Bear Flag Trading Pattern

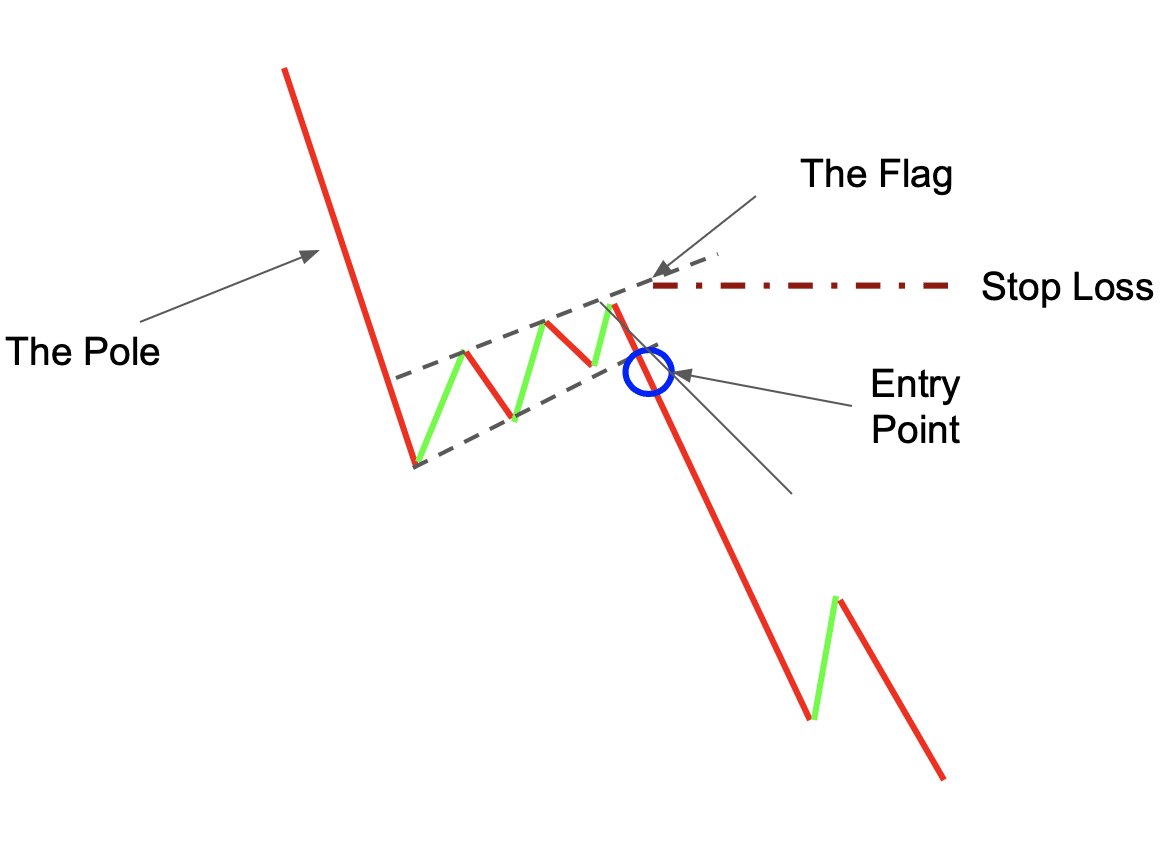

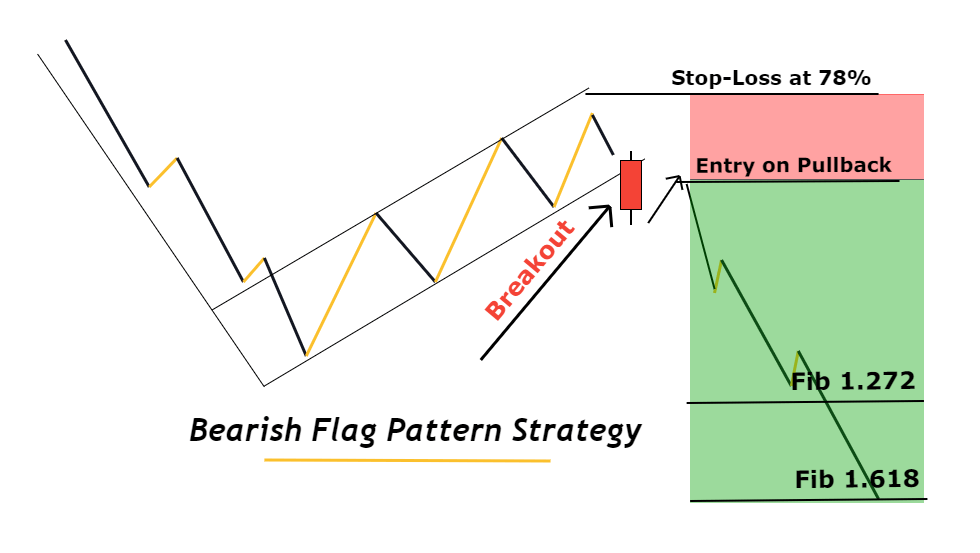

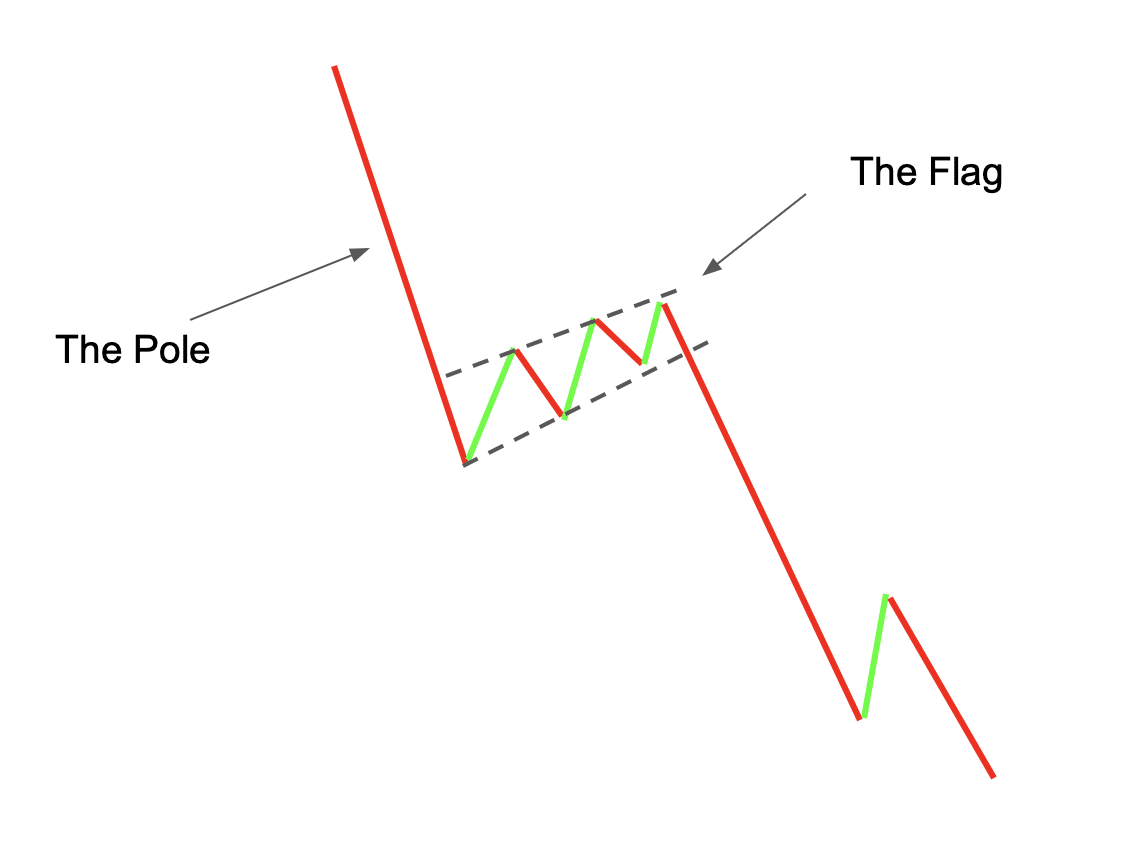

Bear Flag Trading Pattern - A bear flag is a price action within the context of a downtrend that produces an orderly price increase consisting of a narrow trend range comprised of higher swing/pivot highs and higher swing/pivot lows. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Bear flags are ideal for trading downtrends. Iii.i bullish flag pattern vs bearish flag. Web the bear flag pattern has long been a popular and reliable trading signal used by technical traders in the markets to identify the likely continuation of a downtrend. In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500, then reflects on the emergence of defensive sectors like consumer staples. Web a bear flag is a small price consolidation pattern that forms after a rapid price move in a downtrend. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. I accurate bearish flag chart pattern strategy: It is a small downward sloping price channel that can be delineated with two parallel lines hanging off a rapid price decline that forms the pole of the flag. Bear flag patterns require a flagpole, upward sloping resistance trendline, and an upward sloping support trendline to form. V the psychology behind bear flag pattern. Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. Ii what is a bearish flag pattern? Web a bear flag is a small. Web the bear flag pattern is a popular price pattern used by technical traders within the financial markets to determine trend continuations. Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. V the psychology behind bear flag pattern. This article will explore bear flag trading. Followed by at. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” Web the bear flag pattern has long been a popular and reliable trading signal used by technical traders in the markets to identify the likely continuation of a downtrend. In the context of technical analysis, a flag is a price. Web the flag is a period of sideways price action immediately after the flag pole. Iii how to trade a bearish flag pattern? Iv when should you trade the bear flag pattern? As a continuation pattern, the bear flag helps sellers to push the price action further lower. Volume patterns are often used to confirm bull and bear flag price. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. In the context of technical analysis, a flag is a price pattern that, in. He also recaps earnings movers,. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. Bear flag patterns require a flagpole, upward sloping resistance trendline, and an upward sloping support trendline to form. Ii what is a bearish flag pattern? A bear flag is a price action within the context of a downtrend that produces. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. A strong momentum move lower with large range candles. Iv when should you trade the bear flag pattern? Sometimes, traders often call it the inverted flag pattern as opposed to the bull flag.. Web a bear flag pattern consists of a larger bearish candlestick (going down in price), which forms the flag pole. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers, then a bounce that has parallel upper and lower trendlines, which form the flag. Followed by at least three or more smaller consolidation. Web bear flag trading pattern. Sometimes, traders often call it the inverted flag pattern as opposed to the bull flag. In the context of technical analysis, a flag is a price pattern that, in. As a continuation pattern, the bear flag helps sellers to push the price action further lower. It is considered a continuation pattern, indicating that the prevailing. Bear flag patterns require a flagpole, upward sloping resistance trendline, and an upward sloping support trendline to form. Web the bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. Web the bearish flag pattern is a powerful technical analysis tool used by traders to. I accurate bearish flag chart pattern strategy: As a continuation pattern, the bear flag helps sellers to push the price action further lower. In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500, then reflects on the emergence of defensive sectors like consumer staples. As a continuation pattern, the bear flag helps sellers to push the price action further lower. He also recaps earnings movers, including dis, shop, and more. Sometimes, traders often call it the inverted flag pattern as opposed to the bull flag. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. Web a bear flag is a bearish trend continuation pattern used in technical analysis by traders to identify new downtrends with traders entering sell trades when the price breaks below the support breakout point. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers, then a bounce that has parallel upper and lower trendlines, which form the flag. It is a small downward sloping price channel that can be delineated with two parallel lines hanging off a rapid price decline that forms the pole of the flag. These patterns are considered continuation patterns in technical analysis terms, as they have a habit of occurring before the trend which preceded their formation is continued. Bear flag patterns require a flagpole, upward sloping resistance trendline, and an upward sloping support trendline to form. This article will explore bear flag trading. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities.

What Is A Bear Flag Pattern?

Learn About Bear Flag Candlestick Pattern ThinkMarkets EN

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

How to Trade a Bearish Flag Pattern

Bearish Flag Strategy Quick Profits In 5 Simple Steps

How To Trade A Bear Flag Pattern

Bear Flag Chart Pattern Meaning, Benefits & Reliability Finschool

How to Trade a Bearish Flag Pattern

What Is a Bear Flag Pattern and How to Use It The Crypto News

Bear Flag Pattern Explained New Trader U

In The Context Of Technical Analysis, A Flag Is A Price Pattern That, In.

A Bear Flag Is A Price Action Within The Context Of A Downtrend That Produces An Orderly Price Increase Consisting Of A Narrow Trend Range Comprised Of Higher Swing/Pivot Highs And Higher Swing/Pivot Lows.

Iii.i Bullish Flag Pattern Vs Bearish Flag.

Web Bull And Bear Flag Formations Are Price Patterns Which Occur Frequently Across Varying Time Frames In Financial Markets.

Related Post: