Bearish Ending Diagonal Pattern

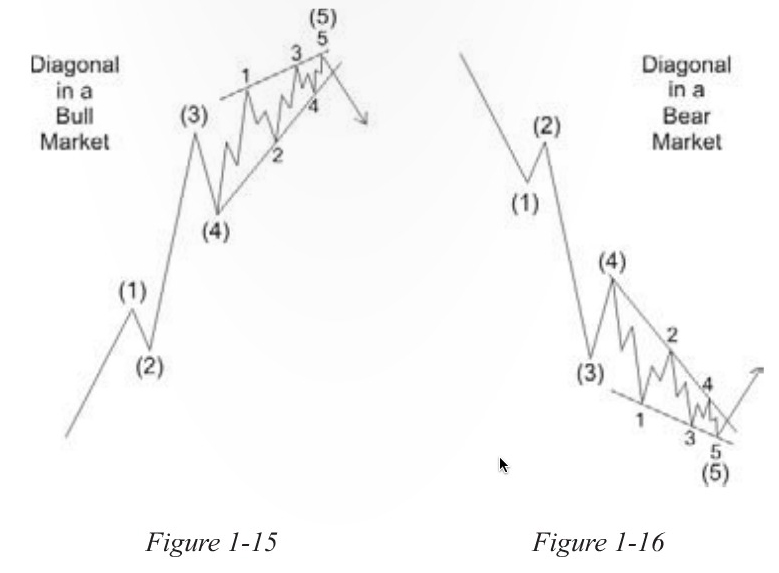

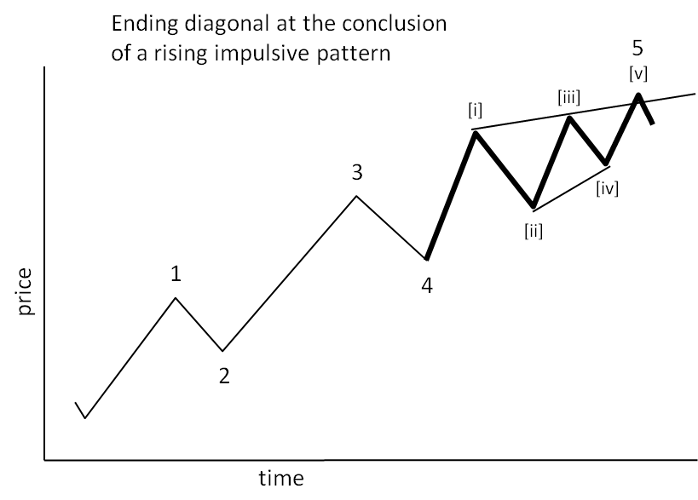

Bearish Ending Diagonal Pattern - Some conventional traders call it “wedge” while others prefer using the original name of the pattern when diving deep into technical analysis. Web frost and prechter did not mention a bearish version of the leading diagonal triangle. Zigzag is one of the most important price waves, and you can spot it after almost every impulsive wave (impulse that. In this video i have explained the standard structure of ending diagonal. A duration of a correction. If it exists, it would look like the chart flipped upside down. The pattern appears in the ending stage,. Web main rules for an ending diagonal. 4.9k views 2 years ago. It reflects a “calming” of market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. Zigzag is one of the most important price waves, and you can spot it after almost every impulsive wave (impulse that. Ending diagonal pattern has different names. Wave 3 always breaks the ending point. There are two variations of the ending diagonal: Some conventional traders call it “wedge” while others prefer using the original name of the pattern when diving. When you spot an ending diagonal (the most common type of diagonal), be ready for a fast. Web wave c is always an impulse or an ending diagonal. Some conventional traders call it “wedge” while others prefer using the original name of the pattern when diving deep into technical analysis. Web types of model. Watch our currency pro service editor. Web an ending diagonal pattern is a type of consolidation that can occur at the completion of a strong move. This chapter describes the concepts of swift and sharp reversal. Watch our currency pro service editor. Web frost and prechter did not mention a bearish version of the leading diagonal triangle. Mostly, the first wave of a contacting ending diagonal. Waves a and c are motive, wave b is corrective. There are two variations of the ending diagonal: Web going forward in time, a line connecting the ends of waves 2 and 4 converges towards (in the contracting variety) or diverges from (in the expanding variety) a line connecting the. Wave c is longer than wave b. When you spot. Web types of model. 41 views 10 months ago elliott wave theory course. If it exists, it would look like the chart flipped upside down. The blue inset in the figure to the upper right shows what is called a. A duration of a correction. Web an ending diagonal pattern is a type of consolidation that can occur at the completion of a strong move. 41 views 10 months ago elliott wave theory course. 4.9k views 2 years ago. There are two variations of the ending diagonal: 4.1 elliott wave 1 and wave 2. A duration of a correction. Web types of model. If it exists, it would look like the chart flipped upside down. This chapter describes the concepts of swift and sharp reversal. Wave b is shorter than wave a. Web going forward in time, a line connecting the ends of waves 2 and 4 converges towards (in the contracting variety) or diverges from (in the expanding variety) a line connecting the. Watch our currency pro service editor. Zigzag is one of the most important price waves, and you can spot it after almost every impulsive wave (impulse that. This. 4.9k views 2 years ago. This pattern is subdivided into five waves. Web the ending diagonal pattern is a pattern that appears in the final stage of a trend, typically in wave 5 or wave c; Ending diagonal pattern has different names. Web frost and prechter did not mention a bearish version of the leading diagonal triangle. It reflects a “calming” of market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. 41 views 10 months ago elliott wave theory course. Web the ending diagonal is the end of an impulse or zigzag. Ending diagonal pattern has different names. 4.1 elliott wave 1. A diagonal is a motive pattern with two corrective characteristics. The blue inset in the figure to the upper right shows what is called a. This wave often occurs when the preceding move of the trend has gone too far, too fast and has run out of steam. The pattern appears in the ending stage,. This chapter describes the concepts of swift and sharp reversal. Wave b is shorter than wave a. Wave 3 always breaks the ending point. Web the ending diagonal pattern is a pattern that appears in the final stage of a trend, typically in wave 5 or wave c; Watch our currency pro service editor. Mostly, the first wave of a contacting ending diagonal is the. Waves a and c are motive, wave b is corrective. Ending diagonal pattern has different names. Ending diagonal pattern explained for beginners. This pattern consists of zigzags or more complex correction formations. Most traders believe price goes in waves. Web types of model.

USDJPY Bearish Crab + Ending diagonal ? for FX_IDCUSDJPY by Fx

Ending Diagonal — Wave Analysis — Education — TradingView

USDCHF Bearish Trend Begins Ending Diagonal Orbex Forex Trading Blog

Ending Diagonal

ENDING DIAGONAL PATTERN ALL YOU NEED TO KNOW!! YouTube

Pin on coding

BTCUSD Bear Market Wave C Ending Diagonal Pattern for COINBASEBTCUSD

Tổng hợp 93+ hình về mô hình ending diagonal triangle NEC

Ending Diagonal — Wave Analysis — Education — TradingView

Ending diagonal patterns Trading On The Mark

A Duration Of A Correction.

Web Leading Diagonal In Elliott Wave Is A Sort Of Impulsive Pattern, But It Differs In Shape And Internal Structure.

Web An Ending Diagonal Pattern Is A Type Of Consolidation That Can Occur At The Completion Of A Strong Move.

This Pattern Is Subdivided Into Five Waves.

Related Post: