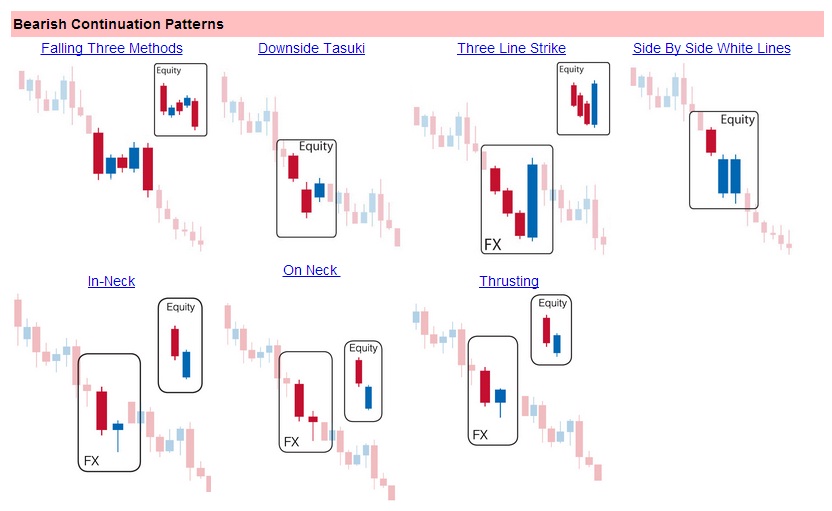

Bearish Continuation Patterns

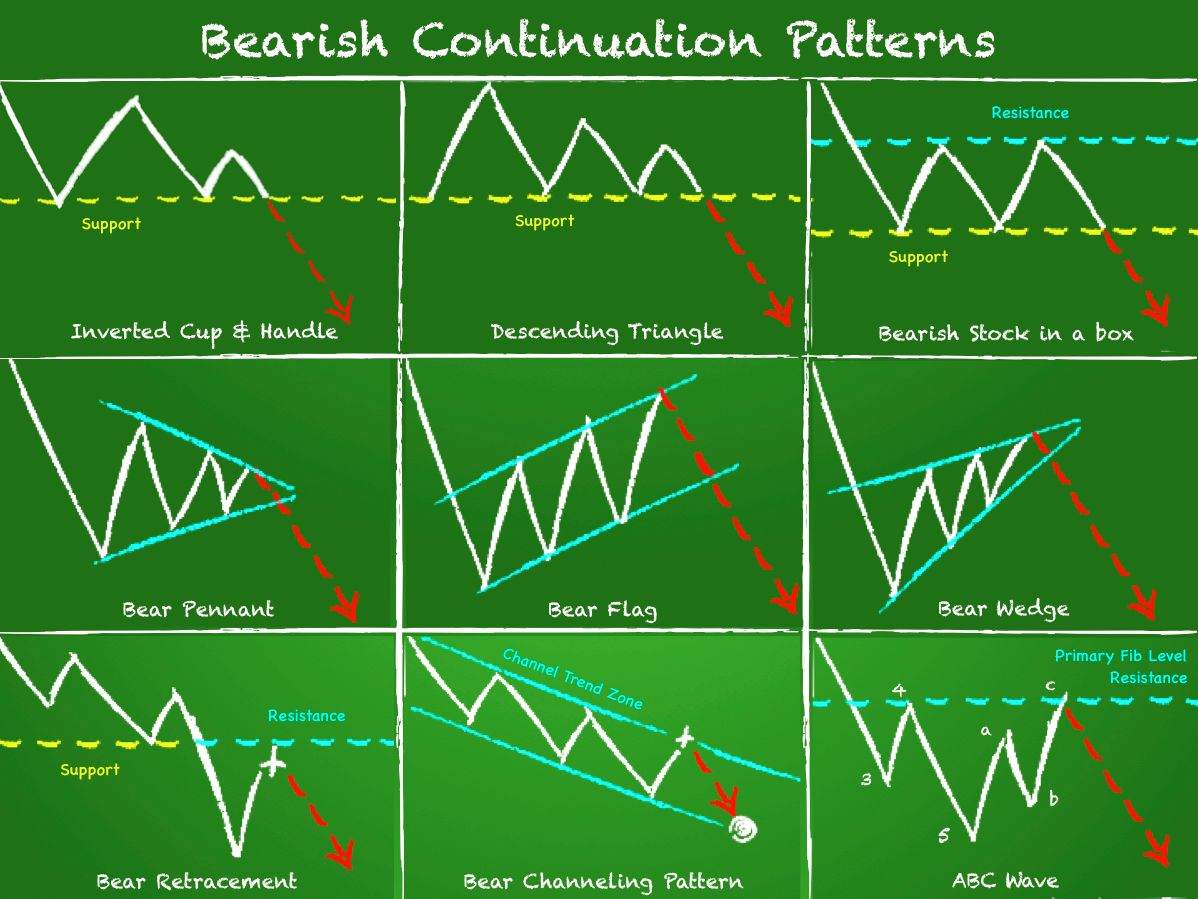

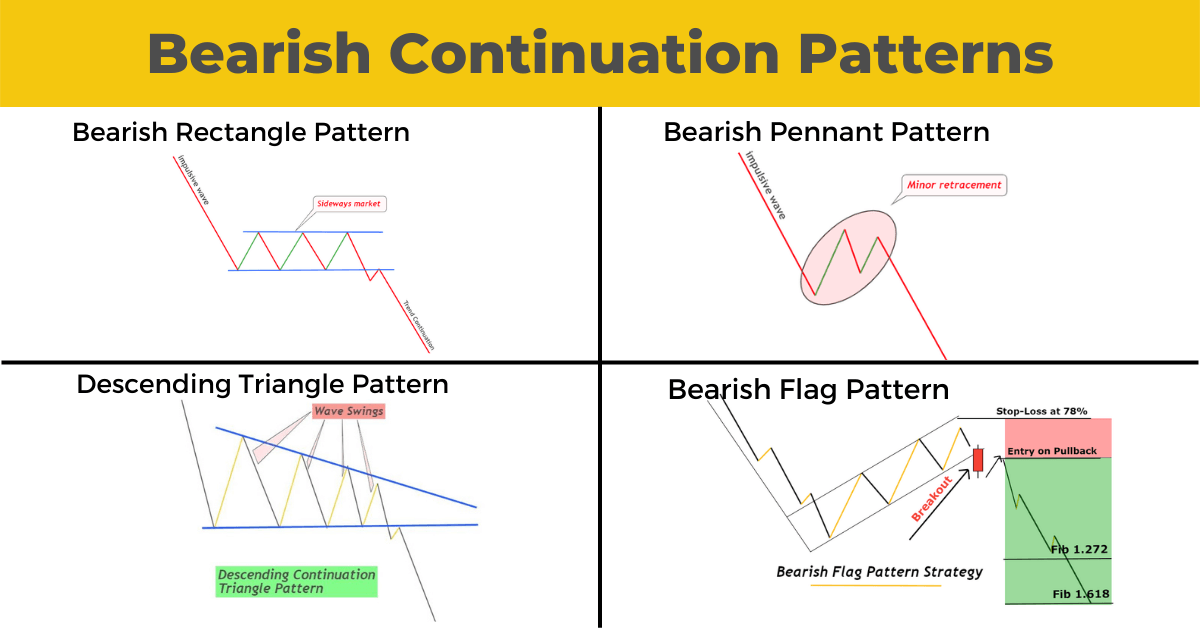

Bearish Continuation Patterns - Web candlestick formations can provide valuable insights into price movement, including uptrends, downtrends, continuation patterns, reversal patterns, and more. Web some of the most common continuation patterns include: The stage is set for a continuation lower. Comprising two consecutive candles, the. Web bearish continuation patterns include: Web the bearish continuation pattern works in the same fashion, with the difference being in the price action trading in a downtrend. It develops during a period of brief. Continuations tend to resolve in the same direction as the prevailing trend:. Depending on their heights and collocation, a bullish or a bearish trend continuation. A pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern,. When these patterns occur, it can indicate that the trend is likely to resume after the pattern completes. Web bearish reversal patterns within a downtrend would simply confirm existing selling pressure and could be considered continuation patterns. Web some of the most common continuation patterns include: Web there was a break below a bearish flag pattern with support near $60,950. Web some of the most common continuation patterns include: Web a bearish “three line strike” pattern mirrors the bullish one. Web bearish japanese candlestick continuation patterns are displayed below from strongest to weakest. Web three line strike is a trend continuation candlestick pattern consisting of four candles. Web the bearish pennant is a continuation chart pattern that appears after a. Comprising two consecutive candles, the. It consists of the 3 strong bearish candles that close progressively lower and are followed by a single. Bearish chart patterns are formed when stock prices start to decline after a period of bullish movement. Candlestick pattern strength is described as either strong, reliable, or weak. Web the bearish thrusting pattern works as a trend. Web a bearish “three line strike” pattern mirrors the bullish one. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. A bearish bias remains given. It has the same structure as the bull flag but inverted. Web bearish japanese candlestick continuation patterns are displayed below from strongest. Web the bearish thrusting pattern works as a trend continuation indicator. Continuation patterns are quite easy to spot, but they do exist in many different forms, with different responses. Web bullish and bearish continuation patterns. Web bearish japanese candlestick continuation patterns are displayed below from strongest to weakest. Comprising two consecutive candles, the. Web bullish and bearish continuation patterns. It has the same structure as the bull flag but inverted. Continuations tend to resolve in the same direction as the prevailing trend:. Web some of the most common continuation patterns include: Web breakout ret est bearish flag pattern the bearish flag is an upside down version of the bull flag. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web the bearish continuation pattern works in the same fashion, with the difference being in the price action trading in a downtrend. Web bearish continuation patterns include: It has the same structure as the bull flag but inverted.. Web a bearish “three line strike” pattern mirrors the bullish one. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. The consolidation phase usually appears midway. Continuations tend to resolve in the same direction as the prevailing trend:. Web goldcontinues to go nowhere as it further trades. Strong candlestick patterns are at least 3. It has the same structure as the bull flag but inverted. Web there was a break below a bearish flag pattern with support near $60,950 on the hourly chart of the btc/usd pair (data feed from kraken). Web there was a break below a bearish flag pattern with support near $60,950 on the. Web the bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. Web there was a break below a bearish flag pattern with support near $60,950 on the hourly chart of the btc/usd pair (data feed from kraken). Web three line strike is a trend continuation candlestick pattern consisting of four candles. Web. The pattern unfolds over two candlesticks, with the second candlestick closing near or at the. Web bearish continuation patterns include: Web breakout ret est bearish flag pattern the bearish flag is an upside down version of the bull flag. Web some of the most common continuation patterns include: There are many methods available to. Continuation patterns are quite easy to spot, but they do exist in many different forms, with different responses. Web a bearish “three line strike” pattern mirrors the bullish one. Web candlestick formations can provide valuable insights into price movement, including uptrends, downtrends, continuation patterns, reversal patterns, and more. When these patterns occur, it can indicate that the trend is likely to resume after the pattern completes. Web bullish and bearish continuation patterns. Web the bearish continuation pattern works in the same fashion, with the difference being in the price action trading in a downtrend. Strong candlestick patterns are at least 3. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web goldcontinues to go nowhere as it further trades within a seven day price range on wednesday. They signify the market sentiment is changing from positive. Comprising two consecutive candles, the.

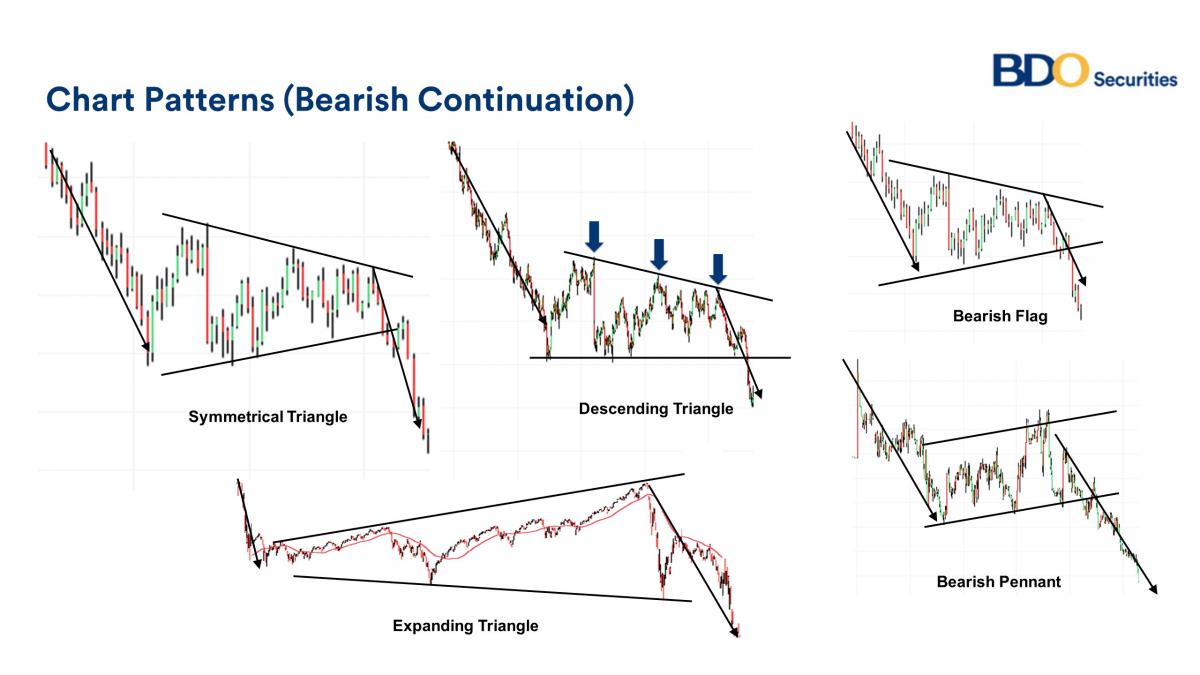

Bullish and Bearish Continuations BDO Unibank, Inc.

What Are Continuation Patterns Charts to Success Phemex Academy

Continuation Pattern Meaning, Types & Working Finschool

bearish continuation triangle pattern for FXUSDCAD by forexsabertooth

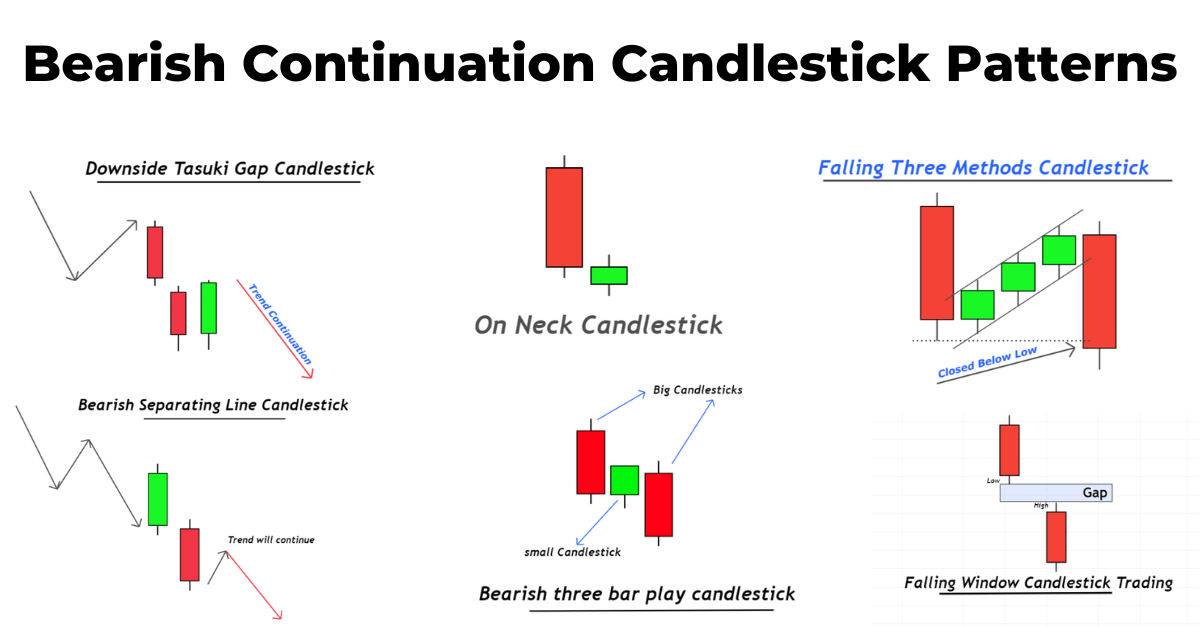

Bearish Continuation Candlestick Patterns ForexBee

Are Chart Patterns Reliable? Tackle Trading

Bearish Continuation Patterns Full Guide ForexBee

Bearish Continuation Patterns Full Guide ForexBee

Top Continuation Patterns Every Trader Should Know

Forex Pips Centre Bearish Continuation Candlestick Pattern

Web Three Line Strike Is A Trend Continuation Candlestick Pattern Consisting Of Four Candles.

A Pattern Is Considered Complete When The Pattern Has Formed (Can Be Drawn) And Then Breaks Out Of That Pattern,.

Candlestick Pattern Strength Is Described As Either Strong, Reliable, Or Weak.

It Has The Same Structure As The Bull Flag But Inverted.

Related Post: