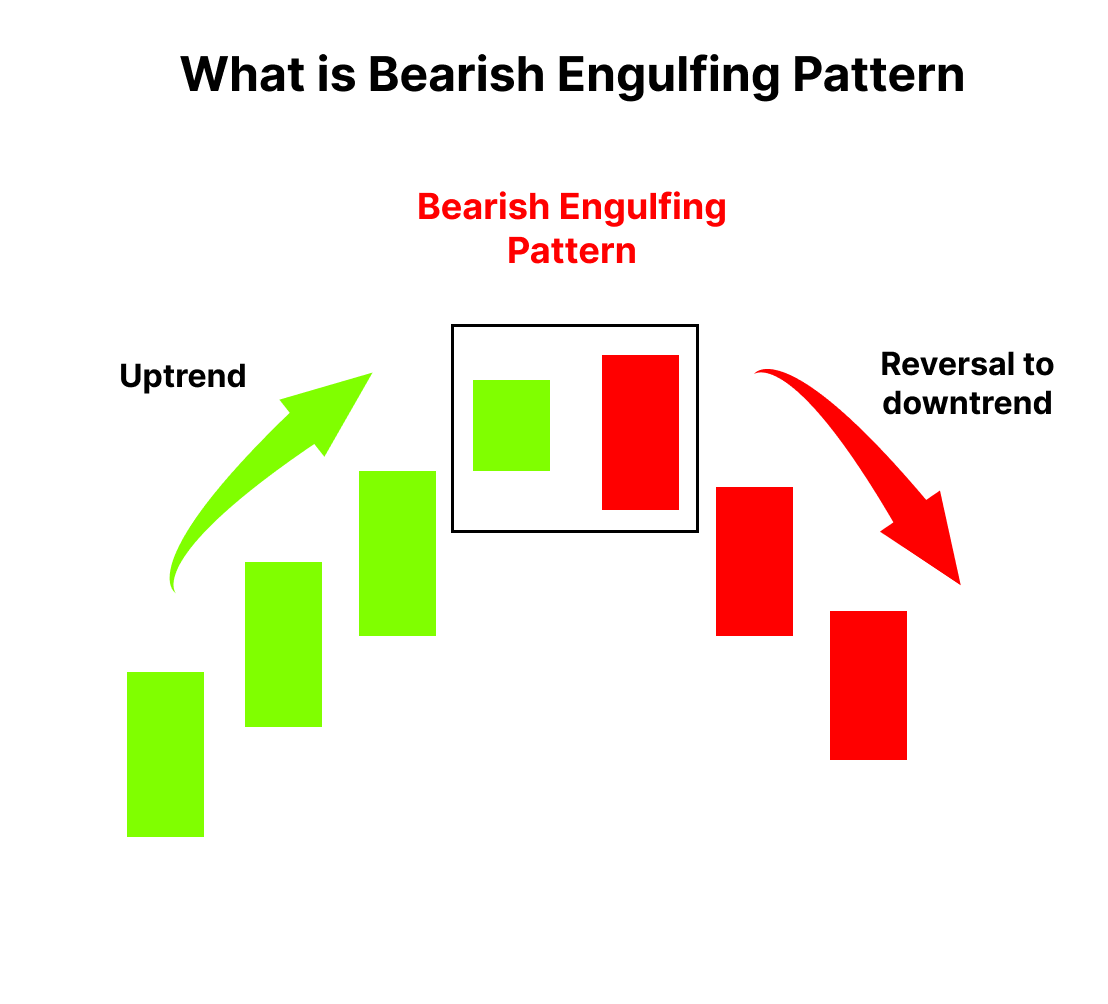

Bearish Pattern - Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Published wed, may 1 202411:03 am edt updated wed, may 1 202411:33 am edt. Bearish candles show that the price of a stock is going down. The head and shoulders pattern is a reliable technical indicator for crypto. Check out or cheat sheet below and feel free to use it for your training! Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Glance into the complicated looking charts for the first time, and you may deem them difficult to understand. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! Web bearish engulfing pattern technical analysis candlesticks charting pattern occurs at tops of uptrends. Web a bearish belt hold is a candlestick pattern that forms during an upward trend. The bearish three line strike continuation is recognized if: Published wed, may 1 202411:03 am edt updated wed, may 1 202411:33 am edt. Web 8 min read. It is one of the shortest bear patterns, generally taking just three to five days to form. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Web there are dozens of popular bearish chart patterns. Many of these are reversal patterns. So, in general, a breakdown from it is the most likely scenario. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Check out or cheat sheet below and feel free to use it for your training! Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! The bearish three line strike. Bearish candles show that the price of a stock is going down. Many of these are reversal patterns. Web bearish engulfing pattern technical analysis candlesticks charting pattern occurs at tops of uptrends. The chart setups based on fibonacci ratios are very popular as well: The bearish three line strike continuation is recognized if: Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Web bearish engulfing pattern technical analysis candlesticks charting pattern occurs at tops of uptrends. Fact checked by lucien bechard. Bearish candlesticks come in many different forms on candlestick charts. So, in general, a breakdown from it is the most likely. The head and shoulders pattern is a reliable technical indicator for crypto. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. They are typically red or black on stock charts. The fourth candle's close. Glance into the complicated looking charts for the first time, and you may deem them difficult to understand. These patterns generally indicate buyers are exiting the market, and prices will likely decrease. Bearish candlesticks come in many different forms on candlestick charts. Web a bearish belt hold is a candlestick pattern that forms during an upward trend. Bearish candles show. These patterns generally indicate buyers are exiting the market, and prices will likely decrease. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. It works in the same manner as a bull flag, with the only difference being that it is a bearish pattern looking to push the price action further. The pattern consists of a long white candle followed by a small black candle. Web conversely, bearish price action could result in the btc token plunging toward its crucial support level of $60,000. May 11, 2024 / 8:24 pm edt / cbs news. Web there are dozens of popular bearish chart patterns. Web the bearish engulfing pattern indicates a sudden. Web a bearish belt hold is a candlestick pattern that forms during an upward trend. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. The head and shoulders pattern is a reliable technical indicator for crypto. Web a bearish pennant pattern is a technical analysis tool that is used to predict. They are typically red or black on stock charts. The pennant is created when the highs and lows of this consolidation form a symmetrical triangle. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. List of bearish candlestick patterns with links to pattern pages. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Web the bearish engulfing pattern indicates a sudden shift in market sentiment when the sellers have overtaken the buyers. Web a bearish engulfing pattern consists of two candlesticks that form near resistance levels where the second bearish candle engulfs the smaller first bullish candle. Web there are dozens of popular bearish chart patterns. Web the head and shoulders pattern indicates a bearish trend. The appearance of a bearish engulfing pattern after an uptrend. Millions of americans were able to see the magical glow of the northern lights on friday night when a powerful geomagnetic storm reached earth. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. If you’re starting from the very beginning, watch our video on candlestick charts. This formation occurs when there is a downtrend followed by a period of consolidation. Similar to dark cloud cover. Web 11 examples of bearish candlestick patterns;

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Bearish Reversal Candlestick Patterns The Forex Geek

Candlestick Patterns The Definitive Guide (2021)

Candlestick Patterns Explained New Trader U

What are Bearish Candlestick Patterns

Bearish Engulfing Pattern Meaning, Example & Limitations Finschool

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

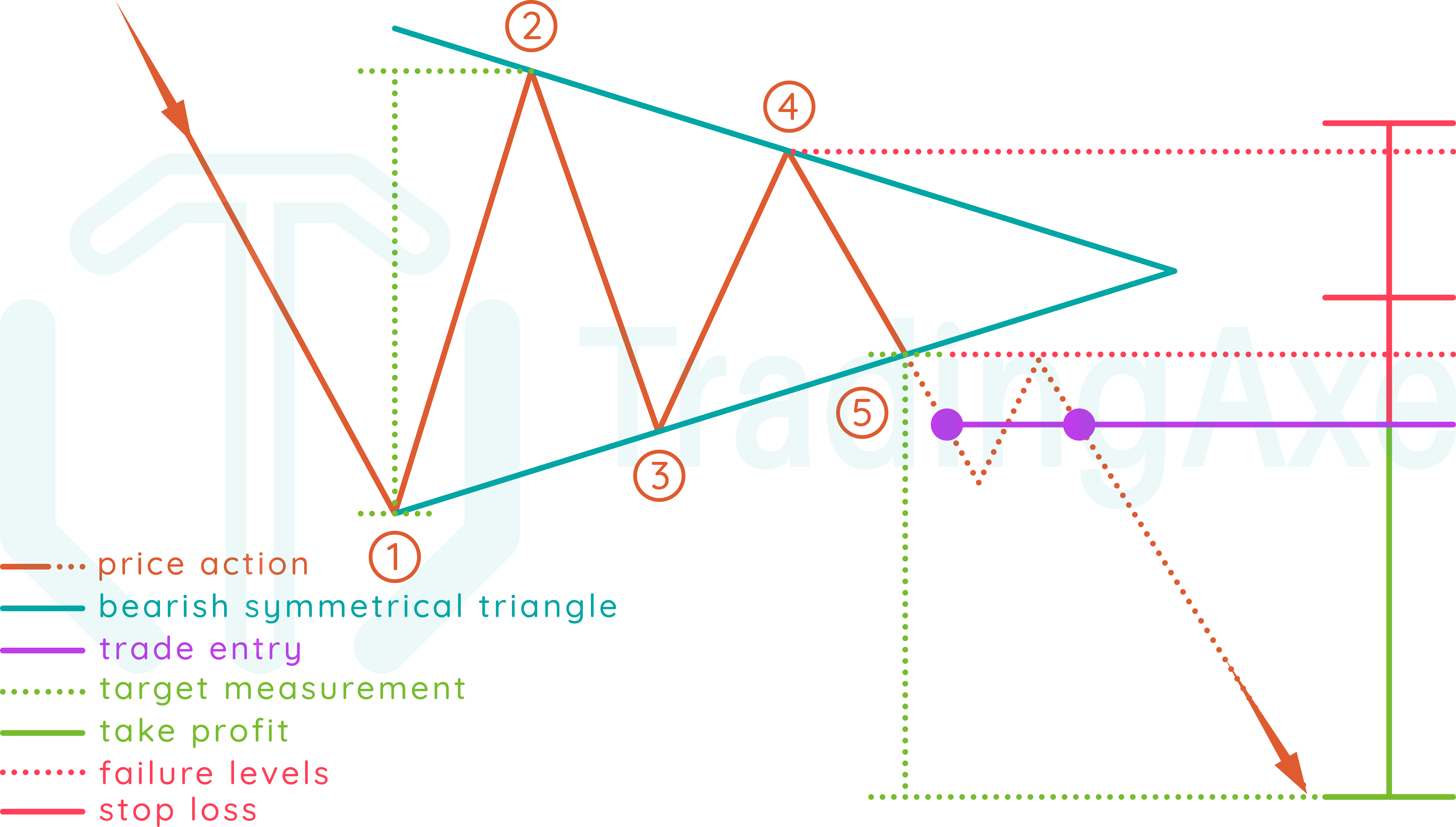

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

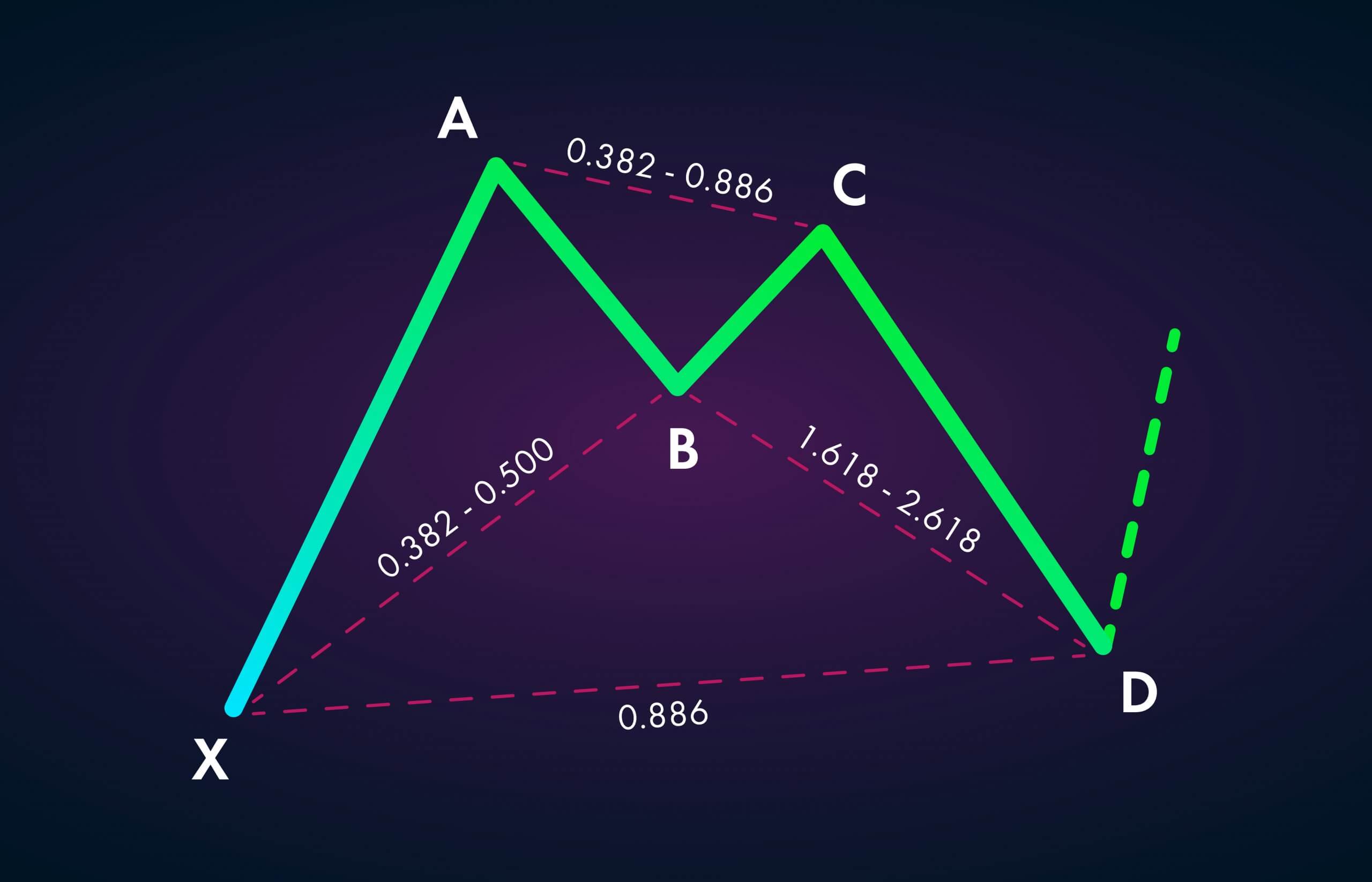

123. Trading The Bullish & Bearish Bat Pattern Forex Academy

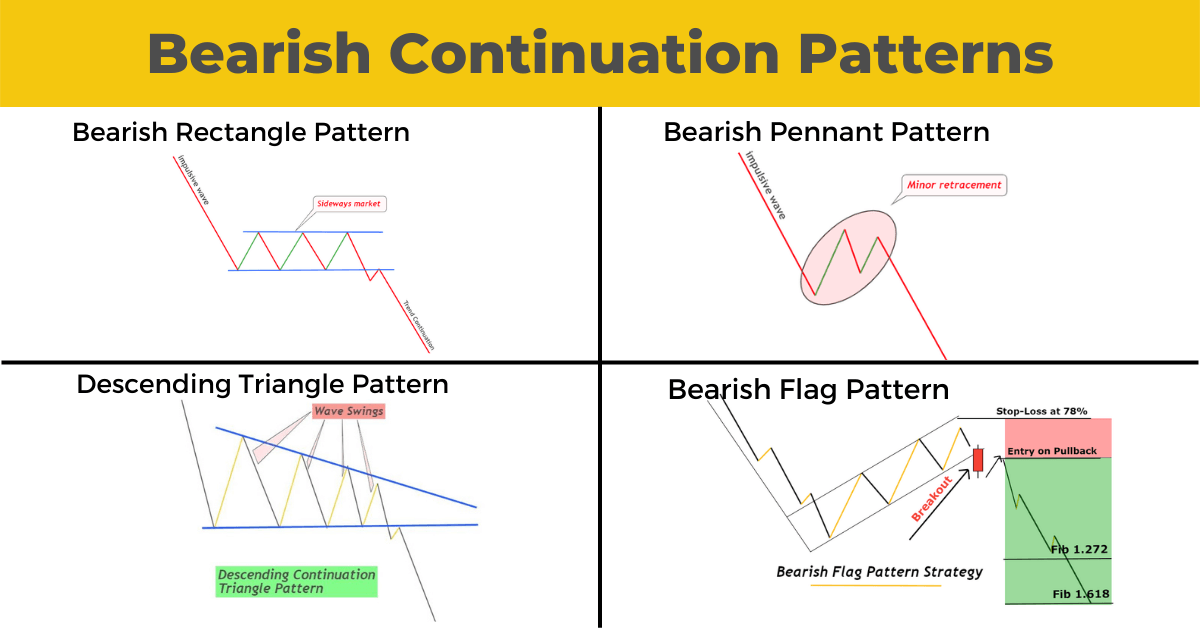

Bearish Continuation Patterns Full Guide ForexBee

In A Bearish Pattern, Volume Is Falling, And A Flagpole Forms On The Right Side Of The Pennant.

Web Bearish Engulfing Pattern Technical Analysis Candlesticks Charting Pattern Occurs At Tops Of Uptrends.

The Pattern Consists Of A Long White Candle Followed By A Small Black Candle.

So, In General, A Breakdown From It Is The Most Likely Scenario.

Related Post: