Abcd Trade Pattern

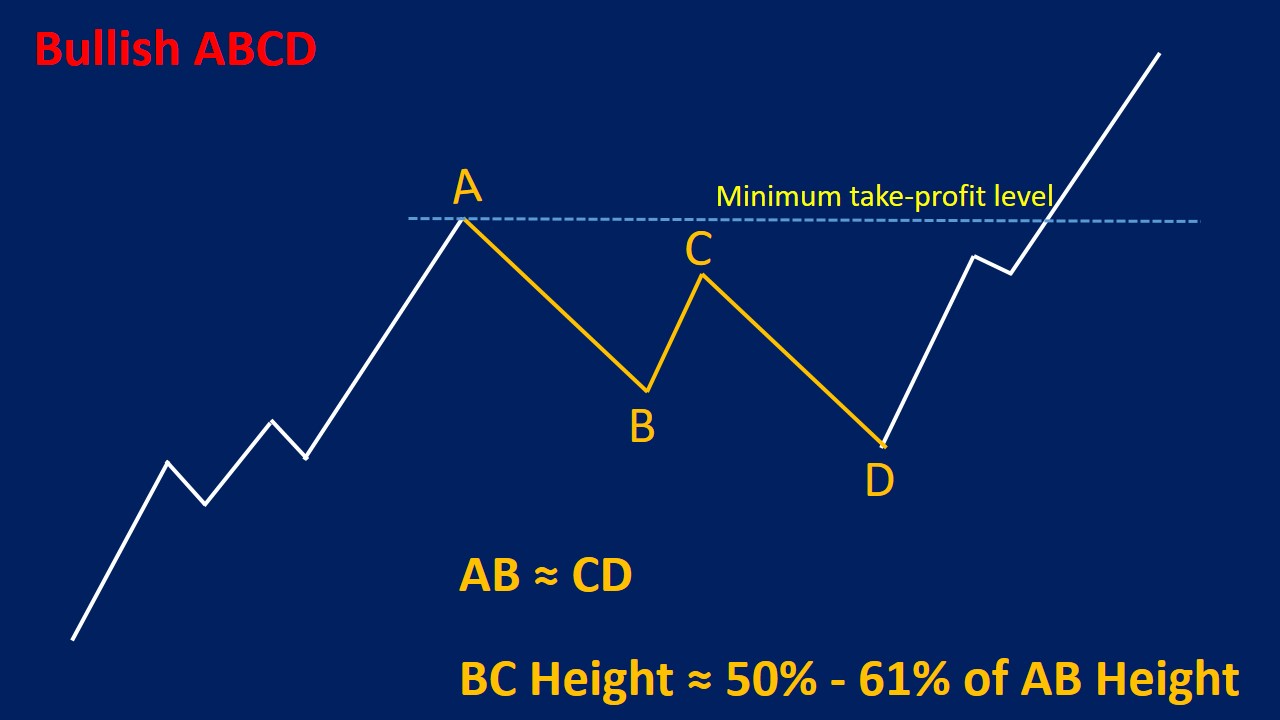

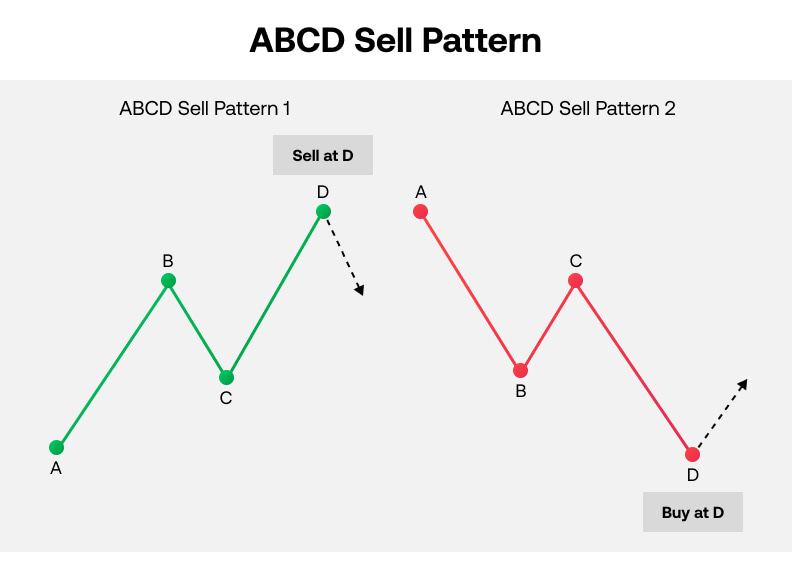

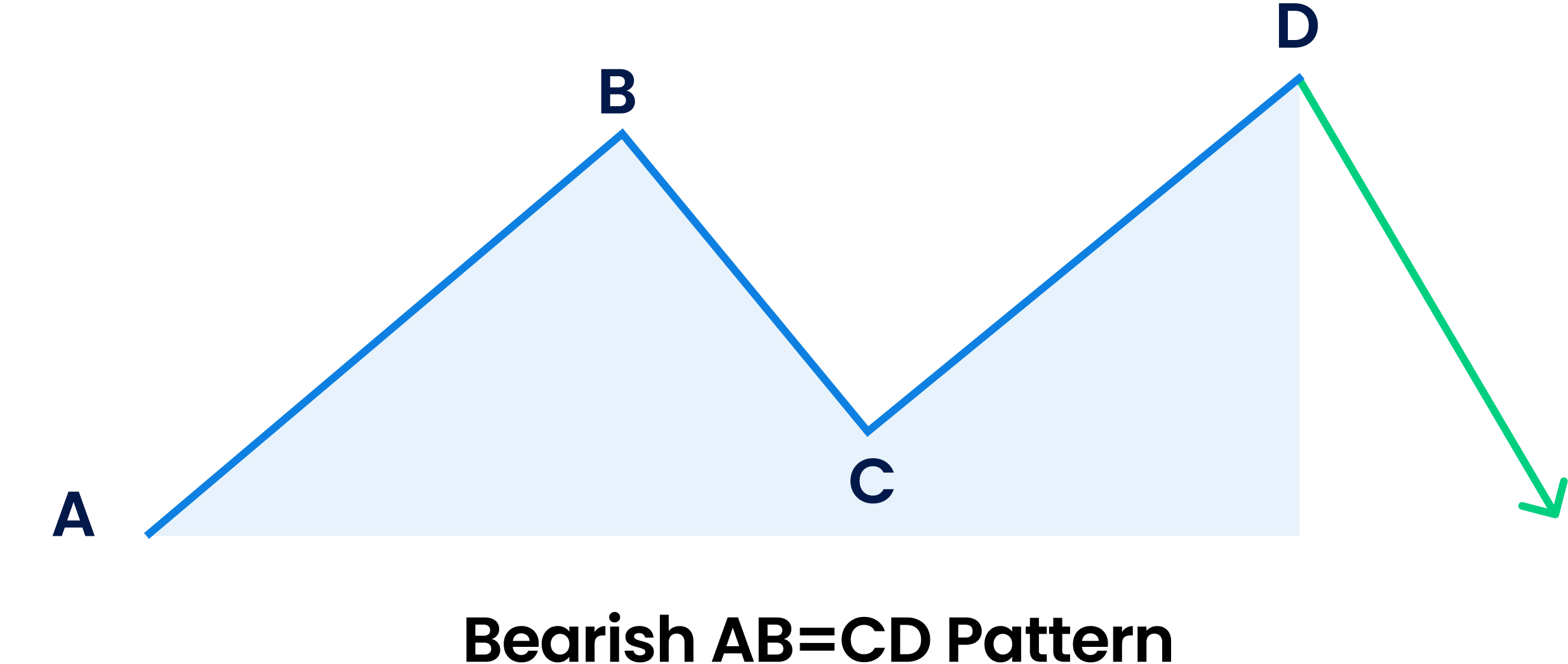

Abcd Trade Pattern - This tool may help you. Web the abcd pattern can be categorized into two primary variants: For example, if a stock has been trending upward, the abcd. This formation typically emerges in. By stelian olar, updated on: At the beginning of an uptrend, for example, the equity would make an aggressive move. It can help forex traders who. Web at its core, the abcd pattern is a harmonic trading pattern based on theoretical elements that form part of elliott wave theory. Web the patterns indicate when the price of a security is about to change and begin trending in the opposite direction. Midday pullback and consolidation 3. Do you know why beginner day traders should learn the abcd. For example, if a stock has been trending upward, the abcd. Web the abcd pattern is a harmonic formation formed on trading charts and used in technical analysis. It can help forex traders who. Web at its core, the abcd pattern is a harmonic trading pattern based on theoretical. Primarily, the ab cd pattern consists of 3. Web a simple process and tactic on how to approach and trade the abcd pattern; This formation typically emerges in. Bullish abcd and bearish abcd. Morning rally to a new high 2. This formation typically emerges in. Morning rally to a new high 2. Web the abcd pattern can be categorized into two primary variants: Web 6 min read. By stelian olar, updated on: This tool may help you. There’s a letter for each price movement: By stelian olar, updated on: Web a simple process and tactic on how to approach and trade the abcd pattern; Are you looking to improve your trading strategy and technical analysis skills? Web the abcd pattern is a harmonic formation formed on trading charts and used in technical analysis. There’s a letter for each price movement: The abcs were fun to learn as a kid, but as a trader, they can make you some. It’s when a stock spikes big, pulls back, then grinds ups and breaks out to a new high. Midday pullback and consolidation 3. Fact checked by lucien bechard. This tool may help you. Bullish ab=cd (abcd) this pattern begins with a decrease in price (ab),. There’s a letter for each price movement: Bullish abcd and bearish abcd. The abcd pattern is an intraday chart pattern. Midday pullback and consolidation 3. An abc pattern a pivot long signal. Fact checked by lucien bechard. Are you looking to improve your trading strategy and technical analysis skills? Web harmonic abcd pattern is a classic reversal pattern. At the beginning of an uptrend, for example, the equity would make an aggressive move. Primarily, the ab cd pattern consists of 3. This formation typically emerges in. C:higher low and grind up breaks through the. Web the patterns indicate when the price of a security is about to change and begin trending in the opposite direction. There’s a letter for each price movement: Web the abcd pattern can be categorized into two primary variants: Morning rally to a new high 2. It’s when a stock spikes big, pulls back, then grinds ups and breaks out to a new high of the day. Web a simple process and tactic on how to approach and trade the abcd pattern; Are you looking to improve your trading strategy and technical analysis skills? This formation typically emerges in. Bullish ab=cd (abcd) this pattern begins with. Do you know why beginner day traders should learn the abcd. The abcd pattern is an intraday chart pattern. The abcd trading pattern may be just what you need. In this article, i will teach you how to recognize that pattern and trade it properly. Web known for its geometric, visual chart patterns, the abcd pattern says a lot about a trade happening on the price chart. By stelian olar, updated on: Midday pullback and consolidation 3. This pattern is composed of 3 main. Web the abcd pattern is a harmonic formation formed on trading charts and used in technical analysis. Web 23 jan 2023, 10:48. It can help forex traders who. C:higher low and grind up breaks through the. Web 6 min read. It consists of four reversal points labeled a, b, c and d. Web at its core, the abcd pattern is a harmonic trading pattern based on theoretical elements that form part of elliott wave theory. Web the patterns indicate when the price of a security is about to change and begin trending in the opposite direction.

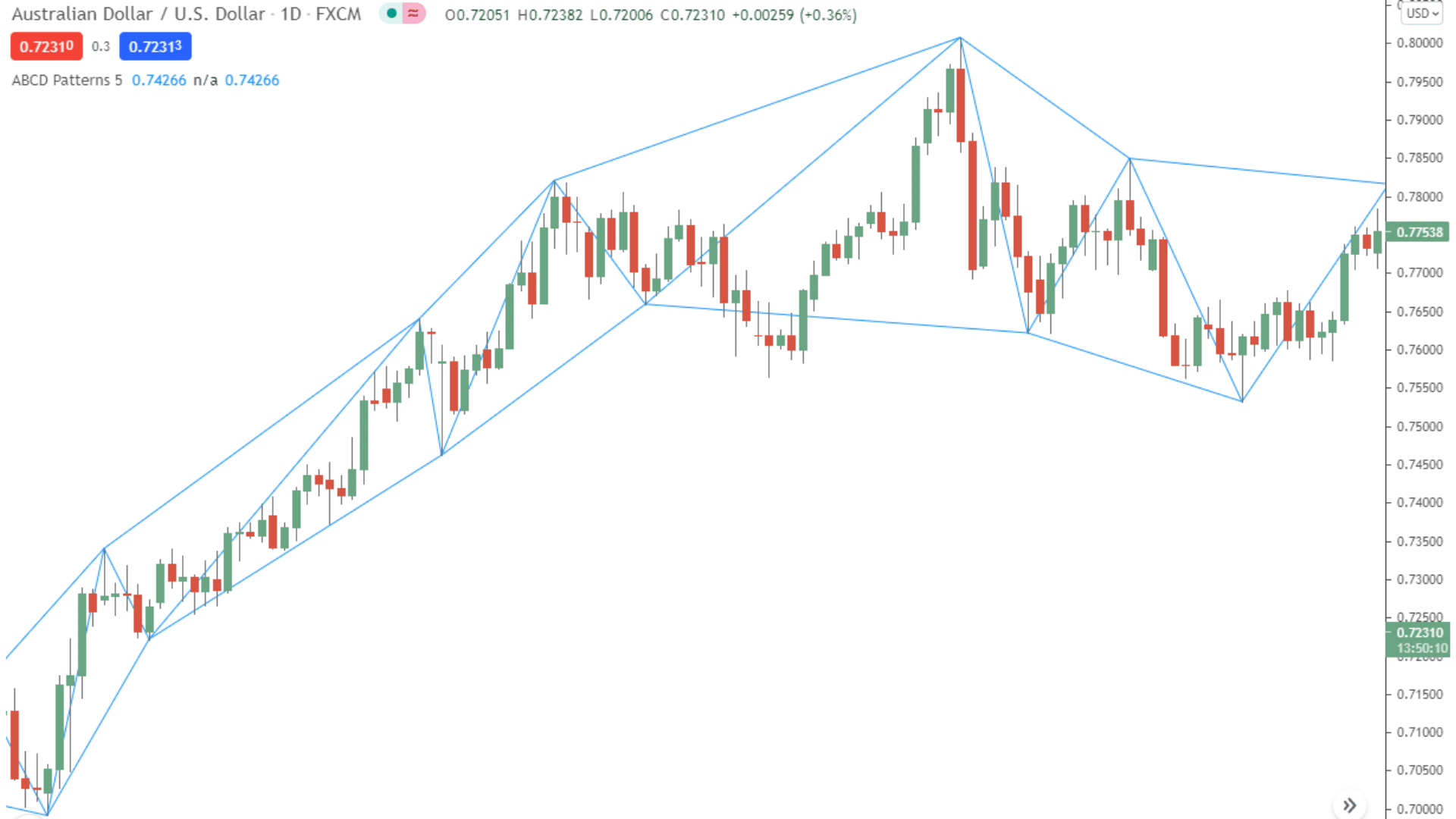

Using the Harmonic AB=CD Pattern to Pinpoint Price Swings Forex

Using the Harmonic AB=CD Pattern to Pinpoint Price Swings Forex

ABCD Pattern Trading Strategy and Examples

ABCD Pattern Day Trading Guide Everything You Need To Maximize Profits

ABCD Pattern Trading What is ABCD Pattern? US

Understanding the Forex ABCD Pattern Blueberry Markets

ABCD Pattern How To Successfully Trade this Harmonic Pattern [Forex

![ABCD Pattern Explained [TraderSwift] Swing Trading Patterns YouTube](https://i.ytimg.com/vi/pwszqQeNH-Y/maxresdefault.jpg)

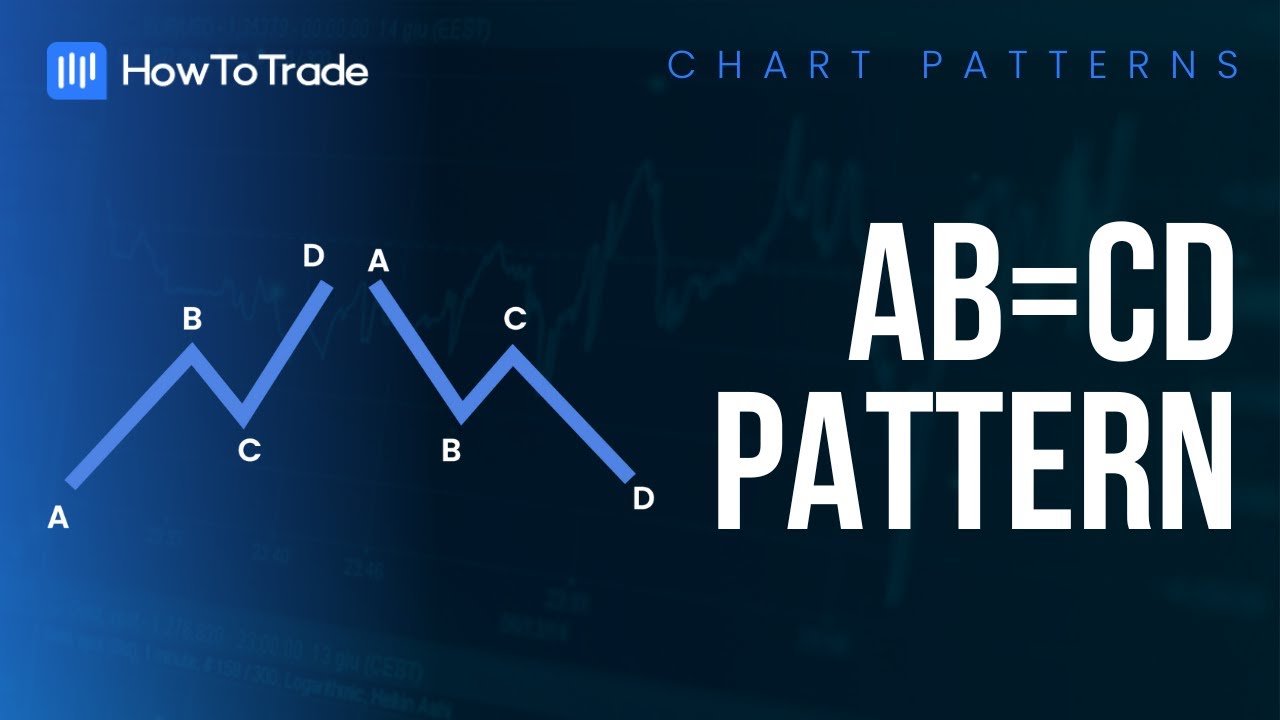

ABCD Pattern Explained [TraderSwift] Swing Trading Patterns YouTube

How to Trade With the ABCD Pattern With Free PDF

ABCD Harmonic Pattern in Forex Identify & Trade Free Forex Coach

Web Harmonic Abcd Pattern Is A Classic Reversal Pattern.

This Tool May Help You.

It’s When A Stock Spikes Big, Pulls Back, Then Grinds Ups And Breaks Out To A New High Of The Day.

Bullish Ab=Cd (Abcd) This Pattern Begins With A Decrease In Price (Ab),.

Related Post: