Bear Flag Chart Pattern

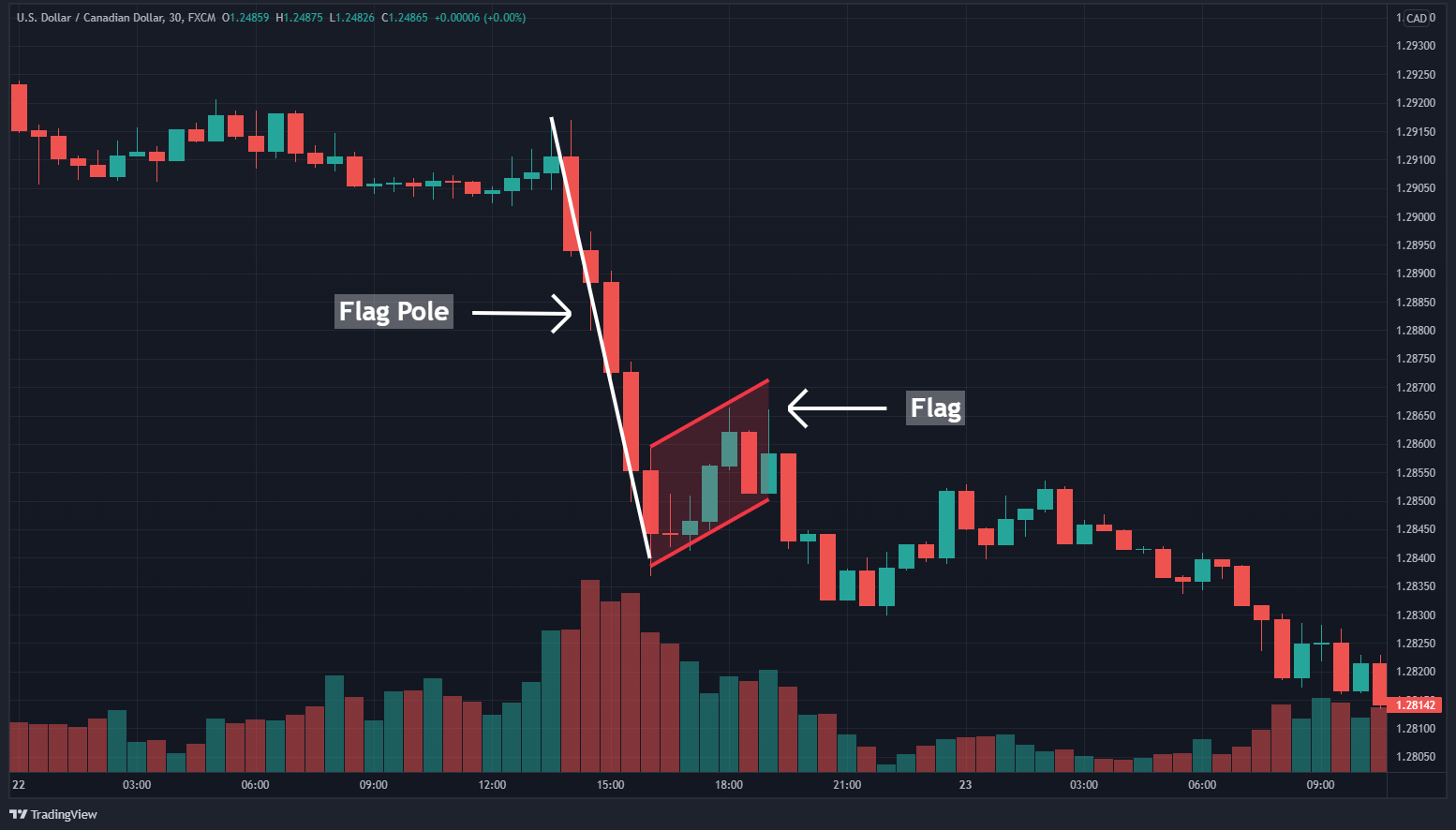

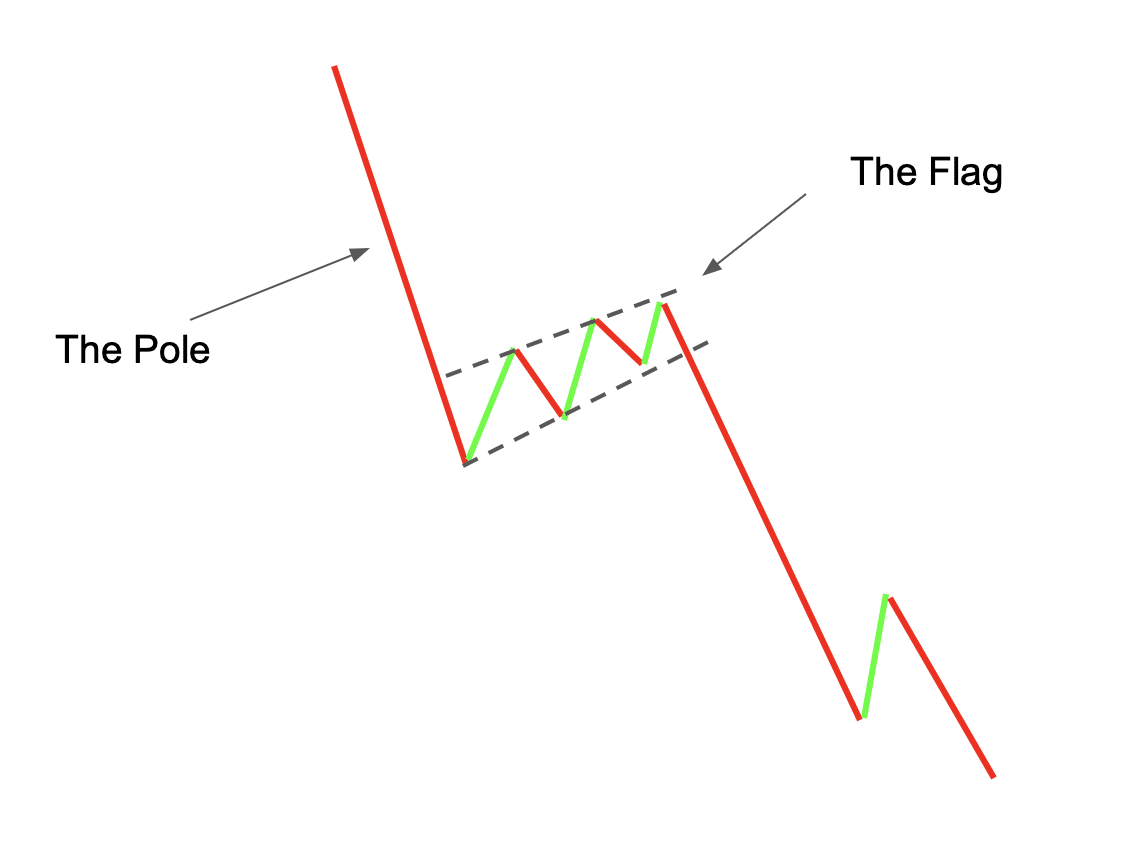

Bear Flag Chart Pattern - Web bearish pennant or bear pennant shows a bear rushing toward the stocks for the continuous downfall, dropping its name into the category of continuous bearish chart pattern. A strong momentum move lower with large range candles. It looks exactly like the bull flag but instead of pushing the price upward, it drops the price more downward. The flag and the flag pole. Web a bear flag is a bearish chart pattern that signals the market is likely to head lower (and the opposite is called a bull flag ). As a continuation pattern, the bear flag helps sellers to push the price action further lower. The pattern resembles a flag on a pole, hence the name bear flag. A weak pullback with small range candles. In this article we look at how to trade these opportunities. Web the bear flag pattern is a chart pattern in technical analysis that signifies continuing an ongoing downward movement in an asset price. It is a small price consolidation pattern that forms after a rapid price move in a downtrend. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Web a bear flag chart is a pattern that appears when there is a significant price decline in an asset, followed by a period of consolidation, which. The flag pole is a pronounced downward price movement, while the flag is a period of sideways price action. Web the bear flag stock chart pattern is a sign that a bearish trend will continue. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers, then a bounce that has parallel upper and. Web a bear flag is a bearish chart pattern that signals the market is likely to head lower (and the opposite is called a bull flag ). Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. He also recaps earnings movers, including dis, shop, and more. It is. Web a bear flag is a bearish continuation chart pattern that forms after a rapid price drop. The above chart highlights a bull flag. Web in contrast, a bear flag is a bearish chart pattern that occurs in a downtrend. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause. In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500, then reflects on the emergence of defensive sectors like consumer staples. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. A strong momentum move lower with large range candles. It works in. Bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Followed by at least three or more smaller consolidation candles, forming the flag. Web a. A weak pullback with small range candles. The pattern resembles a flag on a pole, hence the name bear flag. Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. This video originally premiered on may 7, 2024. In this edition of stockcharts tv's the final bar, dave focuses. Web a bear flag is a bearish chart pattern that signals the market is likely to head lower (and the opposite is called a bull flag ). He also recaps earnings movers, including dis, shop, and more. This article will explore bear flag trading. It is a small price consolidation pattern that forms after a rapid price move in a. As a continuation pattern, the bear flag helps sellers to push the price action further lower. The flag pole and the flag. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend, which is why it is considered to be a continuation pattern. Web a bear flag pattern is constructed by a descending trend or bearish trend, followed by a pause in the trend line or consolidation zone. This pattern indicates a bearish market sentiment. The flag. The image below shows an example of a classic bear flag pattern on a candlestick chart. The pattern resembles a flag on a pole, hence the name bear flag. As a continuation pattern, the bear flag helps sellers to push the price action further lower. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web a bear flag pattern is constructed by a descending trend or bearish trend, followed by a pause in the trend line or consolidation zone. Even the most bearish trader will stop to. Web the bear flag stock chart pattern is a sign that a bearish trend will continue. Web the bear flag pattern is a popular price pattern used by technical traders within the financial markets to determine trend continuations. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” Web in trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend. Overview | how to trade | examples | failure | benefits | limitations | psychology | faq. Web a bear flag is a technical analysis charting pattern used to predict the continuation of a bearish trend. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. Flag patterns are accompanied by. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. As a continuation pattern, the bear flag helps sellers to push the price action further lower.Bear Flag Chart Pattern Meaning, Benefits & Reliability Finschool

Bear Flag Chart Pattern Meaning, Benefits & Reliability Finschool

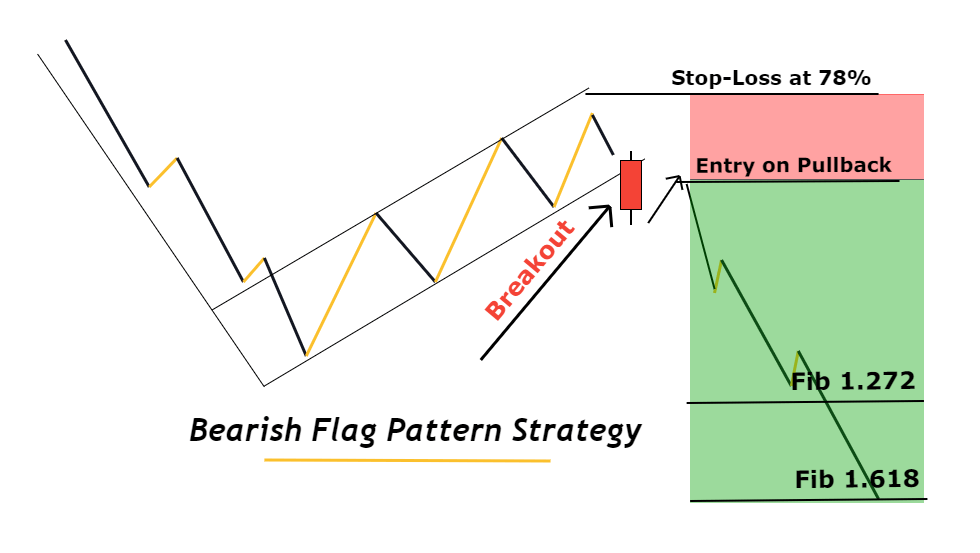

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Bearish Flag Strategy Quick Profits In 5 Simple Steps

How To Trade The Bear Flag Pattern

Bear Flag Chart Pattern

What Is A Bear Flag Pattern? Satoshi Alerts

Bear Flag Pattern Explained New Trader U

Bear Flag Chart Pattern

Bear Flag Pattern How to Identify it and Trade it Like a PRO [Forex

The Flag Pole Is A Pronounced Downward Price Movement, While The Flag Is A Period Of Sideways Price Action.

The Above Chart Highlights A Bull Flag.

A Weak Pullback With Small Range Candles.

Web The Bear Flag Pattern Is A Chart Pattern In Technical Analysis That Signifies Continuing An Ongoing Downward Movement In An Asset Price.

Related Post: