Bear Trap Pattern

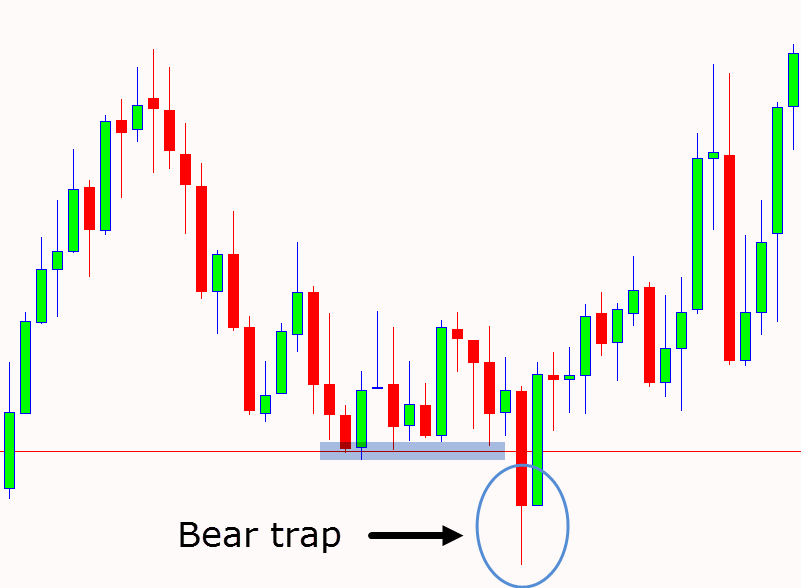

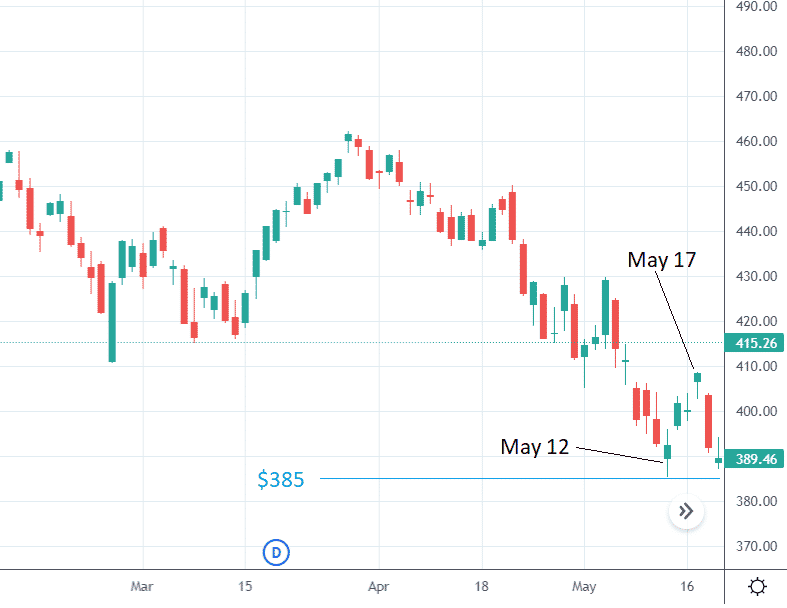

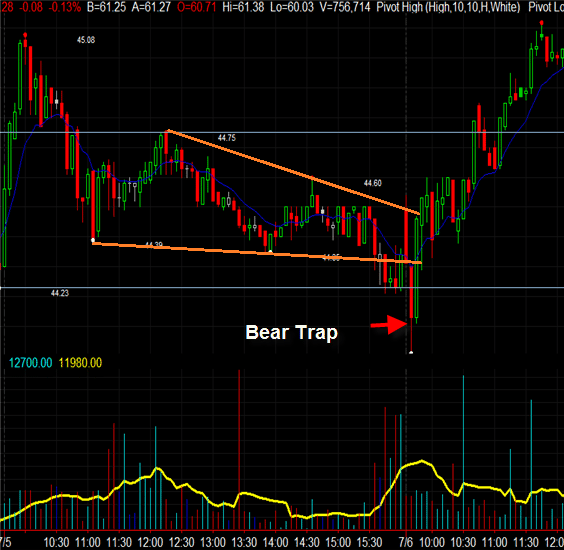

Bear Trap Pattern - This pattern is defined as a bear trap pattern in which the double bottom sell pattern (bearish breakout pattern) is immediately followed by the reverse double top buy pattern (bullish breakout pattern). Web the bear trap stock pattern is a deceptive technical formation in which a financial asset’s price experiences a sudden and sharp decline, giving the impression. You will want a recent range to be broken to the downside with preferably high volume. It is typically characterized by a bottoming tail candle (like may 20th), but it need not be. Web a bear trap is a trading pattern in which the prices of an individual stock or the market as a whole drops sharply, only to reverse shortly thereafter. A bear trap tricks traders into taking short positions on market setups that are seemingly going bearish. Bull and bear traps are p&f signals that quickly reverse. A sudden decline in volume along with a price reversal can be a strong indicator. Web the bear trap chart pattern is a very basic setup. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions. Web the bear trap chart pattern is a very basic setup. It presents a misleading signal indicating a downward trend in a. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. Web a bear trap is a technical stock trading pattern reflecting. Web a bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. Web bear trap definition: You will want a recent range to be broken to the downside with preferably high volume. Web a bear trap is a trading pattern in which the prices of an individual stock or the. A bear trap is a tricky market situation that traders often face. Bull and bear traps are p&f signals that quickly reverse. Web a bear trap is a trading pattern in which the prices of an individual stock or the market as a whole drops sharply, only to reverse shortly thereafter. This pattern is defined as a bear trap pattern. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. Web a bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. The pattern gives a false signal for the continuation of the. The stock will need to. Amateur traders fall into the trap of. It is typically characterized by a bottoming tail candle (like may 20th), but it need not be. A bear trap tricks traders into taking short positions on market setups that are seemingly going bearish. Web a bear trap in trading is a technical reversal pattern at the bottom. At the time of the. Web the bear trap chart pattern is a very basic setup. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. A bear trap is a tricky market situation that traders often face. Web a bear trap in. In reality, however, the price makes a. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions. Web at its core, a bear trap is a market scenario where prices appear to be heading downwards, suggesting a bearish trend. Web bear trap definition: Web. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions. It presents a misleading signal indicating a downward trend in a. In particular, a bull trap is a multiple top breakout that reverses after exceeding the prior highs by one. Amateur traders fall into. Web a bear trap in trading is a technical reversal pattern at the bottom. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions. The pattern gives a false signal for the continuation of the downward trend, presenting that the price drops. A bear. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. A bear trap is a tricky market situation that traders often face. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a. At the time of the. Web the bear trap chart pattern is a very basic setup. Amateur traders fall into the trap of. You will want a recent range to be broken to the downside with preferably high volume. A bear trap tricks traders into taking short positions on market setups that are seemingly going bearish. The stock will need to. A sudden decline in volume along with a price reversal can be a strong indicator. Web this is, in essence the pattern of a bear trap. It is typically characterized by a bottoming tail candle (like may 20th), but it need not be. Web bear trap definition: However, this downward movement is. A bear trap is a tricky market situation that traders often face. Web a bear trap is a trading pattern in which the prices of an individual stock or the market as a whole drops sharply, only to reverse shortly thereafter. Web a bear trap in trading is a technical reversal pattern at the bottom. The pattern gives a false signal for the continuation of the downward trend, presenting that the price drops. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions.

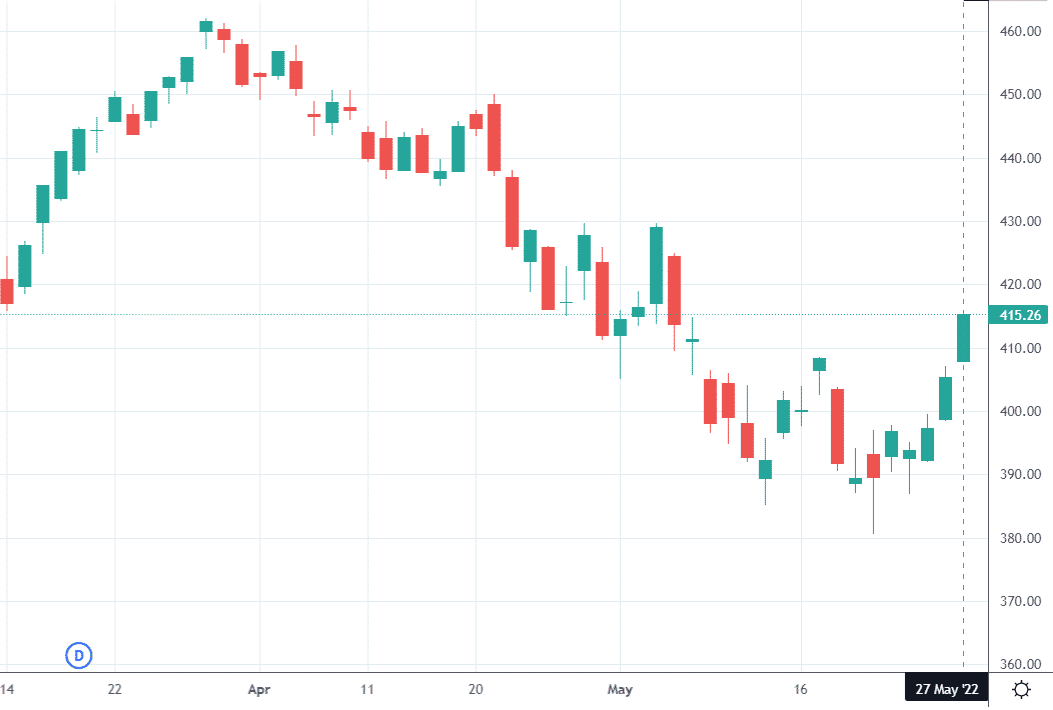

bear trap pattern Options Trading IQ

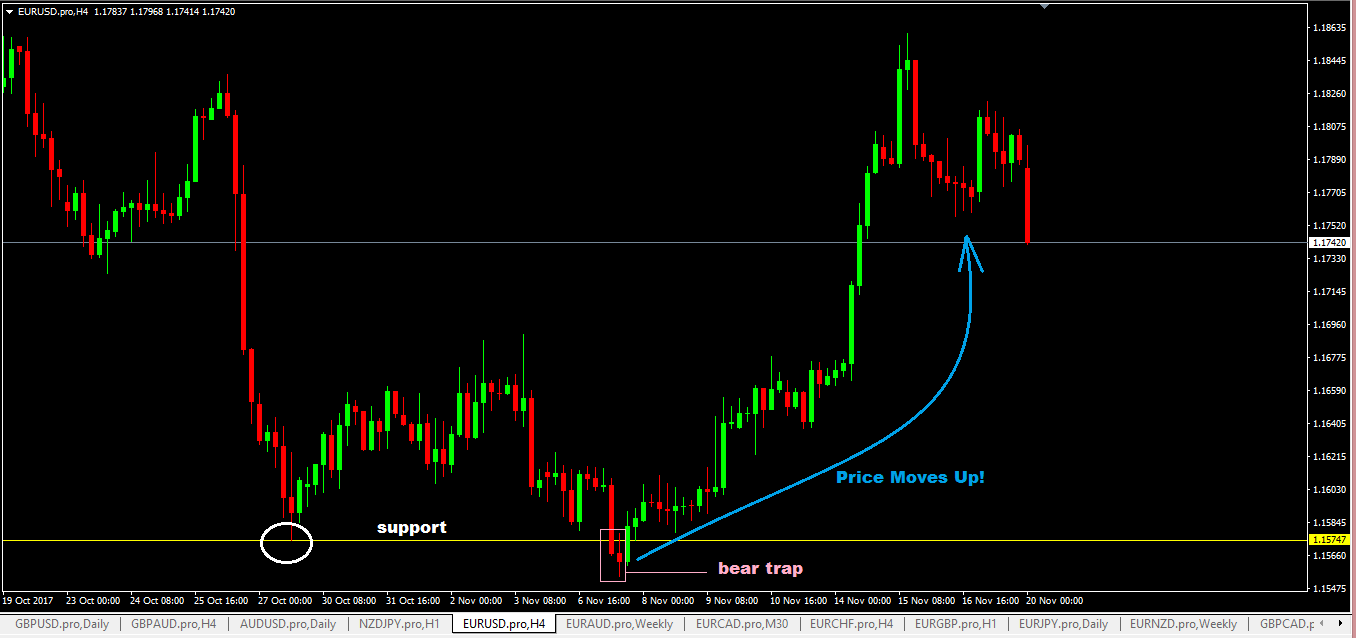

Bear Trap Forex Trading Strategy Learn How To Trade A Bear Trap Pattern

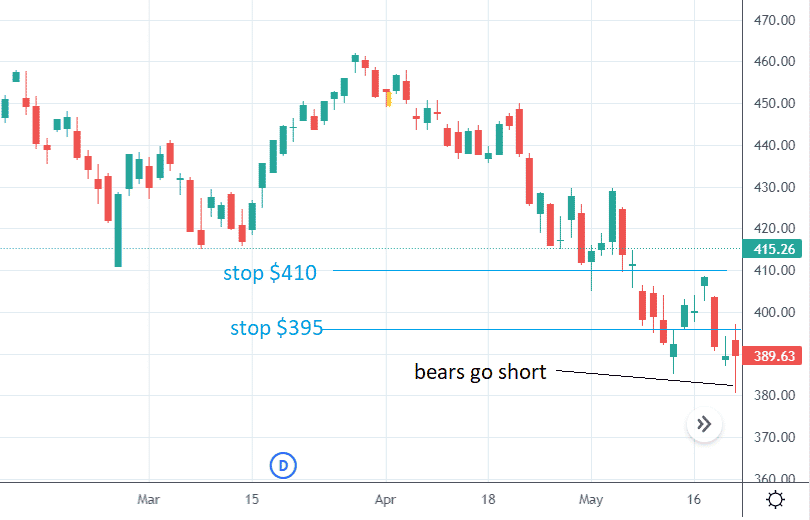

bear trap pattern Options Trading IQ

What is a bear trap in trading? LiteFinance (ex. LiteForex)

Bear and Bull Trap Trading Guide

What Is a Bear Trap Pattern?

What is a Bear Trap Trading Bearish Trap Chart Pattern Technical

Bear Trap Best Strategies to Profit from Short Squeezes TradingSim

Bear trap strategy in 2022 Trading charts, Forex trading quotes

Bear Trap Chart Patterns Indicator for MT4

This Pattern Is Defined As A Bear Trap Pattern In Which The Double Bottom Sell Pattern (Bearish Breakout Pattern) Is Immediately Followed By The Reverse Double Top Buy Pattern (Bullish Breakout Pattern).

It Presents A Misleading Signal Indicating A Downward Trend In A.

Web A Bear Trap Is A Technical Analysis Pattern In Forex And Other Instruments That Occurs When A Downtrend Fails To Continue And The Price Reverses Higher.

In Particular, A Bull Trap Is A Multiple Top Breakout That Reverses After Exceeding The Prior Highs By One.

Related Post: